-

Trump says Ukraine deal close, Europe proposes peace force

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

Chile president-elect dials down right-wing rhetoric, vows unity

-

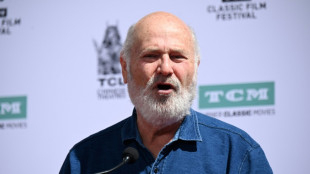

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

Euro drops to dollar parity as eurozone recession fears mount

The euro struck parity with the dollar for the first time in nearly 20 years on Tuesday as a cut in Russian gas supplies to Europe heightened fears of a recession in the eurozone.

The European single currency hit exactly one dollar -- its lowest level since December 2002 -- before bouncing back to as high as $1.0070.

Oil prices plunged on concerns of a wider recession as central banks hike interest rates to fight decades-high inflation, with both main contracts falling back under $100 per barrel at one point.

While European stocks initially moved lower, they rallied in afternoon trading to finish higher. Wall Street's main stock indices were also up in late morning trading.

"Rising inflation, stalling economic growth and more recently fears that Russia could cut gas supplies have pulled the euro lower," said Fiona Cincotta at City Index.

"The nail in the coffin today was dire data showing that economic confidence in Germany fell to a decade low," she added.

Russian energy giant Gazprom on Monday began 10 days of maintenance on its Nord Stream 1 pipeline -- with Germany and other European countries watching anxiously to see if the gas comes back on.

"The gas crisis has really spooked markets over the eurozone economy," Markets.com analyst Neil Wilson told AFP.

With relations between Russia and the West at their lowest in years because of the invasion of Ukraine, Gazprom may not reopen the valves, according to analysts.

"The next few weeks could be challenging for Europe, with possibly maximum uncertainty stretching into August," said SPI Asset Management's Stephen Innes.

"Investors increasingly believe that gas may not start to flow through Nord Stream 1 again following the scheduled maintenance on July 11-21, with further 'temporary' interruptions seen as likely."

Worries about a Covid flare-up in China -- fuelling fears of more lockdowns -- added to the downbeat mood, just as investors prepared for a week of economic data and corporate earnings that could have huge implications for markets.

A forecast-beating US jobs report last week suggested the world's top economy was coping with higher Federal Reserve rates, but it also gave the central bank more room to continue tightening -- leading to concerns it could go too far and cause a contraction.

The European single currency is also under pressure from the Federal Reserve hiking US interest rates more aggressively than the European Central Bank.

The dollar has jumped 14 percent against the euro since the start of the year.

US inflation data due out Wednesday could also solidify the case for the Fed to continue raising interest rates aggressively.

"In anticipation of that, investors have retreated to the safety of the US dollar once more, steering clear of risky assets in favour of haven" assets, said market analyst Craig Erlam at trading platform OANDA.

Central banks have been increasing borrowing costs in a bid to tame inflation, which has been fuelled by soaring energy prices.

Oil and gas prices have rocketed this year after economies reopened from Covid lockdowns and following the invasion of Ukraine by major energy producer Russia, which raised concerns whether supplies will be adequate.

- Key figures at around 1530 GMT -

Euro/dollar: UP at $1.0065 from $1.0041 Monday

Pound/dollar: UP at $1.1911 from $1.1892

Euro/pound: UP at 84.57 pence from 84.38 pence

Dollar/yen: DOWN at 136.66 yen from 137.41 yen

West Texas Intermediate: DOWN 6.8 percent at $96.99 per barrel

Brent North Sea crude: DOWN 6.3 percent at $100.41 per barrel

New York - Dow: UP 0.5 percent at 31,318.22 points

EURO STOXX 50: UP 0.4 percent at 3,487.05

London - FTSE 100: UP 0.2 percent at 7,209.86 (close)

Frankfurt - DAX: UP 0.6 percent at 12,905.48 (close)

Paris - CAC 40: UP 0.8 percent at 6,044.20 (close)

Tokyo - Nikkei 225: DOWN 1.8 percent at 26,336.66 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 20,844.74 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,281.47 (close)

burs-rl/bp

S.Jackson--AT