-

Frank Gehry, master architect with a flair for drama, dead at 96

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

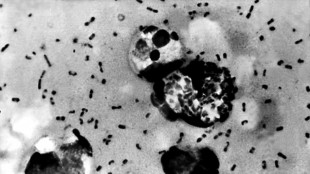

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Australia race clear of England to seize control of second Ashes Test

-

Stocks, dollar rise before key US inflation data

-

Trump strategy shifts from global role and vows 'resistance' in Europe

Trump strategy shifts from global role and vows 'resistance' in Europe

-

Turkey orders arrest of 29 footballers in betting scandal

-

EU hits X with 120-mn-euro fine, risking Trump ire

EU hits X with 120-mn-euro fine, risking Trump ire

-

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

| RBGPF | 0% | 78.35 | $ | |

| RYCEF | -0.96% | 14.51 | $ | |

| CMSC | -0.09% | 23.46 | $ | |

| SCS | -0.34% | 16.175 | $ | |

| RIO | -0.99% | 73.01 | $ | |

| VOD | -1.19% | 12.485 | $ | |

| GSK | -0.55% | 48.305 | $ | |

| RELX | -0.46% | 40.355 | $ | |

| NGG | -0.54% | 75.5 | $ | |

| BTI | -1.56% | 57.15 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| AZN | 0.38% | 90.37 | $ | |

| BCC | -0.6% | 73.82 | $ | |

| JRI | 0.18% | 13.775 | $ | |

| BCE | 1.63% | 23.605 | $ | |

| BP | -3.16% | 36.09 | $ |

Stocks struggle as Nvidia takes centre stage amid AI bubble fears

Stocks struggled Wednesday to kickstart a recovery following the latest stagger across world markets that has been caused by worries over an AI-fuelled bubble and uncertainty over US interest rates.

Rising tensions between China and Japan linked to a spat over Taiwan added to the dour mood on trading floors.

Investors have endured a tough November as speculation has grown that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.

With the Magnificent Seven, including Amazon, Meta, Alphabet and Apple, accounting for the majority of the rally to record highs for Wall Street's three main indexes, there are worries that any problems with them could have huge ripple effects on markets.

And so the spotlight Wednesday turns on the earnings report from the biggest of the bunch: chip giant Nvidia, which this month became the first $5 trillion company.

Investors are nervous that any sign of weakness could be the pin that pops the AI bubble, having spent months fearing that the hundreds of billions invested may have been excessive.

"The AI complex, once the undisputed locomotive of 2025's rally, now sounds like an engine with sand in the gears," said Stephen Innes at SPI Asset Management.

"This isn't a crash, or a panic, or even a proper correction; it's the unmistakable sensation of a market trading at altitude with borrowed oxygen, suddenly aware of how thin the air has become."

He added that four days of losses in Wall Street's S&P 500, the VIX "fear index" hitting 25 -- a level that causes traders concern -- and a tone shift were "all signs that investors are finally blinking at the speed and scale of the AI capex boom".

Meanwhile, a Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that that was the biggest "tail risk" to markets, more so than inflation.

That came after the BBC released an interview with the head of Google's parent company Alphabet -- Sundar Pichai -- who warned every company would be impacted if the AI bubble were to burst.

After a mixed start to the day, Asia mostly fell into negative territory.

Tokyo was weighed down by simmering China tensions after Japanese Prime Minister Sanae Takaichi's comments on Taiwan, which have seen the two sides warn citizens about travel to the other.

The row escalated Wednesday as media reports said China will suspend imports of Japanese seafood.

Japanese investors are also concerned about the country's fiscal state ahead of an economic stimulus package that has pushed government bond yields to record highs.

Hong Kong, Sydney, Seoul, Singapore, Taipei, Wellington, Bangkok and Jakarta also fell but there were gains in Shanghai, Manila and Mumbai.

Also in sight this week is the planned release of key US data, particularly on jobs creation, which will be closely read over for an idea about the Fed's plans for interest rates.

Investors have scaled back their bets on a third successive cut next month -- weighing on markets of late -- after a string of decision makers, including bank boss Jerome Powell, questioned the need for another as inflation remains stubbornly high.

Bitcoin, which on Tuesday fell below $90,000 for the first time in seven months, remained under pressure from the risk-aversion on markets. The cryptocurrency has taken a hefty hit since hitting a record high above $126,000 at the start of October.

- Key figures at around 0705 GMT -

Tokyo - Nikkei 225: DOWN 0.3 percent at 48,537.70 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 25,842.52

Shanghai - Composite: UP 0.2 percent at 3,946.74 (close)

Dollar/yen: DOWN at 155.46 yen from 155.53 yen on Tuesday

Euro/dollar: UP at $1.1587 from $1.1580

Pound/dollar: UP at $1.3153 from $1.3146

Euro/pound: UP at 88.10 from 88.09 pence

West Texas Intermediate: DOWN 0.2 percent at $60.62 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $64.73 per barrel

New York - Dow: DOWN 1.1 percent at 46,091.74 (close)

London - FTSE 100: DOWN 1.3 percent at 9,552.30 (close)

W.Moreno--AT