-

Wall Street stocks edge higher

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

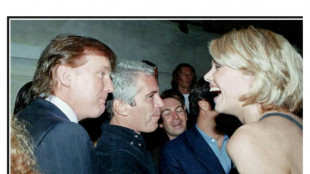

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Q4 Virtual Investor Summit Presentations Now Available On Demand

Q4 Virtual Investor Summit Presentations Now Available On Demand

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

Oil prices rebound on mixed day for global stocks

Oil prices bounced and Wall Street stocks declined Monday, reversing the most recent trends as markets eye the end of a bruising second quarter.

After positive sessions for several leading European and Asian bourses, Wall Street stocks were in the red most of the day, and finished modestly lower.

The broad-based S&P 500, which has fallen about 14 percent since the end of the first quarter, shed 0.3 percent on Monday.

Wall Street last week enjoyed a rare positive performance amid talk that weakening economic data may have set the stage for central banks to tighten less aggressively than they have been suggesting.

But the first session of the week also revealed angst over the current macroeconomic backdrop.

Economists are increasingly pessimistic about the potential for US policymakers to engineer a "soft landing" as central banks tighten monetary policy, reversing a after a long period of rock-bottom borrowing rates due to surging inflation.

The yield on the 10-year US Treasury note, a proxy for interest rate expectations, climbed to around 3.20 percent.

Beth Ann Bovino, chief economist for S&P Global Ratings, said she remained relatively hopeful about the 2022 outlook but that 2023 "is the bigger worry."

Earlier, Asia continued a rally on Monday while London and Frankfurt closed higher and Paris retreated.

Hong Kong led gainers, climbing more than two percent thanks to a strong performance in Chinese tech firms.

Indications that China's crackdown on the sector could be coming to an end added to the upbeat mood in the city.

Oil prices rose after sharp falls last week, with analysts pointing to limited crude supply as a continued worried in spite of the uncertain oil demand outlook.

"The world is increasingly vulnerable to disruptions in energy output given critically low inventories and spare capacity," said commodities analysts at TD Securities.

"We think that oil prices are on a runaway train, and expect that the state of the world's energy supply is so constrained that even in a recession, oil prices could remain elevated."

- Key figures at around 2040 GMT -

New York - Dow: DOWN 0.2 percent at 31,438.26 (close)

New York - S&P 500: DOWN 0.3 percent at 3,900.11 (close)

New York - Nasdaq: DOWN 0.7 percent at 11,523.83 (close)

London - FTSE 100: UP 0.7 percent at 7,258.32 (close)

Frankfurt - DAX: UP 0.5 percent at 13,186.07 (close)

Paris - CAC 40: DOWN 0.4 percent at 6,047.31 (close)

EURO STOXX 50: UP 0.2 percent at 3,538.88 (close)

Tokyo - Nikkei 225: UP 1.4 percent at 26,871.27 (close)

Hong Kong - Hang Seng Index: UP 2.4 percent at 22,229.52 (close)

Shanghai - Composite: UP 0.9 percent at 3,379.19 (close)

Euro/dollar: UP at $1.0583 from $1.0553 Friday

Pound/dollar: FLAT at $1.2268

Euro/pound: UP at 86.24 pence from 86.02 pence

Dollar/yen: UP at 135.48 yen from 135.23 yen

Brent North Sea crude: UP 1.7 percent at $115.09 per barrel

West Texas Intermediate: UP 1.8 percent at $109.57 per barrel

burs-jmb

F.Ramirez--AT