-

Wall Street stocks edge higher

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Q4 Virtual Investor Summit Presentations Now Available On Demand

Q4 Virtual Investor Summit Presentations Now Available On Demand

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

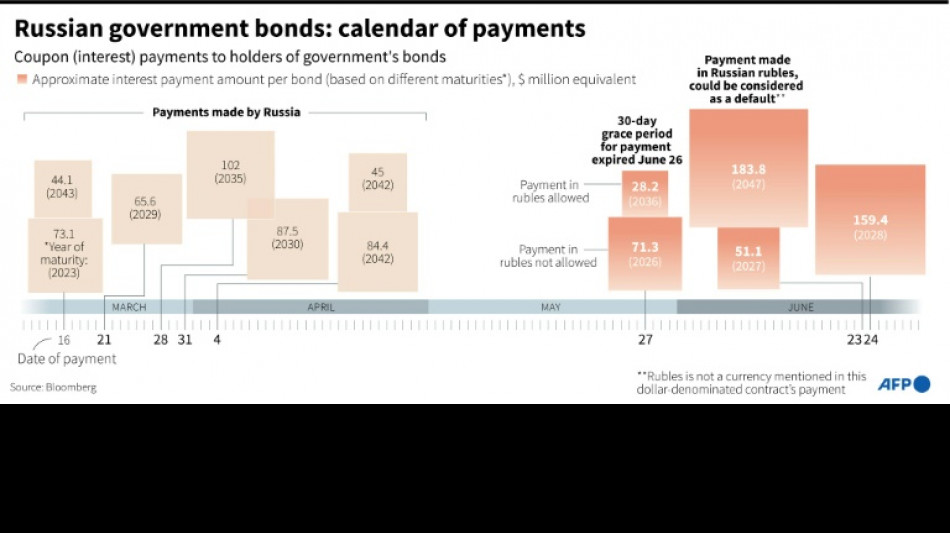

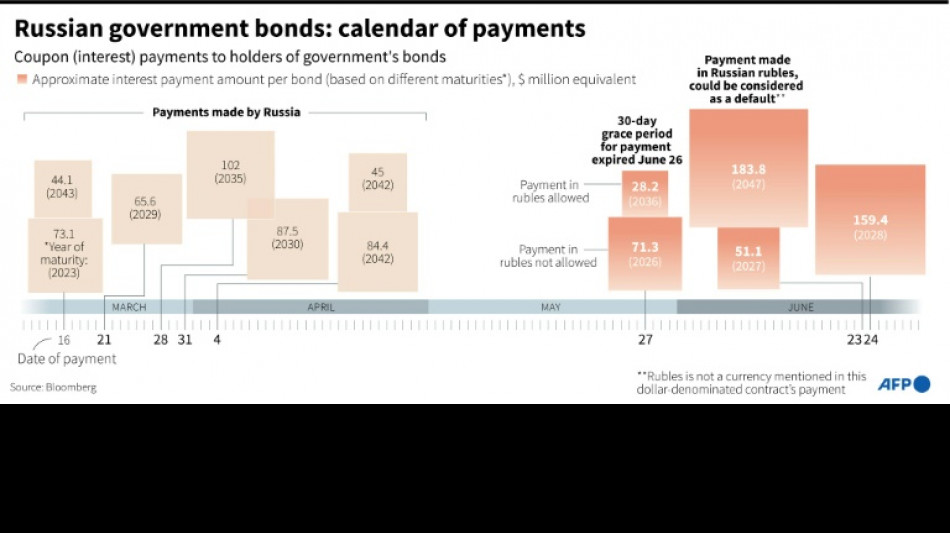

Blocked Russian payments: what impact for Moscow and creditors?

Russia acknowledged Monday that two interest payments on its debt didn't make it to creditors, an event which could be considered a default, even if Moscow disputes such an interpretation.

What happens next?

Why the default risk?

Russia was due to pay $100 million in interest on its debt on May 27 and the one-month grace period on the payment expired on Sunday.

The Russian finance ministry has said it paid the money on May 20. But it acknowledged on Monday that the money didn't reach creditors as the banking intermediaries blocked the transfers due to Western sanctions imposed on Moscow over the war in Ukraine.

The United States has since the end of May blocked Moscow from paying its dollar debts.

How to know if Russia is really in default?

Traditionally, it is the big credit ratings agencies (Fitch, Moody's, S&P Global Ratings) which make such a determination.

However, with the Western sanctions in place, "they are now prohibited from rating Russian government bonds," said Eric Dor, director of economic studies at the IESEG business school.

"We could well have a default without an official declaration by an authorised institution," he added.

It will now likely fall to the Credit Derivatives Determinations Committee (CDDC), a committee of creditors, to make the official determination whether Russia missed the payments and whether this constitutes a default.

The Committee has already acknowledged earlier this month that Russia did not make $1.9 million in penalty interest payments concerning a different payment due.

It plans to meet on Wednesday afternoon to discuss the missed May 27 payment.

It is also the Committee which decides whether or not to trigger payment of credit default swaps (CDS), financial products designed to serve as insurance for creditors against default.

Moscow argues that the fact that creditors didn't receive their money was not of the result of its failure to make the payment, but the actions of third parties, thus there is no default on its part.

What consequences of a default?

Russia's last default on its foreign debt was in 1918, when Bolshevik leader Vladimir Lenin repudiated Tsarist-era debts.

In case a default is declared "Russia won't be able to borrow in foreign currencies," said Slim Souissi, a researcher at the Institute of Business Administration at the University of Caen.

"In the short term, it will have trouble raising funds on international markets" and this could last for years, said Souissi, who previously worked as a financial analyst at Fitch.

Liam Peach, Emerging Europe Economist at Capital Economics, downplayed the impact of a default determination, as Western sanctions are already blocking Russia's access to international capital markets.

Normally, a default can have serious consequences.

Argentina's decision to freeze payment on $100 billion in debt in 2001 triggered a deep economic, political and social crisis.

But with sanctions again blocking Russian access to many markets, Peach said default would be a "largely symbolic event" unlikely to have an additional macroeconomic impact.

Russia's situation is also different in terms of the sums involved.

"There are around $2 billion in payments due from now until the end of the year, and that isn't going to destabilise" the international financial system, said Dor.

Mexico's 1982 default sparked debt crises in several developing countries as creditors demanded higher interest rates.

Peach said only about half of Russian foreign currency bonds are held by foreigners, which reduces the possibility of a wider impact.

Recovering the debt could prove to be thorny to litigate, according to legal experts questioned by AFP. The terms of Russian bonds are notoriously vague, including even on such basic elements as the legal jurisdiction to resolve disputes.

How did Russia try to avoid default?

To get around the ban on dollar payments, Moscow made the equivalent ruble sums available to creditors at the National Settlement Depository (NSD), a Russian financial institution.

According to Souissi, if the bond's terms didn't forsee payment in rubles this would constitute a default.

Moscow said the arrangement allowed Western creditors to recover their money, and they are free to request conversion into the foreign currency of their choice.

But getting the money out of Russia isn't straightforward and "investors weren't keen on opening accounts at the NSD", said Dor.

bur-boc-jvi-dga/rl/cdw

E.Rodriguez--AT