-

Arteta tells faltering leaders Arsenal to harness Wolves 'pain' against Spurs

Arteta tells faltering leaders Arsenal to harness Wolves 'pain' against Spurs

-

Crowley gets nod for Irish as Prendergast drops out

-

Unbeaten Swiss to meet Great Britain in Olympic men's curling semis

Unbeaten Swiss to meet Great Britain in Olympic men's curling semis

-

UK police arrest ex-prince Andrew on suspicion of misconduct

-

Oil extends gains on US-Iran tensions, Europe stocks slide

Oil extends gains on US-Iran tensions, Europe stocks slide

-

Former prince Andrew, a historic downfall

-

Sri Lanka post 178-7 against Zimbabwe ahead of T20 Super Eights

Sri Lanka post 178-7 against Zimbabwe ahead of T20 Super Eights

-

OpenAI's Altman tells leaders regulation 'urgently' needed

-

US renews threat to leave IEA

US renews threat to leave IEA

-

Liverpool boss Slot says Isak in 'final stages of rehab'

-

Airbus ready to build two new European fighter jets if 'customers' ask

Airbus ready to build two new European fighter jets if 'customers' ask

-

UN Sudan probe finds 'hallmarks of genocide' in El-Fasher

-

Costelow starts, Hamer-Webb makes Wales debut in Six Nations clash with Scotland

Costelow starts, Hamer-Webb makes Wales debut in Six Nations clash with Scotland

-

Facing US warnings, Iran defends right to nuclear enrichment

-

Ex-South Korea leader Yoon gets life in prison for insurrection

Ex-South Korea leader Yoon gets life in prison for insurrection

-

OpenAI's Altman says at India summit regulation 'urgently' needed

-

British couple held in Iran sentenced to 10 years

British couple held in Iran sentenced to 10 years

-

West Indies ease past Italy to tune up for T20 Super Eights

-

Laser-written glass can store data for millennia, Microsoft says

Laser-written glass can store data for millennia, Microsoft says

-

At least 16 killed after building collapses in Pakistan following blast

-

Summit photo op fails to unite AI startup rivals

Summit photo op fails to unite AI startup rivals

-

OpenAI's Altman says world 'urgently' needs AI regulation

-

Horror comics boom in our age of anxiety

Horror comics boom in our age of anxiety

-

Turkey fires up coal pollution even as it hosts COP31

-

London fashion week opens with tribute to one of its greats

London fashion week opens with tribute to one of its greats

-

Ex-S.Korea leader Yoon gets life in prison for insurrection

-

Pea soup, veggie mash contest warms up Dutch winter

Pea soup, veggie mash contest warms up Dutch winter

-

South Korea's Yoon: from rising star to jailed ex-president

-

Private companies seek to import fuel amid Cuban energy crisis

Private companies seek to import fuel amid Cuban energy crisis

-

India search for 'perfect game' as South Africa loom in Super Eights

-

India's Modi calls for inclusive tech at AI summit

India's Modi calls for inclusive tech at AI summit

-

Airbus planning record commercial aircraft deliveries in 2026

-

Elections under fire: Colombia endures deadliest campaign in decades

Elections under fire: Colombia endures deadliest campaign in decades

-

Traore backs 'hungry' Italy against France in Six Nations

-

All-rounder Curran brings stuttering England to life at the death

All-rounder Curran brings stuttering England to life at the death

-

South Korea court weighs death sentence for ex-president Yoon

-

Tech chiefs address India AI summit as Gates cancels

Tech chiefs address India AI summit as Gates cancels

-

Australia rejects foreign threats after claim of China interference

-

Somali militias terrorise locals after driving out Al-Qaeda

Somali militias terrorise locals after driving out Al-Qaeda

-

Peru picks Balcazar as interim president, eighth leader in a decade

-

Australian defence firm helps Ukraine zap Russian drones

Australian defence firm helps Ukraine zap Russian drones

-

General strike to protest Milei's labor reforms starts in Argentina

-

Cuban opposition figure Ferrer supports Maduro-like US operation for Cuba

Cuban opposition figure Ferrer supports Maduro-like US operation for Cuba

-

High-stakes showdown in Nepal's post-uprising polls

-

Asian markets rally after Wall St tech-led gains

Asian markets rally after Wall St tech-led gains

-

After Greenland, Arctic island Svalbard wary of great powers

-

Veteran Slipper set for new Super Rugby landmark

Veteran Slipper set for new Super Rugby landmark

-

Sudan's historic acacia forest devastated as war fuels logging

-

Deadly Indonesia floods force a deforestation reckoning

Deadly Indonesia floods force a deforestation reckoning

-

Australia vow to entertain in bid for Women's Asian Cup glory

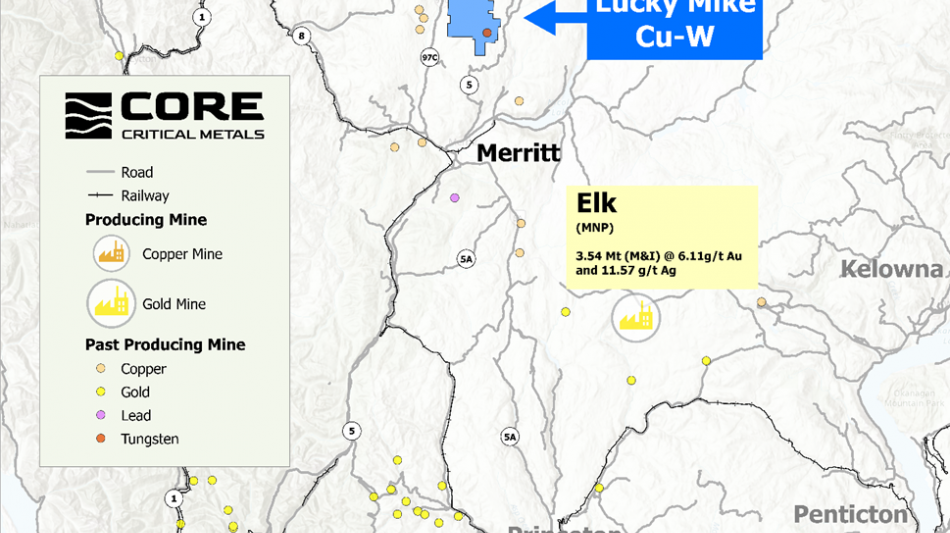

Core Critical Metals Corp. Announces Acquisition of the Advanced Lucky Mike Silver-Copper-Tungsten Project

VANCOUVER, BC / ACCESS Newswire / February 19, 2026 / Core Critical Metals Corp. ("CCMC" or the "Company") (TSXV:CCMC)(OTC PINK:CCMCF)(WKN:A41G8G), a North American mineral acquisition and exploration company, is pleased to announce that, subject to the approval of the TSX Venture Exchange (the "Exchange"), it has executed an arm's length option agreement dated February 18, 2026 (the "Option Agreement"), for the right to purchase an up to an eighty percent (80%) interest in the Lucky Mike Silver-Copper-Tungsten property (the "Property" or "Lucky Mike" or "LMSL")from First Atlantic Nickel Corp. (TSXV:FAN)("FAN").

The Lucky Mike Property consists of 37 claims totaling approximately 7,675 hectares and is an advanced exploration project located roughly equal distance between Kamloops and Merritt, BC, adjacent to the major Coquihalla Highway near the Surrey Lake summit.

Property Highlights

Prime Location in a Safe Jurisdiction: LMSL is situated in British Columbia's premier copper porphyry and gold mining belt, offering access to established mining infrastructure.

Strategic Proximity to Major Operations: LMSL is located adjacent to Teck's Highland Valley Copper Mine (Canada's largest, producing 127,000 tonnes of copper in 20251), on trend with New Gold's New Afton and Copper Mountain Mine, enhancing discovery odds in a high-success area2.

Teck recently announced its mine life extension plan for Highland Valley, moving the mine's closure date from 2028 out to 2046 with a capital investment of $2.1 to $2.4 billion, making it the largest critical minerals investment in B.C. history.

Significant Historic Copper Resource: Hosts a 73.5 million tonne historic estimate at 0.27% CuEq equating to approximately 402 million pounds of contained copper3,4,5.

Strong Tungsten Potential: In 1943 the Strategic Metals Committee part of the Wartime investigation for Tungsten drilled 14 diamond drill holes over a 100 metre strike length. Eight holes intersected a weighted average of 0.312% WO3 over an average width of 25 feet5.

Untapped Exploration Upside: Features a 7-kilometer skarn alteration footprint indicating multiple porphyry centers, with AI analysis identifying high-priority, untested targets for potential grade improvements at depth.

High-Grade Intercepts and Showings: Historic drilling identified 5.4% Cu in samples and 789 meters at 0.16% Cu, plus volcanic breccias up to 0.4% Cu, signaling strong mineralization potential.

Drill-Ready and Permitted: Fully permitted with new targets verified by independent AI, ready for immediate drilling to vector toward porphyry cores and expand resources.

Excellent Infrastructure Access: Benefits from a well-developed network of logging roads, proximity to power, water, and local labor in the Nicola Mining District, just 20 km north of Merritt.

Experienced Management Team: Led by a skilled group with decades in exploration, finance, and operations, including recent porphyry discoveries and successful fundraising for value creation.

District-Scale Potential: Controls a large 120+ square kilometer land package with cluster-style mineralization, positioned between recent discoveries by Tower Resources and Kodiak Copper.

Figure 1 - Project location map1.

Terms of the Agreement

Pursuant to the Option Agreement, the Company may acquire up to an 80% interest in and to the Property by completing the payments and qualified expenditures set out in the table below:

Period | Due Date | Shares/Cash | Cash | Qualified Expenditures Amount | Earn-In |

First Option Earn-in Requirements | On the Effective Date of the Agreement | - | $150,000 | - | CCMC earns 70% only upon completion of all First Option Earn-in Requirements (including the $6,000,000 Qualified Expenditure requirement) |

On or before the first (1st) anniversary of the Effective Date of the Agreement | - | - | $300,000 | ||

On or before the second (2nd) anniversary of the Effective Date of the Agreement | $200,0001 | - | - | ||

On or before the third (3rd) anniversary of the Effective Date of the Agreement | $300,0001 | - | - | ||

On or before the fifth (5th) anniversary of the Effective Date of the Agreement | - | - | $5,700,000 | ||

Second Option Earn-in Requirement | On or before the tenth (10th) anniversary of the Effective Date of the Agreement | - | - | $10,000,0002 | CCMC earns an additional 10% (total 80%) only upon completion of all Second Option Earn-in Requirements |

Total | $500,000 | $150,000 | $16,000,000 | 80% | |

Notes | 1. CCMC will issue shares or pay cash at its election. Any common shares will be issued based on the volume weighted average price of the 10 trading days preceding CCMC's notification to FAN of its decision to issue shares. 2. The $10,000,000 Qualified Expenditure requirement due on or before the tenth (10th) anniversary is in addition to (and not inclusive of) the $5,700,000 Qualified Expenditure requirement due on or before the fifth (5th) anniversary. | ||||

The Property is subject to an existing 2% net smelter returns ("NSR") royalty.

Following completion of the second option (earning an 80% interest), FAN and CCMC will enter into a Joint Venture agreement ("JV"). Under the terms of the JV, each of FAN and CCMC will be responsible for their pro rata share of exploration expenditures at the Property with CCMC remaining the operator of the Property.

In the event that FAN elects not to contribute its pro rata share, its participating interest shall be diluted. If, as a result of such dilution, FAN's participating interest is reduced to ten percent (10%) or less (the "Conversion Threshold"), FAN shall be deemed to have withdrawn from the JV and its remaining participating interest shall be automatically converted into a 3% NSR royalty with a 2% buyback for $7,500,000 (the "Dilution Royalty"). Upon such conversion, FAN shall have no further right to participate in the Property, nor any obligation to contribute to future expenditures.

Notwithstanding the above, CCMC shall, at its sole cost, fund one hundred percent (100%) of all expenditures approved in the annual work program and budget for the Property until the delivery of a Feasibility Study (the "Carry End Date").

FAN shall not be required to contribute any capital to the JV prior to the Carry End Date, and its participating interest shall not be subject to dilution during such period.

No finder's fees are payable on this transaction.

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Deepak Varshney, P.Geo., Chief Executive Officer and a Director of the Company, who is a "Qualified Person" as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

About Core Critical Metals Corp.

Core Critical Metals Corp. is a North American mineral acquisition and exploration company focused on the development of quality critical metal properties that are drill-ready with high-upside and expansion potential.

CORE CRITICAL METALS CORP.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email [email protected] or visit www.xanderresources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

https://www.teck.com/news/news-releases/2026/teck-announces-2025-production-and-sales-update-and-reaffirms-outlook.

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

A qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the Property.

Sookochoff, L (1974), Memo - Resource Estimate, W.A. Dexter & Le Bourgh; R. Tough & Associates Ltd.; BC Property File No. 10721.

Smyth, W.R. (1985), Memo - Rey Lake Copper Deposit, Ministry of Energy, Mines and Petroleum Resources; BC Property File No. 10719.

Turner, J. (2013), Technical Report NI43-101 for the Lucky Mike Copper-Tungsten Property, Merritt, BC, Nicola Mining District; Plate Resources Inc.; 80 pages.

Forward-looking statements:

This news release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). Forward-looking statements are statements that are not historical facts and are generally identified by words such as "expects", "plans", "intends", "anticipates", "believes", "estimates", "may", "will", "should", "could" and similar expressions. Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company's ability to satisfy the cash and/or share payment obligations and incur the required expenditures to earn an interest in the Lucky Mike Property under the Option Agreement; the timing and likelihood of the Company earning an initial 70% interest and an additional 10% interest; the timing and terms for formation of a JV following completion of the earn-in; the Company's proposed exploration and development plans and potential work programs on the Property (including any drill programs or target generation initiatives); the use and expected benefits of any data analytics or artificial intelligence-supported targeting; and the potential to validate, expand upon or otherwise advance any historic mineral resource estimate or historic exploration results referenced in this news release.

Forward-looking statements are based on management's reasonable assumptions, estimates and opinions as of the date of this news release. Such assumptions include, without limitation: that the Company will obtain all required approvals, including acceptance by the Exchange,, and that the Company will be able to complete any share issuances contemplated under the Option Agreement subject to Exchange acceptance; that the Company will be able to access required funding on acceptable terms; that the Company will be able to obtain all necessary corporate, regulatory and stock exchange approvals; that the Company will be able to carry out exploration activities as planned; that exploration results will be consistent with management's expectations; that contractors and service providers will perform as expected; and that general business and economic conditions will remain supportive of the Company's plans.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: the risk that the Company is unable to complete payments or incur required expenditures under the Option Agreement, resulting in the loss of the option; risks that required approvals, including acceptance by the Exchange, are delayed or not obtained, and that any share issuances may be subject to additional conditions or may not be completed on the timeline anticipated; financing risk and equity market volatility; the risk that required regulatory or stock exchange approvals are delayed or not obtained; exploration risk, including the risk that exploration results are not as anticipated or do not support further advancement of the Property; risks related to the interpretation of exploration data and the reliability of any historic information; risks associated with the use of new technologies and data-driven methods; operational risks and hazards; environmental risks and liabilities; permitting and land access risks; changes in laws, regulations and government policies; community and Indigenous relations risks; commodity price fluctuations; and general business, economic, competitive, political and social uncertainties.

The Company is an exploration-stage issuer and does not currently have mineral reserves. Exploration is speculative, requires substantial expenditures and may not result in the discovery of economically recoverable mineralization. There can be no assurance that any forward-looking statements will prove to be accurate, as actual results and future events may differ materially from those anticipated. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update or revise any forward-looking statements except as required by applicable law.

SOURCE: Core Critical Metals Corp.

View the original press release on ACCESS Newswire

K.Hill--AT