-

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

-

Cherki stars in Man City win at Forest

-

Schwarz records maiden super-G success, Odermatt fourth

Schwarz records maiden super-G success, Odermatt fourth

-

Russia pummels Kyiv ahead of Zelensky's US visit

-

Smith laments lack of runs after first Ashes home Test loss for 15 years

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

What they said as England win 4th Ashes Test - reaction

-

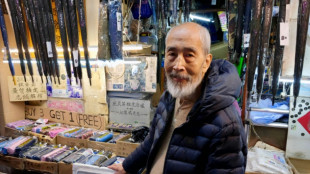

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

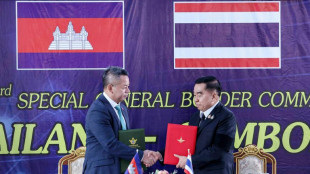

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

-

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

-

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

-

Six Australia wickets fall as England fight back in 4th Ashes Test

Six Australia wickets fall as England fight back in 4th Ashes Test

-

Man Utd made to 'suffer' for Newcastle win, says Amorim

-

Morocco made to wait for Cup of Nations knockout place after Egypt advance

Morocco made to wait for Cup of Nations knockout place after Egypt advance

-

Key NFL week has playoff spots, byes and seeds at stake

-

Morocco forced to wait for AFCON knockout place after Mali draw

Morocco forced to wait for AFCON knockout place after Mali draw

-

Dorgu delivers winner for depleted Man Utd against Newcastle

-

US stocks edge lower from records as precious metals surge

US stocks edge lower from records as precious metals surge

-

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

-

Former Ivory Coast coach Gasset dies at 72

Former Ivory Coast coach Gasset dies at 72

-

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

-

Salah helps 10-man Egypt beat South Africa and book last-16 place

Salah helps 10-man Egypt beat South Africa and book last-16 place

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

-

Salah helps Egypt beat South Africa and book last-16 place

Salah helps Egypt beat South Africa and book last-16 place

-

Australia's Ikitau facing lengthy lay-off after shoulder injury

-

Another 1,100 refugees cross into Mauritania from Mali: UN

Another 1,100 refugees cross into Mauritania from Mali: UN

-

Guardiola proud of Man City players' response to weighty issues

-

Deadly blast hits mosque in Alawite area of Syria's Homs

Deadly blast hits mosque in Alawite area of Syria's Homs

-

The Jukebox Man on song as Redknapp records 'dream' King George win

-

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

Liverpool boss Slot says Ekitike reaping rewards for greater physicality

-

Judge jails ex-Malaysian PM Najib for 15 more years after new graft conviction

-

Musona rescues Zimbabwe in AFCON draw with Angola

Musona rescues Zimbabwe in AFCON draw with Angola

-

Zelensky to meet Trump in Florida on Sunday

-

'Personality' the key for Celtic boss Nancy when it comes to new signings

'Personality' the key for Celtic boss Nancy when it comes to new signings

-

Arteta eager to avoid repeat of Rice red card against Brighton

-

Nigeria signals more strikes likely in 'joint' US operations

Nigeria signals more strikes likely in 'joint' US operations

-

Malaysia's former PM Najib convicted in 1MDB graft trial

-

Elusive wild cat feared extinct rediscovered in Thailand

Elusive wild cat feared extinct rediscovered in Thailand

-

Japan govt approves record budget, including for defence

Fed set to raise interest rates to rein in inflation

US central bankers on Wednesday are poised to take the first step to raise borrowing costs in a bid to cap rising inflation before it surges out of control.

The Federal Reserve will have to walk a tightrope to ensure its efforts don't derail the recovery from the Covid-19 pandemic as Russia's invasion of Ukraine introduces new uncertainty in an economy battered by supply chain snarls and labor shortages.

"There is no good answer to that in any economics textbook," David Wilcox, a former senior Fed advisor, told AFP, stressing that communication from the central bank about its willingness to act will be key in pulling off its balancing act.

The central bank's Federal Open Market Committee is due to announce its rate decision at 1800 GMT, when its two-day meeting concludes.

Fed Chair Jerome Powell has said he favors increasing the benchmark interest rate by 0.25 percentage points from zero, where it has been since March 2020.

It would be the first in a series of hikes, which would pull back on the stimulus rushed into place at the start of the Covid-19 pandemic.

The Fed chief has expressed confidence that inflation will retreat in the coming months as supply chain issues and shortages are resolved in the world's largest economy.

But China's latest lockdowns of several cities, affecting tens of millions of people and closing off a key supplier to American tech giant Apple, shows the pandemic and its disruptions are not over.

Policymakers are better equipped to handle inflation that is too high rather than too low, as was the case in the decade following the 2008 global financial crisis, during which inflation and employment were slow to recover.

However, with the annual consumer price index growing 7.9 percent in February, its fastest pace in four decades, the central bank faces intense criticism that it missed the inflation danger, and has moved too slowly in response to rising prices for cars, housing and food.

And the war in Ukraine together with Western sanctions on Russia have sent oil prices surging, although they retreated Tuesday closing below $100 a barrel for the first time in three weeks.

- Raising rates a must -

"The Federal Reserve's delays in raising interest rates and its continued misreading of inflation, monetary and fiscal policies are now complicated by the negative supply shock imposed by Russia's invasion of Ukraine," said Mickey Levy of Berenberg Capital Markets.

"Even without the surge in oil and commodity prices, the Fed is wrong on every count," Levy wrote in a column in The Wall Street Journal, saying the central bank "must begin to raise rates."

But Wilcox, now with the Peterson Institute for International Economics and Bloomberg Economics, defended the Fed's performance, saying officials have adjusted to changing circumstances.

"I think the allegation that the Fed is behind the curve is considerably over done," he said. "They have been caught by surprise, as the vast majority of prognosticators were," but "they've had the guts and the courage" to change their mind publicly.

Economists project six or seven rate increases this year, which would still leave the policy rate below two percent, assuming central bankers raise it in quarter-point steps.

However, Powell and other policymakers have stressed that they will do whatever is needed to tamp down inflation.

After it begins ratcheting up borrowing costs, the Fed is next expected to begin offloading its massive stockpile of assets purchased to provide liquidity to the economy during the pandemic, a process expected to start in the summer and proceed gradually, to avoid roiling financial markets.

"The most important thing for the Fed to communicate in an environment of enormous uncertainty" is to make clear "how it will respond," Wilcox said.

O.Gutierrez--AT