-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

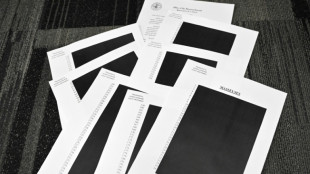

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

-

BeMetals Announces Settlement of All Outstanding Debt

-

Who Does the Best Mommy Makeover in Bellevue?

Who Does the Best Mommy Makeover in Bellevue?

-

Zenwork Joins CERCA to Support IRS Modernization and Strengthen National Information Reporting Infrastructure

-

Cellbxhealth PLC Announces Holding(s) in Company

Cellbxhealth PLC Announces Holding(s) in Company

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Most markets down as Fed holds and Trump announces fresh tariffs

Asian markets mostly fell Thursday while the dollar held most of its gains as traders weighed a cautious Federal Reserve with strong tech earnings and Donald Trump's tariffs on key economies South Korea and India.

The central bank held interest rates steady and refrained from suggesting it would cut any time soon despite as he brushed off relentless pressure from the US president, with recent data indicating inflation remains elevated.

While two members of the policyboard took the rare move of dissenting and voting to cut, investors pared their bets on a reduction in September sending the dollar rallying against its peers.

The bank cited a moderation in economic activity in the first half and "solid" labour market conditions but warned "uncertainty about the economic outlook remains elevated", while inflation too is somewhat heightened.

Asked about Trump's tariff deals and whether they brought more certainty, Fed boss Jerome Powell told reporters: "It's been a very dynamic time for these trade negotiations."

He added that "we're still a ways away from seeing where things settle down".

Kerry Craig of JP Morgan Asset Management said: "With some details on baseline tariffs only just becoming clear, and many of the details of the recently agreed 'deals' still to be ironed out, the risk is that inflation rates will continue to rise in the coming months."

The latest developments on the trade front saw Trump announce a deal that sees 15 percent tariffs on South Korean goods and a commitment from Seoul to invest $350 billion in the United States.

He also said India was to face 25 percent tolls, coupled with an unspecified penalty over New Delhi's purchases of Russian weapons and energy.

And he signed an executive order implementing an additional 40 percent tax on Brazilian products, as Trump lambasts what he calls Brazil's "witch hunt" against his far-right ally, former president Jair Bolsonaro on coup charges.

Traders are keeping tabs on talks with other countries that are yet to sign deals with Washington ahead of Trump's self-imposed Friday deadline.

After a broadly negative day on Wall Street, Asian markets struggled.

Hong Kong, Shanghai, Sydney, Singapore, Seoul, Manila, Wellington and Bangkok all fell, though Tokyo, Taipei and Jakarta edged up.

There was little movement in the yen after the Bank of Japan decided against hiking interest rates, while lifting economic growth and inflation costs. It also cautiously welcomed the country's trade deal with the United States.

Traders had been given a healthy lead from the tech sector after titans Microsoft and Meta posted better-than-expected earnings, sending their stocks soaring in after-market trade.

Amazon and Apple are die to release later Thursday.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 41,020.91 (break)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 24,871.40

Shanghai - Composite: DOWN 0.7 percent at 3,591.17

Euro/dollar: UP at $1.427 from $1.1409 on Wednesday

Pound/dollar: UP at $1.3260 from $1.3239

Dollar/yen: DOWN at 148.81 yen from 149.50 yen

Euro/pound: UP at 86.18 pence from 86.15 pence

West Texas Intermediate: FLAT at $70.00 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $73.10

New York - Dow: DOWN 0.5 percent at 44,632.99 (close)

London - FTSE 100: UP 0.6 percent at 9,136.32 (close)

M.White--AT