-

Russia to re-privatise airport that it seized

Russia to re-privatise airport that it seized

-

K-pop label ADOR files damages suit against ex-NewJeans member

-

Injured Archer included in England T20 World Cup squad but no place for Smith

Injured Archer included in England T20 World Cup squad but no place for Smith

-

Saudi says UAE-backed advance in Yemen threatens its security

-

Loss and laughter: war medics heal in west Ukraine mountains

Loss and laughter: war medics heal in west Ukraine mountains

-

Iran president urges government to heed economic protests

-

China fires missiles on second day of military drills around Taiwan

China fires missiles on second day of military drills around Taiwan

-

Precious metals fall again, stocks mixed as traders wind down

-

Bethell says 'lot more to do' to nail down England number three spot

Bethell says 'lot more to do' to nail down England number three spot

-

Injured Archer included in England T20 World Cup squad

-

Trump says US hit dock for Venezuela drug boats

Trump says US hit dock for Venezuela drug boats

-

The race to find Formula 1's first-ever woman champion

-

China fires rockets on second day of military drills around Taiwan

China fires rockets on second day of military drills around Taiwan

-

Rockets, jets fuel unification hopes on Chinese island near Taiwan

-

Saudi-led coalition says targets arms shipments from UAE in Yemen

Saudi-led coalition says targets arms shipments from UAE in Yemen

-

Falcons hold off Rams second-half comeback to win 27-24

-

Nuggets reel from Jokic injury, Thunder rout Hawks

Nuggets reel from Jokic injury, Thunder rout Hawks

-

What to know about China's drills around Taiwan

-

Bangladesh's former prime minister Khaleda Zia dies aged 80

Bangladesh's former prime minister Khaleda Zia dies aged 80

-

Japan footballer 'King Kazu' signs for new team at 58

-

Saudi-led coalition says targeted arms shipments from UAE in Yemen

Saudi-led coalition says targeted arms shipments from UAE in Yemen

-

Jokic suffers 'gut-wrenching' knee injury as Nuggets thrashed

-

Nuggets suffer Jokic injury scare in Heat drubbing

Nuggets suffer Jokic injury scare in Heat drubbing

-

Bangladesh ex-PM Khaleda Zia dies aged 80

-

Precious metals fall again, Asian stocks swing as traders wind down

Precious metals fall again, Asian stocks swing as traders wind down

-

Chinese homeschool students embrace freer youth in cutthroat market

-

End of an era as Bangladesh ex-PM Zia dies

End of an era as Bangladesh ex-PM Zia dies

-

Bangladesh ex-PM Khaleda Zia dies aged 80: party statement

-

North Korea's Kim touts new rocket launchers that could target South

North Korea's Kim touts new rocket launchers that could target South

-

Police say Bondi Beach mass shooting suspects 'acted alone'

-

China conducts second day of military drills around Taiwan

China conducts second day of military drills around Taiwan

-

Pantheon Resources PLC Announces Final Results for the Year Ended 30 June 2025

-

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

Empire Metals Limited Announces Conditional Sale of 75% of Eclipse Gold Project

-

Agronomics Limited Announces Further Equity Investment in BlueNalu

-

Infantino defends World Cup ticket prices, cites 'crazy' demand

Infantino defends World Cup ticket prices, cites 'crazy' demand

-

Idris Elba, Lionesses recognised in UK honours list

-

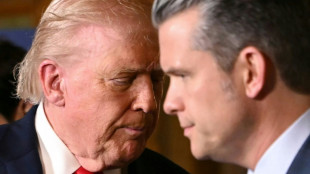

Trump warns Hamas, Iran after Netanyahu talks

Trump warns Hamas, Iran after Netanyahu talks

-

Ex-heavyweight champion Joshua 'stable' after fatal road accident in Nigeria

-

Hosts Morocco cruise as South Africa reach Cup of Nations last 16

Hosts Morocco cruise as South Africa reach Cup of Nations last 16

-

Beyonce declared a billionaire by Forbes magazine

-

Precious metals slump as stocks near end of banner 2025

Precious metals slump as stocks near end of banner 2025

-

El Kaabi brace helps Morocco reach AFCON last 16 as group winners

-

Trump, Netanyahu meet in Florida to discuss Gaza, Iran

Trump, Netanyahu meet in Florida to discuss Gaza, Iran

-

Meat-loving Argentines shun beef as inflation bites

-

Barcelona's Araujo returns to training after weeks out

Barcelona's Araujo returns to training after weeks out

-

Nancy promises no let-up even if Celtic go top of Premiership

-

Appollis penalty sends South Africa past Zimbabwe and into AFCON last-16

Appollis penalty sends South Africa past Zimbabwe and into AFCON last-16

-

George Clooney, his wife Amal and children become French

-

Russia says Ukraine attacked Putin's home, Kyiv calls this 'lie'

Russia says Ukraine attacked Putin's home, Kyiv calls this 'lie'

-

World stocks sluggish as precious metals drop

Precious metals fall again, stocks mixed as traders wind down

Precious metals extended losses Tuesday on profit-taking after hitting recent records, while equities fluctuated in quiet trade as investors wound down ahead of the New Year break.

Traders were taking it easy in the last few days of 2025 following a stellar 12 months that have seen tech firms push several stock markets to all-time highs, while bitcoin, gold and silver have also enjoyed multiple peaks.

Minutes from the Federal Reserve's most recent policy meeting -- at which it cut interest rates a third straight time -- are due to be released later in the day and will be scanned for an idea about whether a fourth can be expected in January.

The US central bank's monetary easing in the back end of this year has been a key driver of the markets' rally, compounding a surge in the tech sector on the back of the vast amounts of cash pumped into all things AI.

It has also helped offset recent worries about a possible tech bubble and warnings that traders might not see a return on their investments in artificial intelligence for some time.

Still, Asian markets have enjoyed a healthy year, with Seoul's Kospi piling on more than 75 percent and Tokyo's Nikkei 225 more than 26 percent -- both having hit records earlier in the year.

But the two edged down Tuesday, with Sydney, Mumbai and Taipei also lower. Hong Kong, Singapore, Wellington, Bangkok and Jakarta rose. Shanghai was flat.

London rose at the open, Frankfurt was flat and Paris dipped.

The mixed performance followed losses for all three main indexes on Wall Street.

The big moves of late have been seen in precious metals, with gold hitting a record just shy of $4,550. Silver, meanwhile, topped out at $84 after soaring around 150 percent this year.

Investors have been piling into the commodities on bets for more US rate cuts, a weaker dollar and geopolitical tensions.

Silver has also been boosted by increased central bank purchases and supply concerns.

However, both metals have pulled back sharply this week on profit-taking, with gold now around $4,360 and silver at $74.50.

"Headlines screamed collapse, but zooming out, all that really happened was a reset to three- or four-day levels," wrote SPI Asset Management's Stephen Innes.

"The market ran hot, tripped over its own shoelaces, and landed back where it had been standing earlier in the week. One beneficial side effect is that silver flushed enough excess to no longer screen as overbought, which matters more than the move itself."

Oil dipped, having jumped more than two percent Monday when investors rowed back bets on peace talks to end Russia's war with Ukraine as a meeting between US President Donald Trump and Ukrainian counterpart Volodymyr Zelensky ended with little progress.

That surge followed Friday's similar-sized rally on optimism for a breakthrough to end the nearly four-year conflict.

An end to the war could see sanctions on Russian oil removed, which would see a huge fresh supply hit the market.

Bitcoin, which has tumbled since spiking above $126,000 in October, was stabilising just below $90,000 after a shaky end to the year.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 50,339.48 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 25,854.60 (close)

Shanghai - Composite: FLAT at 3,965.12 (close)

London - FTSE 100: UP 0.1 percent at 9,878.94

Euro/dollar: UP at $1.1768 from $1.1766 on Monday

Pound/dollar: DOWN at $1.3503 from $1.3504

Dollar/yen: DOWN at 156.00 yen from 156.06 yen

Euro/pound: UP at 87.15 pence from 87.00 pence

West Texas Intermediate: FLAT at $58.07 per barrel

Brent North Sea Crude: FLAT at $61.92 per barrel

New York - Dow: DOWN 0.5 percent at 48,461.93 (close)

D.Lopez--AT