-

Russia pummels Kyiv ahead of Zelensky's US visit

Russia pummels Kyiv ahead of Zelensky's US visit

-

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

-

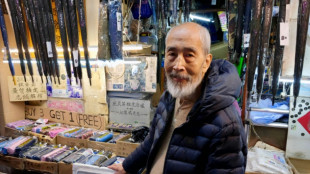

Hong Kongers bid farewell to 'king of umbrellas'

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

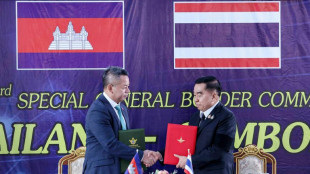

Thailand and Cambodia agree to 'immediate' ceasefire

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

England need 175 to win chaotic 4th Ashes Test

-

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

-

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

-

Six Australia wickets fall as England fight back in 4th Ashes Test

-

Man Utd made to 'suffer' for Newcastle win, says Amorim

Man Utd made to 'suffer' for Newcastle win, says Amorim

-

Morocco made to wait for Cup of Nations knockout place after Egypt advance

-

Key NFL week has playoff spots, byes and seeds at stake

Key NFL week has playoff spots, byes and seeds at stake

-

Morocco forced to wait for AFCON knockout place after Mali draw

-

Dorgu delivers winner for depleted Man Utd against Newcastle

Dorgu delivers winner for depleted Man Utd against Newcastle

-

US stocks edge lower from records as precious metals surge

-

Somalia denounces Israeli recognition of Somaliland

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

Draper to miss Australian Open

-

Former Ivory Coast coach Gasset dies at 72

-

Police arrest suspect after man stabs 3 women in Paris metro

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

Japan govt approves record budget, including for defence

-

Malaysia's Najib convicted of abuse of power in 1MDB graft trial

-

Seoul to ease access to North Korean newspaper

Seoul to ease access to North Korean newspaper

-

History-maker Tongue wants more of the same from England attack

BoE hikes rate again as Ukraine war fuels inflation

The Bank of England on Thursday hiked its main interest rate to its pre-pandemic level to combat runaway inflation that risks soaring far higher as the Ukraine conflict fuels energy costs.

The BoE hiked borrowing costs by a quarter-point to 0.75 percent, its third increase in a row.

The decision came one day after the US Federal Reserve carried out the first of what is expected to be a number of rate hikes this year to tackle decades-high inflation.

The UK central bank said the country's annual inflation rate could top 8.0 percent this year, as the Ukraine war fuels already sky-high prices for oil, gas and other commodities.

It had previously forecast inflation to peak at 7.25 percent in April.

The BoE even warned that, should wholesale energy prices continue to soar, inflation could potentially be "several percentage points higher" than the prior estimate.

Eight members of the bank's nine-strong Monetary Policy Committee, including governor Andrew Bailey, voted to lift its key rate by a quarter point, while Jon Cunliffe wanted it kept at 0.5 percent due to worries over the soaring cost of living.

- Ukraine fallout -

"Regarding inflation, the invasion of Ukraine by Russia has led to further large increases in energy and other commodity prices including food prices," the BoE said in a statement.

"It is also likely to exacerbate global supply chain disruptions, and has increased the uncertainty around the economic outlook significantly."

The bank said global inflationary pressures would "strengthen considerably further" over the coming months, meaning that net energy importers including Britain would likely experience slowing growth.

The latest official data showed that UK annual inflation hit 5.5 percent in January, the highest level since 1992.

Inflation is rocketing around the world also as economies reopen from the pandemic.

The Fed on Wednesday announced a quarter-point rate hike, the first since it slashed its rate to zero at the start of the Covid-19 crisis.

"Like the US Federal Reserve, the bank is signalling an unyielding approach in the face of surging inflation," said Deloitte chief economist Ian Stewart.

"That points to further increases in interest rates on both sides of the Atlantic in the next 12 months, and to weaker growth."

The European Central Bank last week "significantly" lifted its inflation forecasts for the eurozone on sky-high energy prices and uncertainty over the war in Ukraine, but it gave itself time before raising interest rates.

- 'Annus horribilis' -

The UK's February inflation data is due Wednesday.

This coincides with a budget update from the government, which is facing higher repayment costs on its vast pandemic bill following rate hikes.

Finance minister Rishi Sunak has already announced a major tax hike starting in April on UK workers and businesses.

That same month, a cap on domestic gas and electricity bills is set to significantly increase.

While Britain's unemployment rate has fallen to its pre-pandemic level, wages are eroding at the fastest pace in eight years as prices soar.

"UK consumers now face an annus horribilis, as rising borrowing costs will be compounded by higher food and energy bills, and tax rises to boot," said AJ Bell analyst Laith Khalaf.

He noted that while rate hikes "will mean savers getting a bit more return on cash held in the bank, elevated inflation means they will actually be worse off".

The bank also confirmed Thursday it would stop the reinvestment of government bonds under its massive quantitative easing stimulus, which now stands at £867 billion ($1.1 trillion).

A.Anderson--AT