-

French cycling hope Seixas dreaming of Tour de France debut

French cycling hope Seixas dreaming of Tour de France debut

-

France detects Russia-linked Epstein smear attempt against Macron: govt source

-

EU nations back chemical recycling for plastic bottles

EU nations back chemical recycling for plastic bottles

-

Terror at Friday prayers: witnesses describe blast rocking Islamabad mosque

-

Iran expects more US talks after 'positive atmosphere' in Oman

Iran expects more US talks after 'positive atmosphere' in Oman

-

US says 'key participant' in 2012 attack on Benghazi mission arrested

-

Why bitcoin is losing its luster after stratospheric rise

Why bitcoin is losing its luster after stratospheric rise

-

Arteta apologises to Rosenior after disrespect row

-

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

Terror at Friday prayers: witness describes 'extremely powerful' blast in Islamabad

-

Winter Olympics men's downhill: Three things to watch

-

Ice dancers Chock and Bates shine as US lead Japan in team event

Ice dancers Chock and Bates shine as US lead Japan in team event

-

Stellantis takes massive hit on 'overestimation' of EV demand

-

Stocks rebound though tech stocks still suffer

Stocks rebound though tech stocks still suffer

-

Spanish PM urges caution as fresh rain heads for flood zone

-

Iran says to hold more talks with US despite Trump military threats

Iran says to hold more talks with US despite Trump military threats

-

Russia accuses Kyiv of gun attack on army general in Moscow

-

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

Cambodia reveals damage to UNESCO-listed temple after Thailand clashes

-

Norway crown princess 'deeply regrets' Epstein friendship

-

Italy set for Winter Olympics opening ceremony as Vonn passes test

Italy set for Winter Olympics opening ceremony as Vonn passes test

-

England's Jacks says players back under-fire skipper Brook '100 percent'

-

Carrick relishing Frank reunion as Man Utd host Spurs

Carrick relishing Frank reunion as Man Utd host Spurs

-

Farrell keeps the faith in Irish still being at rugby's top table

-

Meloni, Vance hail 'shared values' amid pre-Olympic protests

Meloni, Vance hail 'shared values' amid pre-Olympic protests

-

Olympic freestyle champion Gremaud says passion for skiing carried her through dark times

-

US urges new three-way nuclear deal with Russia and China

US urges new three-way nuclear deal with Russia and China

-

Indonesia landslide death toll rises to 74

-

Hemetsberger a 'happy psychopath' after final downhill training

Hemetsberger a 'happy psychopath' after final downhill training

-

Suicide blast at Islamabad mosque kills at least 31, wounds over 130

-

Elton John accuses UK tabloids publisher of 'abhorrent' privacy breaches

Elton John accuses UK tabloids publisher of 'abhorrent' privacy breaches

-

Lindsey Vonn completes first downhill training run at Winter Olympics

-

Digital euro delay could leave Europe vulnerable, ECB warns

Digital euro delay could leave Europe vulnerable, ECB warns

-

Feyi-Waboso out of England's Six Nations opener against Wales

-

Newcastle manager Howe pleads for Woltemade patience

Newcastle manager Howe pleads for Woltemade patience

-

German exports to US plunge as tariffs exact heavy cost

-

Portugal heads for presidential vote, fretting over storms and far-right

Portugal heads for presidential vote, fretting over storms and far-right

-

Suicide blast at Islamabad mosque kills at least 30, wounds over 130: police

-

Russia says Kyiv behind Moscow shooting of army general

Russia says Kyiv behind Moscow shooting of army general

-

Greenland villagers focus on 'normal life' amid stress of US threat

-

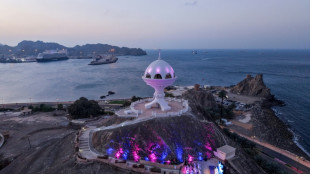

Iran, US hold talks in Oman after Trump military threats

Iran, US hold talks in Oman after Trump military threats

-

Stocks waver as tech worries build

-

Dupont, Jalibert click to give France extra spark in Six Nations bid

Dupont, Jalibert click to give France extra spark in Six Nations bid

-

'Excited' Scots out to prove they deserve T20 World Cup call-up

-

EU tells TikTok to change 'addictive' design

EU tells TikTok to change 'addictive' design

-

India captain admits 'there will be nerves' at home T20 World Cup

-

Stellantis takes massive hit for 'overestimation' of EV shift

Stellantis takes massive hit for 'overestimation' of EV shift

-

'Mona's Eyes': how an obscure French art historian swept the globe

-

Iran, US hold talks in Oman

Iran, US hold talks in Oman

-

Iran, US hold talks in Oman after deadly protest crackdown

-

In Finland's forests, soldiers re-learn how to lay anti-personnel mines

In Finland's forests, soldiers re-learn how to lay anti-personnel mines

-

Israeli president visits Australia after Bondi Beach attack

| SCS | 0.12% | 16.14 | $ | |

| GSK | 1.11% | 59.835 | $ | |

| NGG | 0.79% | 87.585 | $ | |

| CMSC | -0.19% | 23.505 | $ | |

| BTI | 1.55% | 62.933 | $ | |

| BCC | 1.65% | 90.66 | $ | |

| BCE | -0.71% | 25.39 | $ | |

| AZN | 3.29% | 193.53 | $ | |

| CMSD | 0.17% | 23.931 | $ | |

| RIO | 2.12% | 93.09 | $ | |

| JRI | 0.76% | 12.979 | $ | |

| RBGPF | 0.12% | 82.5 | $ | |

| RYCEF | 0.3% | 16.67 | $ | |

| VOD | 2.7% | 15.025 | $ | |

| BP | 2.05% | 38.97 | $ | |

| RELX | -1.67% | 29.595 | $ |

Rolling Stone Magazine Makes SMX a Headliner, Declaring its "PROOF is the New Flex" (NASDAQ:SMX)

NEW YORK, NY, NY / ACCESS Newswire / October 9, 2025 / It started quietly - a few headlines, a few countries, a few brands trying to track what happens after a product's life ends. But behind those headlines, a much larger story has been taking shape. A new economy is emerging, one that doesn't run on speculation or sentiment, but on verification. SMX (NASDAQ:SMX) is building it, molecule by molecule.

This isn't a metaphor. SMX's molecular marking technology embeds digital memory within physical materials - including plastics, rubber, textiles, metals, and electronics - giving every product its own unique, unforgeable identity. Each mark links to the digital ledger, recording a full lifecycle that regulators, brands, and investors can all see in real time. For the first time, waste, compliance, and authenticity are all measurable within the same economic layer.

That's what makes the "proof economy" so powerful. It's not about counting carbon credits or chasing pledges. It's about giving physical goods the same auditability that finance gave to money.

From Proof of Concept to Proof as Currency

Every major shift in history started when someone found a better way to measure value. Gold standardized trade. The internet digitized commerce. Now, proof is quantifying sustainability.

Rolling Stone caught the cultural cue first, calling out that plastic promises are dead and proof is the new flex - a headline that landed like a verdict. USA Today followed with the numbers, highlighting the sheer scale of the plastics market and the mounting demand for traceability. The Straits Times wrote about Singapore's adoption of digital passports for plastics - real infrastructure built around what SMX's technology makes possible.

SMX is creating the next logical evolution: verified materials that can be valued, exchanged, and even traded as digital assets. That's where the company's Plastic Cycle Token (PCT) enters. Built on a digital ledger, it links the physical proof embedded in recycled materials to a tradable digital representation - turning sustainability from a regulatory checkbox into an asset class.

If that sounds like the beginning of a new market, that's because it is.

Beyond Compliance, Toward Monetization

Carbon credits were built on trust; the proof economy is built on data. That difference changes everything. With SMX's system, a kilogram of recycled plastic isn't just a green stat - it's a verified, tokenized commodity that can be audited, valued, and sold.

This structure is already taking hold. Aninterview in Dow Jones-owned OPIS highlighted how SMX's partnership work across Asia is digitalizing waste flows, converting liability into data-backed assets. Governments see a path to measurable impact. Brands see a way to verify claims without paperwork. Investors are seeing liquidity form around verified sustainability.

And then there's the cultural dimension. Morning Honey drew the line , showing how SMX's tech not only ensures transparency but also stabilizes trade - reducing tariff risks and improving consumer trust. When supply chains become transparent, markets reward authenticity instead of marketing.

That's the quiet revolution: proof as profit.

From Niche to Necessity

Sustainability once lived in the ESG section of an annual report. Today, it's creeping onto balance sheets, into valuations, and across government budgets. Proof has become infrastructure - the connective tissue linking transparency, taxation, and trade.

And SMX is the company wiring it together. By uniting chemistry, AI, and blockchain, it's building what the financial world has never had before: a real-time accounting system for materials. The PCT isn't a gimmick - it's a model for how verified circularity becomes measurable value.

Investors used to ask, "Where's the revenue?" Now they're asking, "Where's the proof?" SMX answered both.

The Era of Proof Has a Market Cap

This isn't the end of the sustainability story; it's the start of an entirely new marketplace - one where proof itself is the tradable asset. In this new economy, data doesn't just describe value, it defines it. Proof becomes the medium of trust, a digital-physical handshake that connects brands, regulators, and consumers in real-time.

SMX didn't just join the sustainability movement. It built the economic infrastructure that the movement was waiting for - a system where transparency earns a margin and accountability compounds like interest.

Building on the work done in 2025, the next global market won't be powered by oil or data. It'll be powered by proof. And SMX isn't waiting for it to arrive. It's already minting it.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

The information in this press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "forecast," "intends," "may," "will," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release may include, for example: matters relating to the Company's fight against abusive and possibly illegal trading tactics against the Company's stock; successful launch and implementation of SMX's joint projects with manufacturers and other supply chain participants of gold, steel, rubber and other materials; changes in SMX's strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; SMX's ability to develop and launch new products and services, including its planned Plastic Cycle Token; SMX's ability to successfully and efficiently integrate future expansion plans and opportunities; SMX's ability to grow its business in a cost-effective manner; SMX's product development timeline and estimated research and development costs; the implementation, market acceptance and success of SMX's business model; developments and projections relating to SMX's competitors and industry; and SMX's approach and goals with respect to technology. These forward-looking statements are based on information available as of the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing views as of any subsequent date, and no obligation is undertaken to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: the ability to maintain the listing of the Company's shares on Nasdaq; changes in applicable laws or regulations; any lingering effects of the COVID-19 pandemic on SMX's business; the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; the risk of downturns and the possibility of rapid change in the highly competitive industry in which SMX operates; the risk that SMX and its current and future collaborators are unable to successfully develop and commercialize SMX's products or services, or experience significant delays in doing so; the risk that the Company may never achieve or sustain profitability; the risk that the Company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk that the Company experiences difficulties in managing its growth and expanding operations; the risk that third-party suppliers and manufacturers are not able to fully and timely meet their obligations; the risk that SMX is unable to secure or protect its intellectual property; the possibility that SMX may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties described in SMX's filings from time to time with the Securities and Exchange Commission.

CONTACT:

EMAIL: [email protected]

SOURCE: SMX (Security Matters)

View the original press release on ACCESS Newswire

H.Romero--AT