-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

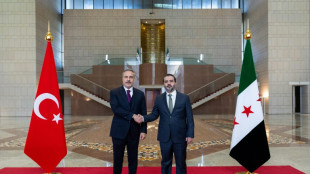

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

-

Rugby players lose order challenge in brain injury claim

Rugby players lose order challenge in brain injury claim

-

UK singer Chris Rea dies at 74, days before Christmas

-

Last of kidnapped Nigerian pupils handed over, government says

Last of kidnapped Nigerian pupils handed over, government says

-

Zambia strike late to hold Mali in AFCON opener

-

Outcry follows CBS pulling program on prison key to Trump deportations

Outcry follows CBS pulling program on prison key to Trump deportations

-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

Peraso Confirms Receipt of Unsolicited, Non-Binding Acquisition Proposal from Mobix Labs, Inc.

SAN JOSE, CA / ACCESS Newswire / June 27, 2025 / Peraso Inc. (NASDAQ:PRSO) ("Peraso" or the "Company"), a pioneer in mmWave wireless technology solutions, today confirmed that it has received an unsolicited, non-binding proposal from Mobix Labs, Inc. ("Mobix") to acquire all of the Company's issued and outstanding equity securities in exchange for newly issued shares of Mobix common stock, with a fixed exchange ratio based on the average daily closing price of the Company's common stock over the 30 calendar days ending on June 11, 2025, plus a 20% premium, or approximately $1.20 per share.

Peraso believes that certain financial information and characterizations of the Company included in Mobix's press release dated June 26, 2025 are potentially inaccurate.

For example, the Company reported net revenue of approximately $3.8 million for the three months ended March 31, 2025, and approximately $14.2 million for the fiscal year ended December 31, 2024.

Investors are urged to read the Company's filings with the Securities and Exchange Commission (the "SEC"), including its Annual Report on Form 10-K for the year ended December 31, 2024, and its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025. These filings contain audited and reviewed financial statements and remain the authoritative source of information regarding the Company's financial position and results of operations.

In addition, the Company is currently in compliance with all applicable continued listing requirements of the Nasdaq Stock Market. Mobix's press release incorrectly states that, based on the Company's recent SEC filings, the Company must raise its market value to at least $35 million by November 2025 to maintain its Nasdaq listing. The Company satisfies the continued listing standards through compliance with the stockholders' equity alternative under Nasdaq Listing Rule 5550(b)(1), which requires maintaining stockholders' equity of at least $2.5 million. The Company is permitted to rely on this standard as an alternative to the $35 million market value of listed securities requirement cited by Mobix.

Peraso's Board of Directors is evaluating the Company's options to enhance stockholder value. The Company's Board of Directors and management team are committed to acting in the best interests of all stockholders. Consistent with its fiduciary duties and in consultation with the Company's financial and legal advisors, the Board of Directors will carefully review Mobix's proposal to determine the course of action that it believes is in the best interest of the Company and its stockholders. The Company does not intend to make further comments regarding potential transactions or provide any public updates regarding proposed or potential transactions, unless required by applicable law or a regulatory body. There can be no assurance that any transaction will be completed at this price or at any other price with such third party or any other third party.

No action is required by Peraso stockholders at this time.

About Peraso Inc.

Peraso Inc. (NASDAQ:PRSO) is a pioneer in high-performance 60 GHz unlicensed and 5G mmWave wireless technology, offering chipsets, modules, software, and IP. Peraso supports a variety of applications, including fixed wireless access, military, immersive video, and factory automation. For additional information, please visit www.perasoinc.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the "safe harbor" created by those sections. All statements in this release that are not based on historical fact are "forward-looking statements." These statements may be identified by words such as "estimates," "anticipates," "projects," "plans," "strategy," "goal," or "planned," "seeks," "may," "might", "will," "expects," "intends," "believes," "could," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context. There can be no assurance that the Company will enter into negotiations with Mobix or a third party for the sale of the Company, the non-binding proposal or a third-party proposal will result in a formal offer or that any such offer will ultimately result in a completed transaction.

Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors. These factors include, but are not limited to: risks related to the Company's business as a result of the time necessary to review and explore the proposal from Mobix and potentially other proposals, including the potential loss of customers, loss of revenue and other negative impacts from the time management must devote to these discussions; risks related to the loss of personnel; general acquisition-related risks, including costs and cash expenditures associated with exploring and executing a potential transaction; the Company's continued compliance with the continued listing requirements and standards of the Nasdaq Stock Market; timing, receipt and fulfillment of customer orders associated with the Company's mmWave products and solutions; anticipated use of mmWave by customers and intended users of the Company's products; the availability and performance of Peraso's products and solutions; the successful integration of Peraso's products and technology with customer and third-party semiconductor, antenna and system solutions; reliance on manufacturing partners to assist successfully with the fabrication of the Company's ICs and antenna modules; availability of quantities of ICs supplied by manufacturing partners at a competitive cost; level of intellectual property protection provided by the Company's patents; vigor and growth of markets served by the Company's customers and its operations; and other risks included in the Company's SEC filings. Peraso undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future.

Peraso and the Peraso logo are registered trademarks of Peraso Inc. in the U.S. and/or other countries.

###

Company Contact:

Jim Sullivan, CFO

Peraso Inc.

P: 408-418-7500

E: [email protected]

SOURCE: Peraso Inc.

View the original press release on ACCESS Newswire

E.Hall--AT