-

Wall Street stocks edge higher

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

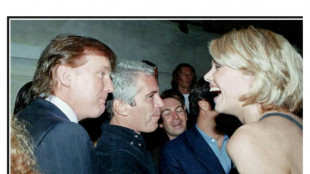

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Q4 Virtual Investor Summit Presentations Now Available On Demand

Q4 Virtual Investor Summit Presentations Now Available On Demand

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

Stocks split on China, US consumer confidence

European and Asian stocks climbed Tuesday and oil prices rallied further as China slashed the quarantine time for visitors, fuelling hopes of recovery for the world's second largest economy.

But US equities were hit by another disappointing economic sentiment indicator, reviving investor concerns about the impact of a likely recession.

The news from China came as Beijing and Shanghai appeared to have contained a Covid outbreak that had forced officials to impose lockdowns that compounded global supply chain snarls, further pushing up inflation.

Authorities said inbound travellers would have to quarantine for only 10 days instead of three weeks.

The news boosted share prices, already striving to rebound from recent sharp losses triggered by fears of a global recession.

"The Covid crisis appears to be rapidly retreating in China," noted Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

"The prospects of rapid recovery for the world's second largest economy is helping lift miners, as metals prices rise in expectation of a surge in demand in the commodity-hungry economy."

Asian markets closed higher, with both Hong Kong and Shanghai rising 0.9 percent.

At the same time, G7 leaders meeting in Germany condemned China's "non-transparent and market-distorting" international trade practices in an end-of-summit statement that hit out directly at Beijing for the first time.

Traders also digested comments from European Central Bank President Christine Lagarde, who said the ECB would go "as far as necessary" to fight inflation that is set to remain "undesirably high".

Paris rose 0.6 percent and Frankfurt added 0.4 percent. London climbed 0.9 percent.

Global equity markets have been recovering ground as investors believe central banks could decide to raise interest rates by more modest amounts than previously thought.

The US Federal Reserve and its peers are hiking borrowing costs in an attempt to cool inflation, which has soared around the world to the highest levels in decades.

Such action has increased the prospect of a global recession, causing economists to think that future rate hikes could be less steep than in recent months.

But early gains on Wall Street evaporated following a new report showing a drop in US consumer confidence.

The Conference Board's monthly consumer confidence index fell to 98.7 from 103.2, its lowest level since February 2021, as US consumer prices rise at their fastest pace in more than four decades.

"It looks like investors are potentially underestimating the big macro risks facing them by bidding up equity prices over the last few days," City Index analyst Fawad Razaqzada told AFP.

"It is far too early to be optimistic that this latest recovery will hold."

The Dow was down 0.4 percent in late morning trade, while the S&P 500 slid 0.7 percent and the tech-heavy Nasdaq Composite fell 1.4 percent.

- Oil jumps as G7 targets Russia -

Oil prices, a major driver of the soaring inflation, rose on fears of further supply tightening, in addition to prospects for higher Chinese demand.

This comes after G7 leaders agreed to work on a price cap for Russian oil, a US official said Tuesday, as part of efforts to cut the Kremlin's revenues.

International sanctions placed on Russia following its invasion of Ukraine are taking their toll.

Moody's ratings agency has confirmed that Russia defaulted on its foreign debt for the first time in a century, after bond holders did not receive $100 million in interest payments.

- Key figures at around 1530 GMT -

New York - Dow: DOWN 0.4 percent at 31,324.65 points

EURO STOXX 50: UP 0.2 percent at 3,506.13

London - FTSE 100: UP 0.9 percent at 7,323.41 (close)

Frankfurt - DAX: UP 0.4 percent at 13,231.82 (close)

Paris - CAC 40: UP 0.6 percent at 6,086.02 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 27,049.47 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 22,418.97 (close)

Shanghai - Composite: UP 0.9 percent at 3,409.21 (close)

Brent North Sea crude: UP 2.0 percent at $113.22 per barrel

West Texas Intermediate: UP 1.4 percent at $111.11 per barrel

Euro/dollar: DOWN at $1.0527 from $1.0583 Monday

Pound/dollar: DOWN at $1.2188 from $1.2268

Euro/pound: UP at 86.35 pence from 86.24 pence

Dollar/yen: UP at 136.26 yen from 135.48 yen

burs-rl/kjm

T.Sanchez--AT