-

Smith laments lack of runs after first Ashes home Test loss for 15 years

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

What they said as England win 4th Ashes Test - reaction

-

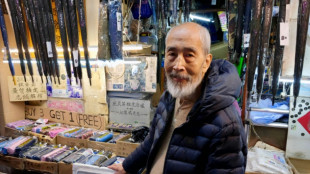

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

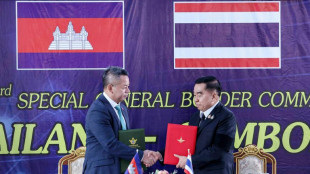

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

-

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

-

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

-

Six Australia wickets fall as England fight back in 4th Ashes Test

Six Australia wickets fall as England fight back in 4th Ashes Test

-

Man Utd made to 'suffer' for Newcastle win, says Amorim

-

Morocco made to wait for Cup of Nations knockout place after Egypt advance

Morocco made to wait for Cup of Nations knockout place after Egypt advance

-

Key NFL week has playoff spots, byes and seeds at stake

-

Morocco forced to wait for AFCON knockout place after Mali draw

Morocco forced to wait for AFCON knockout place after Mali draw

-

Dorgu delivers winner for depleted Man Utd against Newcastle

-

US stocks edge lower from records as precious metals surge

US stocks edge lower from records as precious metals surge

-

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

-

Former Ivory Coast coach Gasset dies at 72

Former Ivory Coast coach Gasset dies at 72

-

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

-

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

-

Seoul to ease access to North Korean newspaper

-

History-maker Tongue wants more of the same from England attack

History-maker Tongue wants more of the same from England attack

-

Australia lead England by 46 after 20 wickets fall on crazy day at MCG

Beijing's vow to stabilise the market has worked... for now

An unexpected pledge by top Beijing officials this week to shore up the economy sent Asian stocks surging after days of jitters over China's coronavirus rebound, war in Ukraine and an uncertain property market.

It was seen as a sign of China's economic planners acknowledging anxiety over hot-button issues from tech and real estate to listings abroad.

But the soothing words -- delivered after a meeting chaired by Vice Premier Liu He -- are yet to be matched by hard policy decisions.

So what does it all mean?

What has China said and why?

Top financial leaders on Wednesday said they would maintain capital market "stability", support overseas IPOs and reduce risks involving troubled property developers -- whose problems repaying debts have threatened to destabilise the economy.

Their meeting called for policies "beneficial to markets", indirect but instructive language on government concerns which sent shares -- tech stocks in particular -- soaring in Hong Kong.

The comments come as China's annual growth target of around 5.5 percent -- its lowest in decades -- has been challenged by coronavirus resurgences, a property slump and global uncertainty following Russia's invasion of Ukraine.

Reprieve for tech ?

The announcement was music to the ears of investors in Chinese tech firms, which had been flayed for more than a year by a state crackdown on the sector.

Regulators have targeted everything from their market size to data use, rocking share prices, wiping billions off company valuations and smothering IPOs outside of China.

Scrutiny has hit some of the country's biggest names, including Alibaba and Tencent, pushing once-proud billionaire tech doyens into the shadows.

The latest guidance, which called for more "predictable regulation" of the tech sector, suggests some parts of government are willing to signal more clearly ahead of policy changes.

"It is notable, very notable, that Liu He himself would feel the need to step in," Kendra Schaefer, head of tech policy research at consultancy Trivium, told AFP, forecasting "a more measured approach to reform and regulation".

Yet, she cautioned that scrutiny of the tech behemoths -- which dominate everything from shopping to ride hailing -- and the way they use the public's data "isn't going away".

What about real estate?

China's heavily indebted property sector has sagged under rules dubbed the "three red lines", which targeted debt ratios to reduce the risks of companies going bust.

The rules challenged developers' models of endless debt-driven expansion and major firms have been pushed to the brink of collapse.

Wednesday's statement offered some solace to the bruised sector, experts said.

"One important signal was from the Ministry of Finance, which indicated that there are no plans to expand trials of property tax reforms," said IHS Markit's Asia-Pacific chief economist Rajiv Biswas.

But the statement did not indicate a change to the "three red lines" policy or offer hope of government bailouts to stricken companies.

"The government is unlikely to provide any large-scale support that would benefit distressed developers," said Lucror Analytics' senior credit analyst Leonard Law, although "emphasis on stability may help stem the negative spiral".

And what now for US listings?

Beijing launched security probes on several US-listed Chinese companies after a controversial New York IPO by ride-hailing giant Didi Chuxing went ahead last year despite regulator warnings.

The dim view of US listings came as Washington and Beijing's relations sank to a nadir.

Wednesday's meeting said regulators in China and the US had made "positive progress" on the issue of US-listed Chinese stocks.

Both sides are working towards a cooperation plan, guidance from the meeting said.

The reassurance is backlit by war in Ukraine and US warnings of severe sanctions on anyone who helps Russia.

"The last thing Beijing wants on top of everything else is any form of capital flight," ACY Securities chief economist Clifford Bennett told AFP.

While the responsivity from the top to market sentiment is telling, Hong Hao of financial services firm Bocom International warned "it's a very high-level announcement... We still have to wait for detailed implementation."

A.Ruiz--AT