-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

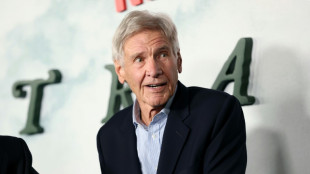

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

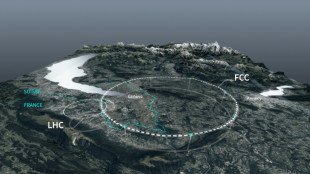

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

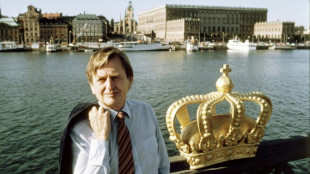

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Altigen Technologies Reports Full Year and Fourth Quarter Fiscal 2025 Results

NEWARK, CALIFORNIA / ACCESS Newswire / December 18, 2025 / Altigen Technologies (OTCQB:ATGN), a leading Silicon Valley-based Microsoft Cloud Communications Solutions provider, announced today its financial results for the fourth quarter and year ended September 30, 2025.

"Our fiscal fourth quarter represented our sixth consecutive quarter of profitability," said Jeremiah Fleming, Altigen President & CEO. "Our business transformation initiative began with operational improvements which significantly improved our bottom line. In FY25 we introduced an all-new solutions portfolio, the success of which has continued to grow throughout the year. We expect to realize increasing growth as our solutions continue to gain market adoption."

Key Financial Highlights (Fiscal 2025 versus Fiscal 2024)

NetRevenue was $13.9 million, compared with $13.6 million;

Cloud services revenue was $6.9 million, compared with $7.1 million;

Services revenue was $5.9 million, compared with $5.2 million;

Gross margin increased to 63%, compared with 62% in the previous year;

GAAP net income totaled $0.7 million, with diluted EPS of $0.03; compared to $1.6M, with diluted EPS of $0.06, respectively.

Net Revenue decreased 7% to $3.5 million

Cloud services revenue decreased 3% to $1.6 million;

Service and Other revenue decreased 7% to $1.6 million;

Gross margin decreased to 63%, compared with 64%;

GAAP net income was $254 thousand, compared with $2.0 million;

EPS per share was $0.01 vs $0.08

Key Financial Highlights (4Q 2025 versus 4Q 2024)

Net Revenue decreased 7% to $3.5 million

Cloud services revenue decreased 3% to $1.6 million;

Service and Other revenue decreased 7% to $1.6 million;

Gross margin decreased to 63%, compared with 64%;

GAAP net income was $254 thousand, compared with $2.0 million;

EPS per share was $0.01 vs $0.08

Select Financial Metrics: Fiscal 2025 versus Fiscal 2024

Select Financial Metrics | |||||||||||||||||||||||

(in thousands, except for EPS and percentages) | Fiscal | Fiscal | Change | YTD | YTD | Change | |||||||||||||||||

Total Revenue | $ | 3,472 | $ | 3,736 | -7 | % | $ | 13,867 | $ | 13,619 | 2 | % | |||||||||||

Cloud Services | 1,635 | 1,680 | -3 | % | 6,877 | 7,097 | -3 | % | |||||||||||||||

Services and Other | 1,602 | 1,731 | -7 | % | 5,926 | 5,159 | 15 | % | |||||||||||||||

Legacy Products | 235 | 325 | -28 | % | 1,065 | 1,363 | -22 | % | |||||||||||||||

Software Assurance | 213 | 315 | -32 | % | 1,001 | 1,293 | -23 | % | |||||||||||||||

Perpetual Software License | 22 | 10 | 120 | % | 64 | 70 | -9 | % | |||||||||||||||

GAAP Operating (Loss)/ Income | $ | 169 | $ | 209 | -19 | % | $ | 619 | $ | (305 | ) | -303 | % | ||||||||||

Operating Margin | 5 | % | 6 | % | 4 | % | -2 | % | |||||||||||||||

GAAP Net (Loss)/Income | $ | 254 | $ | 2,079 | -88 | % | $ | 738 | $ | 1,560 | -53 | % | |||||||||||

GAAP (Loss)/ Income Per Share | 0.01 | 0.08 | nm | $ | 0.03 | $ | 0.06 | nm | |||||||||||||||

Adjusted EBITDA (1) | $ | 356 | $ | 507 | -30 | % | $ | 1,606 | $ | 495 | 224 | % | |||||||||||

Cash Flow from Operations | $ | (152 | ) | $ | 641 | nm | $ | 1,095 | $ | 510 | nm | ||||||||||||

nm = not measurable/ meaningful; *may not add up due to rounding | |||||||||||||||||||||||

1. Adjusted EBITDA excludes one-time litigation costs, other non-recurring or unusual charges, and other immaterial items that may arise from time to time that we do not consider to be directly related to core operating performance.

Trended Financial Information

(in thousands, except for EPS and percentages) | Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | ||||||||||

Total Revenue | $ | 3,472 | $ | 3,517 | $ | 3,500 | $ | 3,378 | $ | 3,736 | $ | 3,283 | $ | 3,360 | $ | 3,240 | ||

Cloud Services | 1,635 | 1,666 | 1,856 | 1,720 | 1,680 | 1,710 | 1,817 | 1,890 | ||||||||||

Services and Other | 1,602 | 1,596 | 1,362 | 1,366 | 1,731 | 1,249 | 1,183 | 996 | ||||||||||

Legacy Products | 235 | 256 | 282 | 292 | 325 | 324 | 360 | 354 | ||||||||||

Software Assurance | 213 | 242 | 268 | 278 | 315 | 296 | 340 | 342 | ||||||||||

Perpetual Software License | 22 | 14 | 14 | 14 | 10 | 28 | 20 | 12 | ||||||||||

GAAP Operating (Loss) / Income | $ | 198 | $ | 125 | $ | 283 | $ | 75 | $ | 209 | $ | 68 | $ | (240 | ) | $ | (342 | ) |

Operating Margin | 6 | % | 4 | % | 8 | % | 2 | % | 6 | % | 2 | % | -7 | % | -11 | % | ||

GAAP Net Income/(Loss) | $ | 254 | $ | 110 | $ | 287 | $ | 87 | $ | 2,079 | $ | 62 | $ | (236 | ) | $ | (345 | ) |

Adjusted EBITDA (1) | 356 | 645 | 314 | 291 | 507 | 214 | (67 | ) | (159 | ) | ||||||||

Adjusted EBITDA excludes one-time litigation costs, other non-recurring or unusual charges, and other immaterial items that may arise from time to time that we do not consider to be directly related to core operating performance.

Conference Call

Altigen will be discussing its financial results and outlook on a conference call today at 1:00 p.m. Pacific Time (4:00 p.m. ET). The conference call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international), conference ID #539578. To access the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international), conference ID #53128. A web archive will be made available at www.altigen.com for 90 days following the call's conclusion.

About Altigen Technologies

Altigen Technologies (OTCQB:ATGN) is focused on driving digital transformation in today's modern workplace. Our Cloud Communications solutions and Technology Consulting services empower companies of all sizes to elevate customer engagement, increase employee productivity and improve operational efficiency. We're headquartered in Silicon Valley with operations strategically located around the world. For more information, call 1-888-ALTIGEN or visit our website at www.altigen.com.

Safe Harbor Statement

This press release contains forward‐looking information. The statements are based on reasonable assumptions, beliefs and expectations of management and the Company provides no assurance that actual events will meet management's expectations. Furthermore, the forward-looking statements contained in this press release are based on the Company's views of future events and financial performances which are subject to known and unknown risks and uncertainties, including, but not limited to, statements regarding the Company's operational improvements, performance enhancements, AI solution development, and expectations for sustainable growth. There can be no assurances that the Company will achieve the expected results, and actual results may be materially different than expectations and from those stated or implied in forward-looking statements.

Please refer to the Company's most recent Annual Report filed with the OTCQB over-the-counter market for a further discussion of risks and uncertainties. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company does not undertake any obligation to update any forward-looking statements.

Contact:

Altigen Communications, Inc.

Investor Relations - [email protected]

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except shares and per share data)

September 30, | |||||

2025 | 2024 | ||||

ASSETS | |||||

Current assets: | |||||

Cash and cash equivalents | $ | 2,750 | $ | 2,575 | |

Accounts receivable, net | 2,428 | 1,770 | |||

Other current assets | 183 | 185 | |||

Total current assets | 5,361 | 4,530 | |||

Operating lease right-of-use assets | 40 | 149 | |||

Goodwill | 2,725 | 2,725 | |||

Property, plant, and equipment, net | 57 | - | |||

Intangible assets, net | 1,074 | 1,242 | |||

Capitalized software development cost, net | 1,621 | 1,363 | |||

Deferred tax asset | 5,347 | 5,638 | |||

Other long-term assets | 20 | 2 | |||

Total assets | $ | 16,245 | $ | 15,649 | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||

Current liabilities: | |||||

Accounts payable | $ | 608 | $ | 98 | |

Accrued compensation and benefits | 625 | 593 | |||

Accrued expenses | 221 | 446 | |||

Deferred consideration | 372 | 744 | |||

Operating lease liabilities - current | 24 | 104 | |||

Deferred revenue - current | 563 | 481 | |||

Total current liabilities | 2,413 | 2,466 | |||

Operating lease liabilities - long-term | 25 | 49 | |||

Deferred revenue - long-term | 77 | 176 | |||

Total liabilities | 2,515 | 2,691 | |||

Stockholders' equity: | |||||

Common stock, $0.001 par value; Authorized 50,000,000 shares; Issued and outstanding 25,847,985 and 24,918,656 shares at September 30, 2025 and 2024, respectively | 25 | 24 | |||

Treasury stock at cost 2,492,646 and 1,918,830 shares at September 30, 2025 and 2024, respectively | (1,579 | ) | (1,565 | ) | |

Additional paid-in capital | 73,240 | 73,193 | |||

Accumulated deficit | (57,956 | ) | (58,694 | ) | |

Total stockholders' equity | 13,730 | 12,958 | |||

Total liabilities and stockholders' equity | $ | 16,245 | $ | 15,649 | |

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

Three Months Ended | Fiscal Year End | ||||||||||

September 30, | September 30, | ||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||

Net revenue | $ | 3,472 | $ | 3,736 | $ | 13,867 | $ | 13,619 | |||

Gross profit | 2,189 | 2,386 | 8,683 | 8,395 | |||||||

Operating expenses: | |||||||||||

Research and development | 306 | 885 | 1,305 | 4,268 | |||||||

Sales, general & administrative | 1,714 | 1,292 | 6,759 | 4,432 | |||||||

Operating income (loss) | 169 | 209 | 619 | (305 | ) | ||||||

Interest and other income | 393 | 16 | 434 | 52 | |||||||

Interest expense and other expense | (17 | ) | (3 | ) | (24 | ) | (26 | ) | |||

Net income (loss) before income taxes | 545 | 222 | 1,029 | (279 | ) | ||||||

Benefit (provision) for income taxes (1) | (291 | ) | 1,857 | (291 | ) | 1,839 | |||||

Net income (loss) | $ | 254 | $ | 2,079 | $ | 738 | $ | 1,560 | |||

Net income (loss) per share | |||||||||||

Basic | $ | 0.01 | $ | 0.08 | $ | 0.03 | $ | 0.06 | |||

Diluted | $ | 0.01 | $ | 0.08 | $ | 0.03 | $ | 0.06 | |||

Weighted average shares used in computing net income (loss) per share | |||||||||||

Basic | 25,848 | 24,919 | 25,848 | 24,919 | |||||||

Diluted | 25,903 | 25,903 | 25,903 | 25,959 | |||||||

(1) The Company's fourth quarter fiscal year 2025 results include a non-cash tax expense of $0.3 million, resulting from the differences between the Company's income tax rate and the statutory rate while the Company's fourth quarter fiscal year 2024 results include a non-cash tax benefit of approximately $1.9 million, primarily due to the release of the valuation allowance for deferred tax assets.

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

Fiscal Year Ended | ||||||

September 30, | ||||||

2025 | 2024 | |||||

Cash flows from operating activities: | ||||||

Net income (loss) | $ | 738 | $ | 1,560 | ||

Adjustments to reconcile net income (loss) to net cash from operating activities: | ||||||

Impairment of capitalized software | 340 | 53 | ||||

Impairment of intangible assets | - | 142 | ||||

Depreciation and amortization | - | 3 | ||||

Deferred income tax expense | 291 | (1,901 | ) | |||

Amortization of intangible assets | 198 | 184 | ||||

Amortization of capitalized software | 216 | 375 | ||||

Adjustment for operating lease expenses | 7 | (19 | ) | |||

Stock-based compensation | 48 | 60 | ||||

Changes in operating assets and liabilities: | ||||||

Accounts receivable and unbilled accounts receivable | (658 | ) | (275 | ) | ||

Prepaid expenses and other current assets | 2 | 51 | ||||

Other long-term assets | (17 | ) | (2 | ) | ||

Accounts payable | 511 | 40 | ||||

Accrued expenses | (564 | ) | 193 | |||

Deferred revenue | (17 | ) | 46 | |||

Net cash provided by operating activities | 1,095 | 510 | ||||

Cash flows from investing activities: | ||||||

Purchase of intangible assets | (8 | ) | - | |||

Purchase of software (PPE) | (78 | ) | - | |||

Capitalized software development costs | (820 | ) | (576 | ) | ||

Net cash used in investing activities | (906 | ) | (576 | ) | ||

Cash flows from financing activities: | ||||||

Payment of deferred consideration in business combination | - | - | ||||

Repurchase of common stock | (14 | ) | - | |||

Proceeds from issuances of common stock | - | - | ||||

Net cash used in financing activities | (14 | ) | - | |||

Net increase (decrease) in cash and cash equivalents | 175 | (66 | ) | |||

Cash and cash equivalents, beginning of year | 2,575 | 2,641 | ||||

Cash and cash equivalents, end of year | $ | 2,750 | $ | 2,575 | ||

Supplemental disclosure of Investing and financing activities | ||||||

Shares repurchased for cashless exercise of stock options | $ | (372 | ) | $ | - | |

SOURCE: Altigen Technologies

View the original press release on ACCESS Newswire

T.Wright--AT