-

Blades of fury: Japan protests over 'rough' Olympic podium

Blades of fury: Japan protests over 'rough' Olympic podium

-

Zelensky defends Ukrainian athlete's helmet at Games after IOC ban

-

Jury told that Meta, Google 'engineered addiction' at landmark US trial

Jury told that Meta, Google 'engineered addiction' at landmark US trial

-

Despite Trump, Bad Bunny reflects importance of Latinos in US politics

-

Epstein accomplice Maxwell seeks clemency from Trump before testimony

Epstein accomplice Maxwell seeks clemency from Trump before testimony

-

Australian PM 'devastated' by violence at rally against Israel president's visit

-

Vonn says suffered complex leg break in Olympics crash, has 'no regrets'

Vonn says suffered complex leg break in Olympics crash, has 'no regrets'

-

Five employees of Canadian mining company confirmed dead in Mexico

-

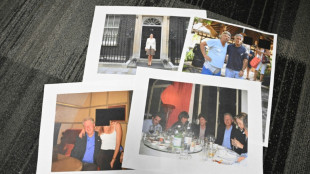

US lawmakers reviewing unredacted Epstein files

US lawmakers reviewing unredacted Epstein files

-

French take surprise lead over Americans in Olympic ice dancing

-

YouTube star MrBeast buys youth-focused banking app

YouTube star MrBeast buys youth-focused banking app

-

French take surprise led over Americans in Olympic ice dancing

-

Lindsey Vonn says has 'complex tibia fracture' from Olympics crash

Lindsey Vonn says has 'complex tibia fracture' from Olympics crash

-

US news anchor says 'hour of desperation' in search for missing mother

-

Malen double lifts Roma level with Juventus

Malen double lifts Roma level with Juventus

-

'Schitt's Creek' star Catherine O'Hara died of blood clot in lung: death certificate

-

'Best day of my life': Raimund soars to German Olympic ski jump gold

'Best day of my life': Raimund soars to German Olympic ski jump gold

-

US Justice Dept opens unredacted Epstein files to lawmakers

-

Epstein taints European governments and royalty, US corporate elite

Epstein taints European governments and royalty, US corporate elite

-

UK PM Starmer refuses to quit as pressure builds over Epstein

-

Three missing employees of Canadian miner found dead in Mexico

Three missing employees of Canadian miner found dead in Mexico

-

Meta, Google face jury in landmark US addiction trial

-

Winter Olympics organisers investigate reports of damaged medals

Winter Olympics organisers investigate reports of damaged medals

-

Venezuela opposition figure freed, then rearrested after calling for elections

-

Japan's Murase clinches Olympic big air gold as Gasser is toppled

Japan's Murase clinches Olympic big air gold as Gasser is toppled

-

US athletes using Winter Olympics to express Trump criticism

-

Japan's Murase clinches Olympic big air gold

Japan's Murase clinches Olympic big air gold

-

Pakistan to play India at T20 World Cup after boycott called off

-

Emergency measures hobble Cuba as fuel supplies dwindle under US pressure

Emergency measures hobble Cuba as fuel supplies dwindle under US pressure

-

UK king voices 'concern' as police probe ex-prince Andrew over Epstein

-

Spanish NGO says govt flouting own Franco memory law

Spanish NGO says govt flouting own Franco memory law

-

What next for Vonn after painful end to Olympic dream?

-

Main trial begins in landmark US addiction case against Meta, YouTube

Main trial begins in landmark US addiction case against Meta, YouTube

-

South Africa open T20 World Cup campaign with Canada thrashing

-

Epstein accomplice Maxwell seeks Trump clemency before testimony

Epstein accomplice Maxwell seeks Trump clemency before testimony

-

Discord adopts facial recognition in child safety crackdown

-

Some striking NY nurses reach deal with employers

Some striking NY nurses reach deal with employers

-

Emergency measures kick in as Cuban fuel supplies dwindle under US pressure

-

EU chief backs Made-in-Europe push for 'strategic' sectors

EU chief backs Made-in-Europe push for 'strategic' sectors

-

Brain training reduces dementia risk, study says

-

Machado ally 'kidnapped' after calling for Venezuela elections

Machado ally 'kidnapped' after calling for Venezuela elections

-

Epstein affair triggers crisis of trust in Norway

-

AI chatbots give bad health advice, research finds

AI chatbots give bad health advice, research finds

-

Iran steps up arrests while remaining positive on US talks

-

Frank issues rallying cry for 'desperate' Tottenham

Frank issues rallying cry for 'desperate' Tottenham

-

South Africa pile up 213-4 against Canada in T20 World Cup

-

Brazil seeks to restore block of Rumble video app

Brazil seeks to restore block of Rumble video app

-

Gu's hopes of Olympic triple gold dashed, Vonn still in hospital

-

Pressure mounts on UK's Starmer as Scottish Labour leader urges him to quit

Pressure mounts on UK's Starmer as Scottish Labour leader urges him to quit

-

Macron backs ripping up vines as French wine sales dive

China XLX Announces 2025 Interim Results

Q2 Profit Saw Strong QoQ Rebound

On Improved Sales Volume and Selling Prices of Products

2025 Interim Results Highlights:

Q2 revenue grew by 16.7% QoQ to approximately RMB 6.82 billion.

Profit attributable to owners of the parent for Q2 surged by 103.4% QoQ to approximately RMB 402million.

The Group continued to optimize the debt structure, with the ratio of long-term borrowings to short-term borrowings improved from 6:4 at the beginning of this year to 7:3 at the end of June and the finance expenses dropped by 14% YoY in the first half.

The debt-to-asset ratio stayed at a healthy level of 63.5%.

HONG KONG, HK / ACCESS Newswire / August 10, 2025 / China XLX Fertiliser Ltd. ("China XLX" or the "Company", together with its subsidiaries collectively referred to as the "Group"), announced that the Group's revenue for the three months ended 30 June 2025 grew by 16.7% quarter-on-quarter to approximately RMB 6.82 billion. Profit attributable to owners of the parent for the period climbed 103.4% quarter-on-quarter to approximately RMB 402 million.

In the first half of this year (the "Review Period"), the Group posted revenue of approximately RMB 12.666 billion, up 5.0% year-on-year. Profit attributable to owners of the parent for the period reduced by 12.8% year-on-year to approximately RMB 599 million.

While the Group's first-quarter results were dragged by lower product prices, its second-quarter results significantly improved from previous quarter. The selling prices of its products, in particular those of urea and melamine, remarkably rebounded in the second quarter on a gradual pickup in downstream demand. Underpinned by enhanced marketing efforts and orderly deployment of new production capacity, the Group's revenue steadily grew as the sales volumes of different products increased at varying degrees

Revenue from urea sales in the first half amounted to approximately RMB 3.225 billion, down by 16% year-on-year mainly due to 19% year-on-year decrease in average selling price. Owing to a combination of factors including market imbalance, export control and reduction in feedstock prices, urea selling prices spiraled downwards early this year and hence dragged down the average selling price of urea for the first half. Nevertheless, urea prices gradually picked up in the second quarter and grew by 10% from previous quarter as the urea export policy became clear and downstream demand was continually unleashed. The Group seized the opportunity arising from eased export control to vigorously expand into overseas markets, resulting in an increased export of 47,000 tons from a year ago and 4% year-on-year growth in the sales volume of urea. Moreover, it continued to strengthen the production technology and took advantage of the favorable environment from declined coal prices to bargain with suppliers for greater reduction in coal costs. As a result, the average production cost came down by 7% year-on-year.

Mainly driven by 8% year-on-year growth in sales volume, revenue from the sale of compound fertilisers grew by 5% year-on-year to approximately RMB 3.566 billion in the first half. The successful commissioning of Guangxi Production Base enabled the Group to cover the Guangdong, Guangxi and Hainan markets. The robust agricultural demand in South China, a major cash crop producing area, drove steady growth in the sales volume of compound fertilisers and led to 11% year-over-year increase in the sales volume of high-efficiency fertilisers. Guangxi Production Base allows the Group to better serve the regional markets.

Revenue from the sale of methanol reached approximately RMB 1.642 billion in the first half, representing 27% year-over-year growth. As the growth pace of production capacity in the market slowed down and many downstream facilities commenced operation, the methanol market showed signs of improvement. In the context of such market environment, the Group signed strategic long-term agreements with upstream suppliers in advance. With stepped-up efforts to stabilize the selling prices and expand foreign trade, the sales volume of methanol grew 28% year-on-year.

During the Review Period, the Group continued to optimize the debt structure and expand the financing channels, with the ratio of long-term borrowings to short-term borrowings improved from 6:4 at the beginning of this year to 7:3 at the end of June. Such loan arrangements not only aligned with the development cycles of the Group's projects and fully met their funding needs, but also helped mitigate the Group's short-term debt repayment pressure and further strengthened its debt structure.

Meanwhile, the Group took advantage of interest rate cuts to refinance high-interest loans, resulting in 0.8 percentage point decrease in average lending rates and 14% year-on-year decrease in finance expenses in the first half. As of the end of June, the Group's debt-to-asset ratio remained at a healthy level of 63.5%. When the Phase II of Jiangxi Project commences operation in the third quarter of this year as planned, it will generate positive cash flow to the Group in the second half, hence reducing the pressure from capital expenditures for the full year and keeping its debt-to-asset ratio within a reasonable range.

Looking ahead into the second half, Mr. Liu Xingxu, Chairman of China XLX , said: Urea prices are expected to stabilize amid sufficient supply in domestic nitrogenous fertiliser market, stable demand and orderly adjustment of urea exports. Furthermore, as the modernization of China's agriculture gathers momentum, the country's crop cultivation areas will continue to expand. There is robust demand for high-efficiency fertilisers from large-scale farmers.

Mr. Liu Xingxu noted that the Group is China's leading advocate for high-efficiency fertilisers. It is committed to the research and applications of advanced technology such as slow-release and controlled-release fertilisers and fertigation. Through vigorous efforts to promote the economical use of water and fertilisers, the efficient planting to boost yields and the fertiliser applications for modern agriculture, the Group reinforces its competitive edges in the market. Meanwhile, it will stick to the strategy of driving "high-quality development based on fertiliser business". By establishing a strong foothold on synthetic ammonia production, it will leverage the economies of scale and the production base model to achieve low-cost operation in coal gasification through efficient recycling of resources at production bases.

The Phase II of Jiangxi Production Base is slated for production in the third quarter of this year, and the New Chemical Materials Project at Xinxiang Production Base is scheduled to commence operation in the first quarter of 2026. Meanwhile, the development of new production bases in Guangxi and Zhundong is progressing on schedule. When all facilities under construction are fully operational by 2027, the Group's cash inflow will significantly outstrip its capital expenditures and hence create a virtuous cycle of "investment, output and growth".

~ END ~

About China XLX Fertiliser Ltd.

China XLX Fertiliser Ltd. is one of the largest and most cost-efficient coal-based urea producers in China. It is principally engaged in developing, manufacturing and selling of urea, compound fertiliser, methanol, dimethyl ether, melamine, furfuryl alcohol, furfural, 2-methylfuran, pharmaceutical intermediates and related differentiated products. The Group adheres to the development strategy of "maintaining overall cost leadership and creating competitive differentiation" while strengthening the core fertiliser operations. With support of the resources in Xinxiang, Xinjiang and Jiangxi, it extends the value chain to upstream new energy and new materials and diversifies into coal chemical related products. The Company's shares (stock code: 01866.HK) are traded on the main board of the Hong Kong Stock Exchange.

Investor and Media Enquiries

China XLX Fertiliser Ltd. | PRChina Limited |

File: 【Press Release】China XLX Announces 2025 Interim Results

File: China XLX Announces 2025 Interim Results

SOURCE: China XLX Fertiliser Ltd.

View the original press release on ACCESS Newswire

N.Walker--AT