-

Australia all out for 152 as England take charge of 4th Ashes Test

Australia all out for 152 as England take charge of 4th Ashes Test

-

Boys recount 'torment' at hands of armed rebels in DR Congo

-

Inside Chernobyl, Ukraine scrambles to repair radiation shield

Inside Chernobyl, Ukraine scrambles to repair radiation shield

-

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

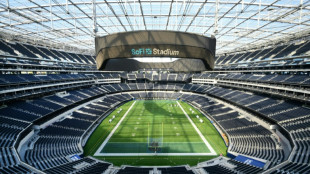

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

-

Villa face Chelsea test as Premier League title race heats up

Villa face Chelsea test as Premier League title race heats up

-

Spurs extend domination of NBA-best Thunder

-

Malaysia's Najib to face verdict in mega 1MDB graft trial

Malaysia's Najib to face verdict in mega 1MDB graft trial

-

Russia makes 'proposal' to France over jailed researcher

-

King Charles calls for 'reconciliation' in Christmas speech

King Charles calls for 'reconciliation' in Christmas speech

-

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

-

UK tech campaigner sues Trump administration over US sanctions

UK tech campaigner sues Trump administration over US sanctions

-

New Anglican leader says immigration debate dividing UK

-

Russia says made 'proposal' to France over jailed researcher

Russia says made 'proposal' to France over jailed researcher

-

Bangladesh PM hopeful Rahman returns from exile ahead of polls

-

Police suspect suicide bomber behind Nigeria's deadly mosque blast

Police suspect suicide bomber behind Nigeria's deadly mosque blast

-

AFCON organisers allowing fans in for free to fill empty stands: source

-

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

-

Pope urges Russia, Ukraine dialogue in Christmas blessing

-

Last Christians gather in ruins of Turkey's quake-hit Antakya

Last Christians gather in ruins of Turkey's quake-hit Antakya

-

Pope Leo condemns 'open wounds' of war in first Christmas homily

-

Mogadishu votes in first local elections in decades under tight security

Mogadishu votes in first local elections in decades under tight security

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh

-

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

-

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

-

Pacific archipelago Palau agrees to take migrants from US

-

Pope Leo expected to call for peace during first Christmas blessing

Pope Leo expected to call for peace during first Christmas blessing

-

Australia opts for all-pace attack in fourth Ashes Test

-

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

-

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

-

Trump takes Christmas Eve shot at 'radical left scum'

Trump takes Christmas Eve shot at 'radical left scum'

-

3 Factors That Affect the Cost of Dentures in San Antonio, TX

-

Leo XIV celebrates first Christmas as pope

Leo XIV celebrates first Christmas as pope

-

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

-

'At your service!' Nasry Asfura becomes Honduran president-elect

'At your service!' Nasry Asfura becomes Honduran president-elect

-

Trump-backed Nasry Asfura declared winner of Honduras presidency

-

Diallo strikes to give AFCON holders Ivory Coast winning start

Diallo strikes to give AFCON holders Ivory Coast winning start

-

Dow, S&P 500 end at records amid talk of Santa rally

-

Spurs captain Romero facing increased ban after Liverpool red card

Spurs captain Romero facing increased ban after Liverpool red card

-

Bolivian miners protest elimination of fuel subsidies

HSBC first-quarter pre-tax profits drop nearly 30% to US$4.2 bn

HSBC said on Tuesday that first-quarter profits dropped nearly 30 percent owing to higher-than-expected credit losses and inflation but the Asia-focused lending giant remained upbeat about its outlook.

The London-based bank announced pre-tax profits of $4.2 billion for January-March, down 28 percent on-year but beating estimates, while reporting revenue declined four percent to $12.5 billion.

"While profits were down on last year's first quarter due to market impacts on wealth revenue and a more normalised level of ECL (expected credit losses), higher lending across all businesses and regions, and good business growth in personal banking, insurance and trade finance bode well for future quarters," chief executive Noel Quinn said in a statement.

The lender reported an ECL of $600 million, compared with a release of $400 million from the same period last year.

The bank said it continued to expect "mid single-digit percentage" growth this year for revenue and lending respectively.

Tuesday's results were published against the backdrop of Russia’s invasion of Ukraine, which the bank said was exacerbating inflationary pressures and contributing to higher ECL charges for the quarter.

"The repercussions from the Russia-Ukraine war, alongside the economic impacts that continue to result from Covid-19, have pushed up the prices of a broad range of commodities, with the resulting increase in inflation creating further challenges for monetary authorities and our customers," the bank said.

Quinn said the "vast majority" of HSBC business in Russia serves multinational corporate clients headquartered in other countries, and the bank was implementing sanctions put in place by the United Kingdom and other governments.

But the bank forecast its operation in Russia may become "untenable" if subject to further restrictions.

HSBC has embarked on a multi-year strategic pivot to Asia and the Middle East, and on Tuesday it noted that while coronavirus restrictions were lifting across much of the globe, key markets such as China and Hong Kong remained committed to zero-Covid controls.

"China's government-imposed lockdown restrictions in major Chinese cities have impacted China’s economy, Asia tourism and global supply chains adversely," the bank said.

China is struggling to deal with skyrocketing case counts in multiple cities and has locked down its finance hub Shanghai for the past month.

Meanwhile, Hong Kong -- HSBC's largest market -- has entered its third year of strict coronavirus controls that have isolated it from the rest of the world and hit businesses hard.

The bank noted that the financial services sector in Hong Kong has remained strong.

HSBC's restructuring effort to lead the market in Asia wealth management had earlier included a programme to invest $6 billion in Hong Kong, China and Singapore and to hire more than 5,000 wealth advisors.

The lender has slashed 35,000 jobs and sold its retail operations in the United States and France.

In February, the bank announced a boon to investors in the form of a $1.0 billion share buyback, adding to a $2.0 billion buyback announced last year.

P.Hernandez--AT