-

Japan says rare earth found in sediment retrieved on deep-sea mission

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

-

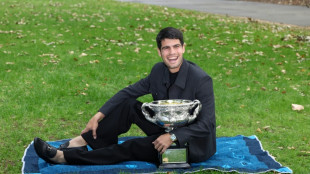

Hatred of losing drives relentless Alcaraz to tennis history

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

Trump says closing Kennedy Center arts complex for two years

-

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Stocks rise as US inflation cools, tech stocks bounce

Equity markets climbed on Thursday as investors welcomed cool US inflation data and tech stocks bounced.

US consumer inflation slowed unexpectedly in November, climbing 2.7 percent from a year ago, coming considerably in below analysts' predictions of a 3.1 percent uptick.

"Although this is just one inflation reading -- and admittedly not the Fed's preferred inflation gauge -- easing inflation concerns could open the door to a more accommodative Fed moving forward," said eToro analyst Bret Kenwell.

"That has markets rallying this morning."

Wall Street's three main indices pushed higher as trading got underway in New York.

Meanwhile, shares in Oracle rose 2.9 percent.

Shares in the cloud computing giant plunged more than five percent Wednesday, dragging down other tech stocks and the Nasdaq index, on reports an investor pulling out put its data centre project at risk.

That report came after Oracle and chip giant Broadcom last week unveiled disappointing earnings reports.

Shares in Google-parent Alphabet and Broadcom both gained 1.4 percent.

"The sector got a boost from a strong set of quarterly results from Micron Technology after last night's close" and its "bullish forward guidance", said Trade Nation analyst David Morrison.

Shares in the company which produces computer memory and storage jumped more than 15 percent at the start of trading.

"The question now is if today's bounce is a dip-buying opportunity which morphs into a 'Santa Rally', or if it is simply a round of short-covering ahead of another lurch lower" said Morrison.

Hopes for an end-of-year rally, often called a Santa Rally, have been dealt a blow after the US Federal Reserve last week hinted that it could pause its rate cuts next month.

Questions about whether all the cash being pumped into AI is creating a bubble have also acted as a dampener on sentiment.

The Bank of England, as expected, cut its key interest rate to 3.75 percent after UK inflation eased faster than expected and as the economy weakened.

However the pound rose as policymakers indicated that although rates would continue to decline in 2026, the pace would be dependent upon data.

That sent the London's FTSE 100 stock index lower for a period in afternoon trading.

The ECB held rates steady, also as expected, while it raised growth forecasts for this year and next.

It was the fourth meeting in a row where the ECB held rates steady following a year-long series of cuts.

"The new macroeconomic projections suggest there is little scope for further easing in the short term," said GianLuigi Mandruzzato, senior economist at EFG Asset Management.

ECB chief Christine Lagarde indicated that "all optionalities should be on the table" regarding future interest rate decisions, citing high global "uncertainty".

Both Frankfurt and Paris stocks were higher in afternoon training.

Asian stock markets mostly sank Thursday after Wednesday's sell-off on Wall Street as worries over the tech sector's colossal spending on artificial intelligence continued to dog investor sentiment.

- Key figures at around 1430 GMT -

New York - Dow: UP 0.7 percent at 48,205.89 points

New York - S&P 500: UP 1.0 percent at 6,785.30

New York - Nasdaq Composite: UP 1.4 percent at 23,009.66

London - FTSE 100: UP less than 0.1 percent at 9,782.22

Paris - CAC 40: UP 0.5 percent at 8,122.36

Frankfurt - DAX: UP 0.6 percent at 24,094.18

Tokyo - Nikkei 225: DOWN 1.0 percent at 49,001.50 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,447.44 (close)

Shanghai - Composite: UP 0.2 percent at 3,876.37 (close)

Euro/dollar: DOWN at $1.1727 from $1.1743 on Wednesday

Pound/dollar: UP at $1.3418 from $1.3379

Dollar/yen: DOWN at 155.38 yen from 155.70

Euro/pound: DOWN at 87.48 pence from 87.77

Brent North Sea Crude: UP 0.6 percent at $60.03 per barrel

West Texas Intermediate: UP 0.7 percent at $56.22 per barrel

burs-rl/jj

N.Walker--AT