-

Liverpool's set-piece problems a 'killer' - Van Dijk

Liverpool's set-piece problems a 'killer' - Van Dijk

-

Mozambique end 39-year wait for first AFCON victory

-

The film that created the Bardot 'sex kitten' myth

The film that created the Bardot 'sex kitten' myth

-

Former England cricket boss Morris dies aged 62

-

Brigitte Bardot on Muslims, men and 'horrible' humanity

Brigitte Bardot on Muslims, men and 'horrible' humanity

-

Nkunku breaks Serie A goal duck to fire AC Milan top

-

Hakimi to feature in Morocco's final AFCON group game

Hakimi to feature in Morocco's final AFCON group game

-

Bardot: the screen goddess who gave it all up

-

Central African Republic president seeks third term in election

Central African Republic president seeks third term in election

-

France's screen siren Brigitte Bardot dies at 91

-

French 'legend' Brigitte Bardot dead at 91

French 'legend' Brigitte Bardot dead at 91

-

French legend Brigitte Bardot dead at 91: foundation

-

Zelensky looks to close out Ukraine plan in meeting with Trump

Zelensky looks to close out Ukraine plan in meeting with Trump

-

Multicultural UK town bids to turn page on troubled past

-

'Unfair election': young voters absent from Myanmar polls

'Unfair election': young voters absent from Myanmar polls

-

Master Lock Comanche wins Sydney-Hobart ocean race for fifth time

-

Bulgaria adopts euro amid fear and uncertainty

Bulgaria adopts euro amid fear and uncertainty

-

Giannis triumphant in NBA return as Spurs win streak ends

-

Texans reach NFL playoffs and Ravens win to stay in hunt

Texans reach NFL playoffs and Ravens win to stay in hunt

-

How company bets on bitcoin can backfire

-

Touadera on path to third presidential term as Central African Republic votes

Touadera on path to third presidential term as Central African Republic votes

-

'Acoustic hazard': Noise complaints spark Vietnam pickleball wars

-

Iraqis cover soil with clay to curb sandstorms

Iraqis cover soil with clay to curb sandstorms

-

Australia's Head backs struggling opening partner Weatherald

-

'Make emitters responsible': Thailand's clean air activists

'Make emitters responsible': Thailand's clean air activists

-

Zelensky looks to close out Ukraine peace deal at Trump meet

-

MCG curator in 'state of shock' after Ashes Test carnage

MCG curator in 'state of shock' after Ashes Test carnage

-

Texans edge Chargers to reach NFL playoffs

-

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

-

Osimhen stars as Nigeria survive Tunisia rally to reach second round

-

How Myanmar's junta-run vote works, and why it might not

How Myanmar's junta-run vote works, and why it might not

-

Zelensky talks with allies en route to US as Russia pummels Ukraine

-

Watkins wants to sicken Arsenal-supporting family

Watkins wants to sicken Arsenal-supporting family

-

Arsenal hold off surging Man City, Villa as Wirtz ends drought

-

Late penalty miss denies Uganda AFCON win against Tanzania

Late penalty miss denies Uganda AFCON win against Tanzania

-

Watkins stretches Villa's winning streak at Chelsea

-

Zelensky stops in Canada en route to US as Russia pummels Ukraine

Zelensky stops in Canada en route to US as Russia pummels Ukraine

-

Arteta salutes injury-hit Arsenal's survival spirit

-

Wirtz scores first Liverpool goal as Anfield remembers Jota

Wirtz scores first Liverpool goal as Anfield remembers Jota

-

Mane rescues AFCON draw for Senegal against DR Congo

-

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

-

Arsenal ignore injury woes to retain top spot with win over Brighton

-

Sealed with a kiss: Guardiola revels in Cherki starring role

Sealed with a kiss: Guardiola revels in Cherki starring role

-

UK launches paid military gap-year scheme amid recruitment struggles

-

Jota's children join tributes as Liverpool, Wolves pay respects

Jota's children join tributes as Liverpool, Wolves pay respects

-

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

-

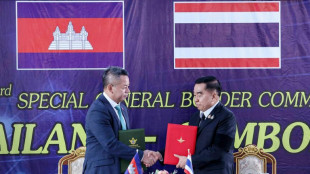

Thailand and Cambodia declare truce after weeks of clashes

Thailand and Cambodia declare truce after weeks of clashes

-

Netanyahu to meet Trump in US on Monday

-

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

-

Cherki stars in Man City win at Forest

Asian equities track Wall St sell-off as US deficit fears grow

Asian equities sank and Treasuries remained under pressure following sharp losses on Wall Street fuelled by US economy fears as Donald Trump tries to push through fresh tax cuts that could balloon the already huge deficit.

A weak auction of 20-year US government debt flashed a warning sign that the bond market was worried about the country's finances, days after Moody's lowered its top-tier credit rating.

The news brought an end to a healthy run-up in recent weeks that was stoked by the China-US tariff detente and signs of progress between the United States and other countries on trade.

Bond yields spiked across the board as investors demanded more interest for holding government debt, signalling their fears about the world's biggest economy -- 30-year Treasuries hit their highest level since late 2023.

The selling came after the auction of 20-year bonds attracted tepid interest, and brought back memories of the sell-off that followed US President Trump's "Liberation Day" tariff blitz last month, which was followed by the White House taking a less aggressive approach.

All three main indexes on Wall Street ended sharply lower.

A tax bill pushed by Trump that is currently going through Congress pairs an extension of the tax cuts from Trump's first presidential term with steep savings in government spending to pay for them.

But many market watchers do not expect the spending cuts in the package to be sufficient to offset the tax cuts, lifting the deficit.

"The proposed tax cuts are raising concerns from economists about the US's fiscal position and there are signs of anxiety in the bond markets about the country's debt burden," said National Australia Bank's Tapas Strickland.

Trump's first-term Treasury Secretary, Steven Mnuchin, warned that "the budget deficit is a larger concern to me than the trade deficit" and called for more spending cuts.

Asian equities also sank, with Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Taipei, Wellington and Manila all in the red.

The dollar also held losses on growing concerns about the US economy, while the uncertainty helped revive demand for safe-haven gold, which was sitting around $3,340 an ounce.

And there are now fears that stocks could be in for another rough ride.

"These higher long-end yields make it a whole lot harder to justify today's equity valuations," said Stephen Innes at SPI Asset Management.

"Tech and growth names -- already stretched -- are staring down the barrel of a tangible equity to rates market repricing, and this could cap the rally fuel that's been driving risk assets since the April tariff detente."

Still, bitcoin broke a fresh record of $110,707 as US lawmakers showed greater bipartisan support for a cryptocurrency bill on the regulation of so-called stablecoins, digital coins whose value is tied to the dollar.

This has sparked fresh hopes for regulatory clarity in the sector, including for bitcoin, which is not directly linked to the dollar.

Oil prices extended losses after data from the US Energy Information Administration showed the country's stockpiles had risen last week.

The news helped reverse a rally in the commodity on Wednesday that was sparked by a CNN report that Israel was planning a strike on Iranian nuclear sites.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.9 percent at 36,967.13 (break)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 23,733.67

Shanghai - Composite: DOWN 0.1 percent at 3,383.87

Euro/dollar: DOWN at $1.1332 from $1.1334 on Wednesday

Pound/dollar: UP at $1.3425 from $1.3421

Dollar/yen: DOWN at 143.36 yen from 143.66 yen

Euro/pound: DOWN at 84.40 pence from 84.42 pence

West Texas Intermediate: DOWN 0.6 percent at $61.21 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $64.54 per barrel

New York - Dow: DOWN 1.9 percent at 41,860.44 (close)

London - FTSE 100: UP 0.1 percent at 8,786.46 (close)

R.Chavez--AT