-

Stokes and Jacks lead rearguard action to keep England alive

Stokes and Jacks lead rearguard action to keep England alive

-

Sri Lanka issues landslide warnings as cyclone toll hits 618

-

McIlroy going to enjoy 'a few wines' to reflect on 'unbelievable year'

McIlroy going to enjoy 'a few wines' to reflect on 'unbelievable year'

-

India nightclub fire kills 25 in Goa

-

Hong Kong heads to the polls after deadly fire

Hong Kong heads to the polls after deadly fire

-

Harden moves to 10th on NBA all-time scoring list in Clippers defeat

-

Number's up: Calculators hold out against AI

Number's up: Calculators hold out against AI

-

McIntosh, Marchand close US Open with 200m fly victories

-

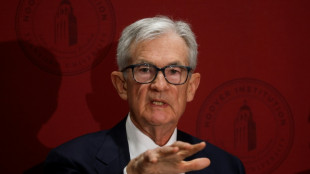

Divided US Fed set for contentious interest rate meeting

Divided US Fed set for contentious interest rate meeting

-

India nightclub fire kills 23 in Goa

-

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

-

Trump's Pentagon chief under fire as scandals mount

-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

-

Torres treble helps Barca extend Liga lead, Atletico slip

Torres treble helps Barca extend Liga lead, Atletico slip

-

PSG thump Rennes but Lens remain top in France

-

Salah opens door to Liverpool exit with 'thrown under the bus' rant

Salah opens door to Liverpool exit with 'thrown under the bus' rant

-

Two eagles lift Straka to World Challenge lead over Scheffler

-

Messi dazzles as Miami beat Vancouver to win MLS title

Messi dazzles as Miami beat Vancouver to win MLS title

-

Bielle-Biarrey strikes twice as Bordeaux-Begles win Champions Cup opener in S.Africa

-

Bilbao's Berenguer deals Atletico another Liga defeat

Bilbao's Berenguer deals Atletico another Liga defeat

-

Salah opens door to Liverpool exit after being 'thrown under the bus'

-

Bethlehem Christmas tree lit up for first time since Gaza war

Bethlehem Christmas tree lit up for first time since Gaza war

-

Slot shows no sign of finding answers to Liverpool slump

-

New Zealand's Robinson wins giant slalom at Mont Tremblant

New Zealand's Robinson wins giant slalom at Mont Tremblant

-

Liverpool slump self-inflicted, says Slot

-

Hundreds in Tunisia protest against government

Hundreds in Tunisia protest against government

-

Mofokeng's first goal wins cup final for Orlando Pirates

-

Torres hat-trick helps Barca down Betis to extend Liga lead

Torres hat-trick helps Barca down Betis to extend Liga lead

-

Bielle-Biarrey strikes twice as Bordeaux win Champions Cup opener in S.Africa

-

Liverpool humbled again by Leeds fightback for 3-3 draw

Liverpool humbled again by Leeds fightback for 3-3 draw

-

'Democracy has crumbled!': Four arrested in UK Crown Jewels protest

-

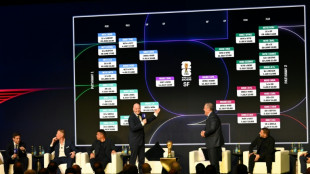

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

Contenders plot path to 2026 World Cup glory as FIFA reveals tournament schedule

-

Inter thump Como to top Serie A ahead of Liverpool visit

-

Maresca fears Chelsea striker Delap faces fresh injury setback

Maresca fears Chelsea striker Delap faces fresh injury setback

-

Consistency the key to Man City title charge – Guardiola

-

Thauvin on target again as Lens remain top in France

Thauvin on target again as Lens remain top in France

-

Greyness and solitude: French ex-president describes prison stay

-

Frank relieved after Spurs ease pressure on under-fire boss

Frank relieved after Spurs ease pressure on under-fire boss

-

England kick off World Cup bid in Dallas as 2026 schedule confirmed

-

Milei welcomes Argentina's first F-16 fighter jets

Milei welcomes Argentina's first F-16 fighter jets

-

No breakthrough at 'constructive' Ukraine-US talks

-

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

Bielle-Biarrey double helps Bordeaux-Begles open Champions Cup defence with Bulls win

-

Verstappen looking for a slice of luck to claim fifth title

-

Kane cameo hat-trick as Bayern blast past Stuttgart

Kane cameo hat-trick as Bayern blast past Stuttgart

-

King Kohli says 'free in mind' after stellar ODI show

-

Arsenal rocked by Aston Villa, Man City cut gap to two points

Arsenal rocked by Aston Villa, Man City cut gap to two points

-

Crestfallen Hamilton hits new low with Q1 exit

| RBGPF | 0% | 78.35 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| BP | -3.91% | 35.83 | $ | |

| RIO | -0.92% | 73.06 | $ |

UBS to absorb Credit Suisse domestic unit, eyes 3,000 job cuts

Banking giant UBS said Thursday it plans to fully absorb Credit Suisse's century-old Swiss division and slash thousands of jobs across Switzerland, as it seeks to redress its recently-swallowed rival.

Switzerland's largest bank, which was strongarmed into a $3.25-billion takeover of its closest domestic rival in March to keep it from going under, said it aimed to complete most of the integration by the end of 2026, with more than $10 billion in cost savings by then.

"Two and a half months since closing the Credit Suisse acquisition, we are wasting no time in delivering value for all our stakeholders from one of the biggest and most complex bank mergers in history," UBS chief executive Sergio Ermotti said.

The announcement came as UBS posted its second-quarter income statement, presenting its first results since the mega-merger that rocked Swiss banking was finalised in June.

Analysts described the picture painted as positive, while investors also seemed enthused, sending UBS's share price soaring by almost five percent to open at 23.25 Swiss francs ($26.4).

The results were strong for UBS, which posted a towering net profit of $29.2 billion. Credit Suisse took a $10.1 billion loss over the same period.

- 'Full integration' -

Credit Suisse had been plagued by scandals prior to the takeover, which was precipitated by fears that a crisis in regional US banks would cross the Atlantic.

Investors and employees alike have been particularly eager for any clues as to the fate of Credit Suisse's Swiss division, which was the unit that best withstood the multiple crises wracking the bank.

But questions have been rife over whether it could continue to operate independently due to the significant overlap with UBS's business in Switzerland.

The answer was no.

"Our analysis clearly shows that full integration is the best outcome for UBS, our stakeholders and the Swiss economy," Ermotti said.

"Our goal is to make the transition for clients as smooth as possible," he said.

"The two Swiss entities will operate separately until their planned legal integration for 2024 with the gradual migration of clients onto UBS systems expected to be completed in 2025."

Until then at least, UBS said it would maintain all of Credit Suisse's extensive sponsorship of sporting and other events and causes in Switzerland.

- Job cuts 'unavoidable' -

Speaking to analysts after the announcement, Ermotti acknowledged that the plan would lead to significant layoffs, but stressed that "cuts were unavoidable regardless of the selected scenario".

The decision to integrate Credit Suisse's business would result in "around 1,000 redundancies", he said, adding that the overall restructuring was "expected to lead to about 2,000 additional redundancies in Switzerland over the next couple of years".

Ermotti stressed that UBS was "committed to minimising the impact on employees", and would provide financial support and retraining opportunities to those affected.

They would also benefit from "a quite healthy Swiss job market", he said.

- Credit Suisse suffers $10 bn loss -

Ermotti also emphasised to analysts that UBS's analysis of Credit Suisse's business showed "the necessity of the decisive actions taken over the weekend" in March when Swiss authorities forced through the merger.

"It was not just a matter of liquidity drying up. Credit Suisse's business model, and business ... was deeply flawed, and its reputation severely damaged," he said.

"The bank was no longer in a position to continue on its own."

Even before the results were released, it was obvious the merger combined two banks pulling in diametrically different directions.

While Credit Suisse in recent years has been racking up towering losses, posting a massive 7.3-billion Swiss franc ($8.3 billion) net loss in 2022, UBS reported a $7.6 billion net profit.

And Thursday's announcement showed that Credit Suisse's woes had continued to pile up, with the former second largest bank in Switzerland showing a pre-tax loss of 8.9 billion Swiss francs ($10.1 billion) in the second quarter.

UBS meanwhile has continued to project strength, announcing earlier this month that it does not need the billions in support offered by the Swiss government and the central bank to go through with the takeover.

But its $29.2-billion profit in the second quarter was heavily distorted by the gigantic takeover, which brought with it a string of exceptional items, and was not comparable with the year-ago quarter.

O.Gutierrez--AT