-

Back to black: Philips posts first annual profit since 2021

Back to black: Philips posts first annual profit since 2021

-

South Korea police raid spy agency over drone flight into North

-

'Good sense' hailed as blockbuster Pakistan-India match to go ahead

'Good sense' hailed as blockbuster Pakistan-India match to go ahead

-

Man arrested in Thailand for smuggling rhino horn inside meat

-

Man City eye Premier League title twist as pressure mounts on Frank and Howe

Man City eye Premier League title twist as pressure mounts on Frank and Howe

-

South Korea police raid spy agency over drone flights into North

-

Solar, wind capacity growth slowed last year, analysis shows

Solar, wind capacity growth slowed last year, analysis shows

-

'Family and intimacy under pressure' at Berlin film festival

-

Basket-brawl as five ejected in Pistons-Hornets clash

Basket-brawl as five ejected in Pistons-Hornets clash

-

January was fifth hottest on record despite cold snap: EU monitor

-

Asian markets extend gains as Tokyo enjoys another record day

Asian markets extend gains as Tokyo enjoys another record day

-

Warming climate threatens Greenland's ancestral way of life

-

Japan election results confirm super-majority for Takaichi's party

Japan election results confirm super-majority for Takaichi's party

-

Unions rip American Airlines CEO on performance

-

New York seeks rights for beloved but illegal 'bodega cats'

New York seeks rights for beloved but illegal 'bodega cats'

-

Blades of fury: Japan protests over 'rough' Olympic podium

-

Zelensky defends Ukrainian athlete's helmet at Games after IOC ban

Zelensky defends Ukrainian athlete's helmet at Games after IOC ban

-

Jury told that Meta, Google 'engineered addiction' at landmark US trial

-

Despite Trump, Bad Bunny reflects importance of Latinos in US politics

Despite Trump, Bad Bunny reflects importance of Latinos in US politics

-

Epstein accomplice Maxwell seeks clemency from Trump before testimony

-

Star Copper to Deploy Advanced Deep-Penetrating 3D IP to Expedite 2026 Drill Program

Star Copper to Deploy Advanced Deep-Penetrating 3D IP to Expedite 2026 Drill Program

-

Apex Mobilizes Second Drill Rig and Provides Phase I Update at the Rift Rare Earth Project in Nebraska, U.S.A.

-

Noram Fully Funded for 2026 and Engages GRE to Update PEA With Multiple High-Value Critical Mineral Byproduct Credits

Noram Fully Funded for 2026 and Engages GRE to Update PEA With Multiple High-Value Critical Mineral Byproduct Credits

-

Gaming Realms PLC Announces FY25 Pre-Close Trading Update

-

Caledonia Mining Corporation Plc - Issue of Securities Pursuant to Long Term Incentive Plan Awards

Caledonia Mining Corporation Plc - Issue of Securities Pursuant to Long Term Incentive Plan Awards

-

Hemogenyx Pharmaceuticals PLC Announces Issue of Equity

-

How Fort Myers Dentists Create Long-Term Care Plans for Healthy Smiles

How Fort Myers Dentists Create Long-Term Care Plans for Healthy Smiles

-

Nikon Introduces the ACTION and ACTION ZOOM Binoculars

-

Australian PM 'devastated' by violence at rally against Israel president's visit

Australian PM 'devastated' by violence at rally against Israel president's visit

-

Vonn says suffered complex leg break in Olympics crash, has 'no regrets'

-

Five employees of Canadian mining company confirmed dead in Mexico

Five employees of Canadian mining company confirmed dead in Mexico

-

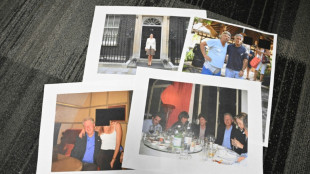

US lawmakers reviewing unredacted Epstein files

-

French take surprise lead over Americans in Olympic ice dancing

French take surprise lead over Americans in Olympic ice dancing

-

YouTube star MrBeast buys youth-focused banking app

-

French take surprise led over Americans in Olympic ice dancing

French take surprise led over Americans in Olympic ice dancing

-

Lindsey Vonn says has 'complex tibia fracture' from Olympics crash

-

US news anchor says 'hour of desperation' in search for missing mother

US news anchor says 'hour of desperation' in search for missing mother

-

Malen double lifts Roma level with Juventus

-

'Schitt's Creek' star Catherine O'Hara died of blood clot in lung: death certificate

'Schitt's Creek' star Catherine O'Hara died of blood clot in lung: death certificate

-

'Best day of my life': Raimund soars to German Olympic ski jump gold

-

US Justice Dept opens unredacted Epstein files to lawmakers

US Justice Dept opens unredacted Epstein files to lawmakers

-

Epstein taints European governments and royalty, US corporate elite

-

UK PM Starmer refuses to quit as pressure builds over Epstein

UK PM Starmer refuses to quit as pressure builds over Epstein

-

Three missing employees of Canadian miner found dead in Mexico

-

Meta, Google face jury in landmark US addiction trial

Meta, Google face jury in landmark US addiction trial

-

Winter Olympics organisers investigate reports of damaged medals

-

Venezuela opposition figure freed, then rearrested after calling for elections

Venezuela opposition figure freed, then rearrested after calling for elections

-

Japan's Murase clinches Olympic big air gold as Gasser is toppled

-

US athletes using Winter Olympics to express Trump criticism

US athletes using Winter Olympics to express Trump criticism

-

Japan's Murase clinches Olympic big air gold

SMX Scores Institutional Growth Backing of $11 Million, Up To $20 Million YTD

NEW YORK, NY / ACCESS Newswire / August 5, 2025 / SMX (Security Matters) PLC (NASDAQ:SMX), a company transforming supply chain transparency through technology that links physical products to tamper-proof digital records, announced in its latest 6-K filing that it has entered into a Securities Purchase Agreement with institutional investors for $11 million. This agreement could bring SMX's total capital raised in 2025 to approximately $20 million, pending full execution of all funding tranches.

This financing sends a strong message: even in one of the most difficult microcap climates in recent years, institutional investors are backing SMX's long-term vision, proprietary technology, and operational momentum with meaningful capital.

Structured across four tranches, the deal is designed to tie funding directly to SMX's execution milestones. No equity is issued upfront; instead, shares are only created upon conversion, with robust safeguards in place to prevent excessive ownership concentration and minimize daily market impact.

The proceeds will give SMX a significant working capital cushion, enabling the company to fast-track several key strategic initiatives:

Expansion of its digital platform that connects physical goods to digital records - enabling traceability, authentication, and compliance across sectors such as gold and precious metals, luxury fashion (e.g., handbags and footwear), semiconductors and electronic components, and agricultural commodities like coffee and natural rubber. SMX's platform not only protects supply chains and prevents counterfeiting, but also enhances material efficiency, reduces ESG compliance hurdles, and brings cost-effective clarity to emerging tariff enforcement rules - transforming regulatory complexity into operational advantage.

Buildout of its digital treasury infrastructure, designed to transform verified, traceable physical materials-such as recycled plastics, metals, textiles, and agricultural inputs - into financial-grade ESG assets. This platform will allow companies to digitize sustainability actions and convert them into authenticated, tradeable units of value. By doing so, SMX intends to unlock an entirely new class of sustainable financial instruments that can be audited, traded, and reported - providing transparency to regulators, confidence to investors, and new monetization pathways for businesses participating in the circular economy.

Strengthening the balance sheet by reducing liabilities, enhancing SMX's capital structure and operational agility. This improved financial positioning supports future strategic partnerships, enables faster decision-making, and ensures the company is focused on growth, execution, and shareholder value.

This infusion of growth capital, secured to accelerate scaled execution, reflects strong conviction - not only in SMX's vision, but in its capacity to follow through. Notably, the financing was structured without warrants, a clear indicator of investor alignment and a commitment to preserving long-term shareholder value.

Though any convertible arrangement brings eventual dilution, SMX emphasizes that such impact is shared equally across all shareholders - including its leadership. The team remains firmly aligned with investors in its pursuit of building durable, scalable value.

Further details are available in the Form 6-K filed with the SEC on August 5, 2025, at smx.tech/sec-filings.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

The information in this press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words "anticipate," "believe," "contemplate," "continue," "could," "estimate," "expect," "forecast," "intends," "may," "will," "might," "plan," "possible," "potential," "predict," "project," "should," "would" and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release may include, for example: matters relating to the Company's fight against abusive and possibly illegal trading tactics against the Company's stock; successful launch and implementation of SMX's joint projects with manufacturers and other supply chain participants of gold, steel, rubber and other materials; changes in SMX's strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans; SMX's ability to develop and launch new products and services, including its planned Plastic Cycle Token; SMX's ability to successfully and efficiently integrate future expansion plans and opportunities; SMX's ability to grow its business in a cost-effective manner; SMX's product development timeline and estimated research and development costs; the implementation, market acceptance and success of SMX's business model; developments and projections relating to SMX's competitors and industry; and SMX's approach and goals with respect to technology. These forward-looking statements are based on information available as of the date of this press release, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing views as of any subsequent date, and no obligation is undertaken to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include: the ability to maintain the listing of the Company's shares on Nasdaq; changes in applicable laws or regulations; any lingering effects of the COVID-19 pandemic on SMX's business; the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; the risk of downturns and the possibility of rapid change in the highly competitive industry in which SMX operates; the risk that SMX and its current and future collaborators are unable to successfully develop and commercialize SMX's products or services, or experience significant delays in doing so; the risk that the Company may never achieve or sustain profitability; the risk that the Company will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; the risk that the Company experiences difficulties in managing its growth and expanding operations; the risk that third-party suppliers and manufacturers are not able to fully and timely meet their obligations; the risk that SMX is unable to secure or protect its intellectual property; the possibility that SMX may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties described in SMX's filings from time to time with the Securities and Exchange Commission.

EMAIL: [email protected]

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire

W.Morales--AT