-

Capuozzo grabs hat-trick as Toulouse win Champions Cup opener

Capuozzo grabs hat-trick as Toulouse win Champions Cup opener

-

Emotional Norris triumph prompts widespread affection and respect

-

Louvre says hundreds of works damaged by water leak

Louvre says hundreds of works damaged by water leak

-

UN calls on Taliban to lift ban on Afghan women in its offices

-

Rutter rescues Brighton in West Ham draw

Rutter rescues Brighton in West Ham draw

-

England trained 'too much' prior to Ashes collapse, says McCullum

-

How Lando Norris won the F1 title

How Lando Norris won the F1 title

-

Tearful Norris completes 'long journey' to become F1 world champion

-

'It's all over': how Iran abandoned Assad to his fate days before fall

'It's all over': how Iran abandoned Assad to his fate days before fall

-

Lando Norris: England's F1 prince charming with a ruthless streak

-

Lando Norris crowned Formula One world champion

Lando Norris crowned Formula One world champion

-

What next for Salah and Liverpool after explosive outburst?

-

Netanyahu expects to move to Gaza truce second phase soon

Netanyahu expects to move to Gaza truce second phase soon

-

Nervous Norwegian winner Reitan overshadows Hovland in Sun City

-

Benin government says 'foiled' coup attempt

Benin government says 'foiled' coup attempt

-

British photographer Martin Parr dies aged 73: Foundation

-

Benin govt says 'foiled' coup attempt

Benin govt says 'foiled' coup attempt

-

Stokes refuses to give up hope as Ashes ambitions hang by thread

-

'Good banter': Smith and Archer clash in Gabba Ashes Test

'Good banter': Smith and Archer clash in Gabba Ashes Test

-

Sri Lanka issues landslide warnings as cyclone toll hits 627

-

Macron threatens China with tariffs over trade surplus

Macron threatens China with tariffs over trade surplus

-

Palestinian coach gets hope, advice from mum in Gaza tent

-

Undercooked, arrogant? Beaten England's Ashes build-up under scrutiny

Undercooked, arrogant? Beaten England's Ashes build-up under scrutiny

-

Benin presidency says still in control despite coup attempt

-

In Jerusalem, Merz reaffirms Germany's support for Israel

In Jerusalem, Merz reaffirms Germany's support for Israel

-

Australia crush England by eight wickets for 2-0 Ashes lead

-

Star UK chef redesigns menu for dieters on skinny jabs

Star UK chef redesigns menu for dieters on skinny jabs

-

Australia on brink of victory at Gabba for 2-0 Ashes lead

-

South Africa coach Conrad says meant no malice with 'grovel' remark

South Africa coach Conrad says meant no malice with 'grovel' remark

-

Neergaard-Petersen edges out Smith for maiden DP World Tour win

-

Stokes and Jacks lead rearguard action to keep England alive

Stokes and Jacks lead rearguard action to keep England alive

-

Sri Lanka issues landslide warnings as cyclone toll hits 618

-

McIlroy going to enjoy 'a few wines' to reflect on 'unbelievable year'

McIlroy going to enjoy 'a few wines' to reflect on 'unbelievable year'

-

India nightclub fire kills 25 in Goa

-

Hong Kong heads to the polls after deadly fire

Hong Kong heads to the polls after deadly fire

-

Harden moves to 10th on NBA all-time scoring list in Clippers defeat

-

Number's up: Calculators hold out against AI

Number's up: Calculators hold out against AI

-

McIntosh, Marchand close US Open with 200m fly victories

-

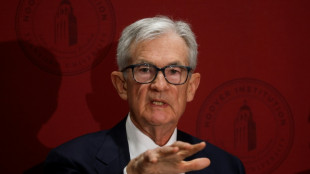

Divided US Fed set for contentious interest rate meeting

Divided US Fed set for contentious interest rate meeting

-

India nightclub fire kills 23 in Goa

-

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

France's Ugo Bienvenu ready to take animated 'Arco' to Oscars

-

Trump's Pentagon chief under fire as scandals mount

-

England's Archer takes pillow to second Ashes Test in 'shocking look'

England's Archer takes pillow to second Ashes Test in 'shocking look'

-

Australia skipper Cummins 'good to go' for Adelaide Test

-

IBC Advanced Alloys Reports Results from its 2025 Annual General Meeting

IBC Advanced Alloys Reports Results from its 2025 Annual General Meeting

-

5 Foods and Habits That Can Reverse Teeth Whitening Results

-

Is The DEA in Systemic Collapse: Corruption, Constitutional Violations, and a Seven-Year War Against Marijuana Medical Science

Is The DEA in Systemic Collapse: Corruption, Constitutional Violations, and a Seven-Year War Against Marijuana Medical Science

-

Onco-Innovations Engages Investment Bank to Pursue Nasdaq Cross-listing and Potential Concurrent Equity Offering

-

Mexico's Sheinbaum holds huge rally following major protests

Mexico's Sheinbaum holds huge rally following major protests

-

Salah tirade adds to Slot's troubles during Liverpool slump

| RBGPF | 0% | 78.35 | $ | |

| RIO | -0.92% | 73.06 | $ | |

| CMSC | -0.21% | 23.43 | $ | |

| NGG | -0.66% | 75.41 | $ | |

| GSK | -0.33% | 48.41 | $ | |

| AZN | 0.17% | 90.18 | $ | |

| BTI | -1.81% | 57.01 | $ | |

| RELX | -0.55% | 40.32 | $ | |

| CMSD | -0.3% | 23.25 | $ | |

| SCS | -0.56% | 16.14 | $ | |

| RYCEF | -0.34% | 14.62 | $ | |

| VOD | -1.31% | 12.47 | $ | |

| BCC | -1.66% | 73.05 | $ | |

| JRI | 0.29% | 13.79 | $ | |

| BCE | 1.4% | 23.55 | $ | |

| BP | -3.91% | 35.83 | $ |

Markets mostly down ahead of key US inflation report

Markets mostly fell Thursday as investors struggled to keep up with Wall Street's rally, despite fresh data reinforcing optimism the Federal Reserve could hold off any more interest rate hikes this year, while another weak China reading dragged the mood.

New York traders cheered news that fewer jobs were created in the US private sector and second-quarter growth was less than initially thought, suggesting the economy was softening after more than a year of monetary tightening.

The readings came a day after figures on job openings and consumer confidence that were seen as giving the Fed room to step back from pushing borrowing costs higher.

Investors now put the chances of another lift this year at less than 50 percent.

The prospect of a less hawkish approach from the US central bank has provided a much-needed boost to equities this week, having endured a painful August.

Focus is now on Thursday's release of the US central bank's preferred gauge of inflation, the personal consumption expenditures (PCE) price index, which will be followed by readings on factory activity and non-farm payrolls for August.

"Investors are reacting with a 'bad news is good news' approach, betting that a slowing economy will lead to a less aggressive Federal Reserve," Mark Hackett, at Nationwide Funds Group, said.

However, there is now a worry that the data will continue to come in below forecast and the economy could slip into recession.

"This has calmed investors, but adds an element of risk if the pendulum continues to swing, as an earnings recovery is critical for a continued strong market," Hackett added.

Meanwhile, China on Thursday revealed that factory activity shrank again this month while services weakened, which will likely pile further pressure on authorities to press ahead with measures to kickstart the sputtering economy.

Officials have announced a series of pledges to help various sectors -- particularly the property industry -- and there is an expectation that more is on the way.

In the latest measure, local reports Thursday said the central bank is drawing up policies that will make it easier for private firms, including developers, to access funding.

However, analysts say the only thing that will appease investors is a wide-ranging "bazooka" of big spending.

"There remains an undercurrent of optimism regarding additional policy measures anticipated for China," said SPI Asset Management's Stephen Innes.

"Nevertheless, tenacious economic apprehensions concerning China persist. The current perspective on China's growth trajectory has become increasingly fixated on the pivotal policy choices that Chinese authorities must navigate."

Fresh data showing the country's manufacturing sector contracted for a fifth straight month in August added to the arguments for more help.

And the need to provide support to the embattled real estate sector was highlighted Wednesday when industry giant Country Garden reported losses of about $6.7 billion for the first half of the year and warned of possible default.

The company's cash flow problems have ignited fears that it could collapse and spread turbulence through China's economy and financial system.

It is due to hold a vote later Thursday by bondholders on extending repayment terms.

Hong Kong and Shanghai fell along with Seoul, Taipei, Mumbai, Bangkok, Jakarta and Manila while Tokyo, Sydney, Singapore and Wellington rose.

London and Paris fell at the open.

Banking giant UBS surged more than five percent at the open in Zurich after posting a $29 billion net profit in the second quarter amid its takeover of fallen rival Credit Suisse, which saw over $10 billion in losses.

It also said the merger would cause 3,000 job cuts in Switzerland in the coming years.

- Key figures around 0715 GMT -

Tokyo - Nikkei 225: UP 0.9 percent at 32,619.34 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 18,378.08

Shanghai - Composite: DOWN 0.6 percent at 3,119.88 (close)

London - FTSE 100: DOWN 0.2 percent at 7,460.92

Dollar/yen: DOWN at 145.97 yen from 146.23 yen Thursday

Euro/dollar: DOWN at $1.0908 from $1.0925

Pound/dollar: UP at $1.2708 from $1.2719

Euro/pound: DOWN at 85.84 pence from 85.87 pence

West Texas Intermediate: FLAT at $81.64 per barrel

Brent North Sea crude: FLAT at $85.83 per barrel

New York - Dow: UP 0.1 percent at 34,890.24 (close)

N.Mitchell--AT