-

Frank Gehry, master architect with a flair for drama, dead at 96

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

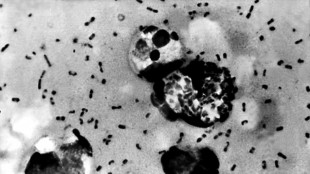

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

| RBGPF | 0% | 78.35 | $ | |

| RYCEF | -0.96% | 14.51 | $ | |

| CMSC | -0.09% | 23.46 | $ | |

| SCS | -0.34% | 16.175 | $ | |

| RIO | -0.99% | 73.01 | $ | |

| VOD | -1.19% | 12.485 | $ | |

| GSK | -0.55% | 48.305 | $ | |

| RELX | -0.46% | 40.355 | $ | |

| NGG | -0.54% | 75.5 | $ | |

| BTI | -1.56% | 57.15 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| AZN | 0.38% | 90.37 | $ | |

| BCC | -0.6% | 73.82 | $ | |

| JRI | 0.18% | 13.775 | $ | |

| BCE | 1.63% | 23.605 | $ | |

| BP | -3.16% | 36.09 | $ |

Stocks steadier before key Nvidia results

Stocks struggled to kickstart a recovery Wednesday following heavy losses triggered by worries over an AI-fuelled bubble.

Bitcoin held above $90,000, the dollar strengthened and oil prices dropped.

"Investors will breathe a sigh of relief that the market sell-off has lost momentum," noted Russ Mould, investment director at AJ Bell.

"Pockets of Europe and Asia were up... and futures prices imply a similar trend when Wall Street opens later today."

Mould said "the key question is whether this is simply the calm before the storm.

"Nvidia reports tonight and the slightest bit of news to disappoint investors has the potential to whip up a tornado across global markets."

Investors have endured a tough November as speculation has grown that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.

With the Magnificent Seven -- including Amazon, Meta, Alphabet and Apple -- powering recent record highs on Wall Street, there are worries that a change in sentiment could have huge ripple effects on markets.

The spotlight Wednesday turns on the earnings report from the biggest of the bunch: chip giant Nvidia, which last month became the first $5-trillion company.

Investors are nervous that any sign of weakness could be the pin that pops the artificial intelligence bubble, having spent months fearing that the hundreds of billions invested may have been excessive.

"The AI complex, once the undisputed locomotive of 2025's rally, now sounds like an engine with sand in the gears," said Stephen Innes at SPI Asset Management.

"This isn't a crash, or a panic, or even a proper correction; it's the unmistakable sensation of a market trading at altitude with borrowed oxygen, suddenly aware of how thin the air has become."

He added that four days of losses in Wall Street's S&P 500, the VIX "fear index" hitting 25 -- a level that causes traders concern -- and a tone shift were "all signs that investors are finally blinking at the speed and scale of the AI capex boom".

Meanwhile, a Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that that was the biggest "tail risk" to markets, more so than inflation.

That came after the BBC released an interview with the head of Google's parent company Alphabet -- Sundar Pichai -- who warned every company would be impacted if the AI bubble were to burst.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.1 percent at 9,559.89 points

Paris - CAC 40: DOWN 0.1 percent at 7,957.56

Frankfurt - DAX: UP 0.1 percent at 23,212.35

Tokyo - Nikkei 225: DOWN 0.3 percent at 48,537.70 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,830.65 (close)

Shanghai - Composite: UP 0.2 percent at 3,946.74 (close)

New York - Dow: DOWN 1.1 percent at 46,091.74 (close)

Euro/dollar: DOWN at $1.1570 from $1.1580

Pound/dollar: DOWN at $1.3105 from $1.3146

Dollar/yen: UP at 156.28 yen from 155.53 yen on Tuesday

Euro/pound: UP at 88.27 from 88.09 pence

Brent North Sea Crude: DOWN 0.9 percent at $64.34 per barrel

West Texas Intermediate: DOWN 0.8 percent at $60.24 per barrel

W.Moreno--AT