-

England boss Tuchel wary of 'surprise' in World Cup draw

England boss Tuchel wary of 'surprise' in World Cup draw

-

10 university students die in Peru restaurant fire

-

'Sinners' tops Critics Choice nominations

'Sinners' tops Critics Choice nominations

-

Netflix's Warner Bros. acquisition sparks backlash

-

France probes mystery drone flight over nuclear sub base

France probes mystery drone flight over nuclear sub base

-

Frank Gehry: five key works

-

US Supreme Court to weigh Trump bid to end birthright citizenship

US Supreme Court to weigh Trump bid to end birthright citizenship

-

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

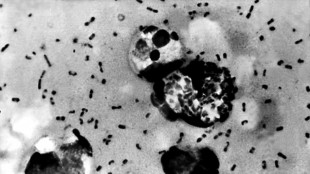

Volcanic eruptions may have brought Black Death to Europe

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

Chelsea's Maresca says rotation unavoidable

-

Italian president urges Olympic truce at Milan-Cortina torch ceremony

-

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

Norris edges Verstappen in opening practice for season-ending Abu Dhabi GP

-

Australia race clear of England to seize control of second Ashes Test

Stocks gloomy on earnings and tech jitters, US rate worries

Global stock markets pulled back Monday as traders awaited key earnings reports, notably from chip giant Nvidia, amid concerns that the US Federal Reserve could hold off on further rate cuts this year.

On Wall Street, the Dow retreated 1.2 percent while the tech-heavy Nasdaq lost 0.8 percent. The broader-based S&P 500 slid 0.9 percent.

Europe lacked inspiration too with the DAX closing off 1.2 percent while London and Paris lost marginal ground.

Major Asian indices had earlier finished lower as well amid simmering tensions between China and Japan which hit tourism and retail firms on Tokyo's exchange.

Besides Nvidia, which dropped 1.9 percent, US retailers Home Depot, Target and Walmart are also set to release their earnings reports.

Those will be monitored for signs of how consumers are faring as President Donald Trump's tariffs bite.

Traders are also awaiting US government data on how the labor market fared in September. The numbers are due for publication Thursday, after the end of the longest government shutdown in US history.

"It'll be the first glimpse of some macro news" that could provide hints on the Fed's preferred path for interest rates moving forward, said Peter Cardillo from Spartan Capital Securities.

Among companies, he added: "It's all up to Nvidia, whether or not it can turn the souring negative sentiment on the AI sector."

Dave Grecsek of wealth management firm Aspiriant added that if Nvidia could meet high expectations, "that could sort of stabilize the market a little bit."

The European Union on Monday cut its eurozone growth forecast for 2026 as risks from international trade and geopolitical tensions weighed on Europe's economy.

Investors have in recent weeks reconsidered prospects for US rate cuts and the AI-fueled tech rally that had lifted several markets to record highs.

Traders are keenly awaiting the release of several reports -- including on jobs and inflation -- that had been held up by the record US government shutdown that ended last week.

With data releases delayed, "chances are growing that the Fed will avoid changing monetary policy when the economic outlook remains murky," said Kathleen Brooks, research director at trading group XTB.

Fed boss Jerome Powell signaled last month that a December cut to borrowing costs was not assured, adding to uncertainty.

All eyes are on this week's earnings update from Nvidia, the world's most valuable company, which late last month hit a market capitalization of $5.0 trillion before slipping back.

For now, Bitcoin suffered from the uncertain climate on trading floors.

The cryptocurrency had climbed to a record high of $126,251 on October 6, buoyed by Trump's pledges to ease regulation on the crypto sector, but has fallen from that level to around $91,634.45.

- Key figures at around 2105 GMT -

New York - Dow: DOWN 1.2 percent at 46,590.24 points (close)

New York - S&P 500: DOWN 0.9 percent at 6,672.41 (close)

New York - Nasdaq Composite: DOWN 0.8 percent at 22,708.08 (close)

London - FTSE 100: DOWN 0.2 percent at 9,675.43 points (close)

Paris - CAC 40: DOWN 0.6 percent at 8,119.02 (close)

Frankfurt - DAX: DOWN 1.2 percent at 23,590.52 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,323.91 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,384.28 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,972.03 (close)

Dollar/yen: UP at 155.23 yen from 154.55 yen on Friday

Euro/dollar: DOWN at $1.1589 from $1.1621

Pound/dollar: DOWN at $1.3156 from $1.3171

Euro/pound: DOWN at 88.09 pence from 88.22 pence

West Texas Intermediate: DOWN 0.3 percent at $59.91 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $64.20 per barrel

Y.Baker--AT