-

Anthropic vows court fight in Pentagon row

Anthropic vows court fight in Pentagon row

-

'Harder path': Obama attacks Trump at Jesse Jackson memorial

-

Amber Glenn says will not visit White House to celebrate Olympic gold

Amber Glenn says will not visit White House to celebrate Olympic gold

-

Russian athletes booed as they parade under own flag at Paralympics opening

-

Trump to attend return of six US troops killed in Iran war

Trump to attend return of six US troops killed in Iran war

-

Tom Brady flag football event moved from Saudi to Los Angeles: reports

-

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

UN chief slams 'unlawful attacks', says Mideast could spiral out of control

-

Middle East war a new shock for financial markets

-

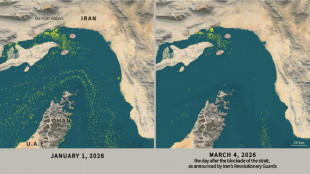

Only nine commercial ships detected crossing the Hormuz Strait since Monday

Only nine commercial ships detected crossing the Hormuz Strait since Monday

-

Mexico unveils 100,000-strong security deployment for World Cup

-

Trump's Iran war violates international law, experts say

Trump's Iran war violates international law, experts say

-

Swiss eyeing fewer F-35 fighters, reshaping defence set-up

-

UK police question three women in Al-Fayed probe

UK police question three women in Al-Fayed probe

-

Oil prices surge as Mideast war rages, stocks fall on US jobs

-

Dupont says France must forget Six Nations title talk against Scotland

Dupont says France must forget Six Nations title talk against Scotland

-

Voices from Iran: protests, fear and scarcity

-

Champions League ambitions encourage Barca gamble in Bilbao

Champions League ambitions encourage Barca gamble in Bilbao

-

This is how Ukraine has countered Russia's Iran-designed drones

-

Dybala out for six weeks as Roma battle for top-four spot

Dybala out for six weeks as Roma battle for top-four spot

-

Sleepless Iranians count cost of war as damage mounts

-

Itoje tells faltering England to 'take the game to Italy' in Six Nations

Itoje tells faltering England to 'take the game to Italy' in Six Nations

-

Leading satellite firm to hold back Gulf state images

-

Tuipulotu urges Scotland to stay in Six Nations title hunt against France

Tuipulotu urges Scotland to stay in Six Nations title hunt against France

-

Trump says only Iran's 'unconditional surrender' can end war

-

US releases Epstein files with uncorroborated Trump allegations

US releases Epstein files with uncorroborated Trump allegations

-

Securing shipping lane from Mideast war 'challenging', say experts

-

Italy have to start beating the best, says captain Lamaro

Italy have to start beating the best, says captain Lamaro

-

US retail sales decline as consumer pullback deepens

-

War in Middle East raises stagflation fears in Europe and beyond

War in Middle East raises stagflation fears in Europe and beyond

-

UN demands swift probe into Israeli strikes on Lebanon

-

Chelsea happy to rotate goalkeepers, says Rosenior

Chelsea happy to rotate goalkeepers, says Rosenior

-

Soaring gas prices spark renewed debate about European electricity

-

Germany's Axel Springer swoops for British newspaper The Telegraph

Germany's Axel Springer swoops for British newspaper The Telegraph

-

US sheds jobs in February in warning sign for Trump's economy

-

Sole Iranian competitor out of Paralympics due to Middle East war

Sole Iranian competitor out of Paralympics due to Middle East war

-

Spanish PM says 'cooperation' with US should prevail over 'confrontation'

-

Lebanese relive 'nightmare' of displacement from war

Lebanese relive 'nightmare' of displacement from war

-

US must probe Iran school strike 'very quickly', UN says

-

AC Milan hoping to revive dimming title hopes in derby against Inter

AC Milan hoping to revive dimming title hopes in derby against Inter

-

Pirovano in 'seventh heaven' after first World Cup victory

-

Iceland proposes August 29 referendum on resuming EU membership talks

Iceland proposes August 29 referendum on resuming EU membership talks

-

Hungary to expel 7 Ukrainians as Zelensky, Orban quarrel over Russian oil

-

Ohtani homers as Japan thrash Taiwan at World Baseball Classic

Ohtani homers as Japan thrash Taiwan at World Baseball Classic

-

Who rules the seas? Torpedoed Iran ship brings focus underwater

-

Pirovano takes downhill at Val di Fassa for first World Cup win

Pirovano takes downhill at Val di Fassa for first World Cup win

-

Iran drone strike on Azerbaijan raises fears of Mideast war spreading to Caucasus

-

Decades of planning and US backing helps fuel Israel's air power

Decades of planning and US backing helps fuel Israel's air power

-

Hungary to expel seven Ukrainians as Zelensky, Orban quarrel over Russian oil

-

Stocks fluctuate, oil climbs as Mideast crisis rages

Stocks fluctuate, oil climbs as Mideast crisis rages

-

Mideast war is heightening uncertainty, Lufthansa warns

European equities rebound as Fed meets

European stock markets rebounded Tuesday, shrugging off steep Asian losses on the eve of a Federal Reserve monetary policy decision and after tumbling the previous day on Ukraine tensions and US rate hike fears.

In late morning deals, Frankfurt equities won 0.9 percent, while London and Paris each gained 1.1 percent in value.

World oil prices also advanced strongly while the dollar strengthened ahead of this week's Fed rate call.

All attention is now on the Fed's two-day gathering that concludes Wednesday, with investors poring over every word from the bank's statement and boss Jerome Powell's subsequent news conference.

- Fears of new sell-off -

"Investors' hands are already shaking after the bloodbath in equity markets so far in 2022, so that any aggressive moves by the Fed could cause a further sell-off among global shares," said AJ Bell investment director Russ Mould.

"The central bank is fully aware it needs to act carefully, but equally it is unlikely to sit on hands given the inflationary pressures that need addressing."

After spending much of last year playing down the spike in prices, the US central bank has in recent months taken a sharp hawkish turn on monetary policy as officials look to bring inflation -- which is at a four-decade high -- under control.

Minutes from the most recent meeting indicate it will begin lifting interest rates from March with three or possibly four more hikes before the end of the year.

On top of that, it plans to start offloading its vast bond holdings.

But while the move to battle runaway prices is seen as crucial, the end of the era of ultra-cheap cash for investors has rattled markets after almost two years of uninterrupted gains to record or multi-month highs.

- 'Volatility prevails' -

Asian indices plunged Tuesday following a highly volatile day on Wall Street fuelled by fears about the Fed's plans, with eyes also on Ukraine.

"Volatility is likely to prevail for the moment," noted Interactive Investor analyst Richard Hunter.

Global equities were spooked Monday with London diving 2.6 percent while Frankfurt and Paris had each tumbled by almost four percent.

Wall Street stocks, however, staged a feverish comeback Monday after stumbling to multi-month lows.

Heightened concern about Russia's troop build-up on Ukraine's border has weighed on investor sentiment, alongside a disappointing start to the corporate earnings season.

Sentiment brightened somewhat Tuesday after Ericsson logged 2021 net profits, as the Swedish telecoms giant makes headway in 5G services.

London investors also digested news of 1,500 job cuts at British consumer goods giant Unilever, whose share price nudged lower.

The announcement comes after Unilever failed with a £50-billion ($68-billion) takeover bid for the consumer health care unit owned by pharmaceutical groups GlaxoSmithKline and Pfizer.

- Key figures around 1050 GMT -

London - FTSE 100: UP 1.1 percent at 7,378.88 points

Paris - CAC 40: UP 1.1 percent at 6,864.20

Frankfurt - DAX: UP 0.9 percent at 15,143.80

EURO STOXX 50: UP 1.1 percent at 4,096.36

Tokyo - Nikkei 225: DOWN 1.7 percent at 27,131.34 (close)

Hong Kong - Hang Seng Index: DOWN 1.7 percent at 24,243.61 (close)

Shanghai - Composite: DOWN 2.6 percent at 3,433.06 (close)

New York - Dow: UP 0.3 percent at 34,364.50 (close)

Euro/dollar: DOWN at $1.1286 from $1.1326 late Monday

Pound/dollar: DOWN at $1.3480 from $1.3488

Euro/pound: DOWN at 83.72 pence from 83.97 pence

Dollar/yen: UP at 114.07 yen from 113.95 yen

Brent North Sea crude: UP 1.3 percent at $87.37 per barrel

West Texas Intermediate: UP 1.2 percent at $84.30 per barrel

burs-rfj/imm

P.Hernandez--AT