-

Morocco coach 'taking no risks' with Hakimi fitness

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

-

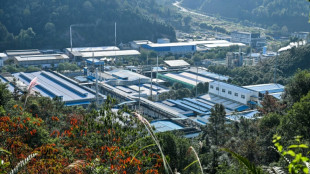

China's rare earths El Dorado gives strategic edge

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

From the Andes to Darfur: Colombians lured to Sudan's killing fields

-

Eagles win division as Commanders clash descends into brawl

Loar Announces Launch of Secondary Public Offering

WHITE PLAINS, NY / ACCESS Newswire / May 13, 2025 / Loar Holdings Inc. (NYSE:LOAR) ("Loar") announced today the launch of a secondary underwritten public offering of 9,000,000 shares of its common stock by certain of its stockholders. In addition, such selling stockholders expect to grant the underwriters a 30-day option to purchase up to 1,350,000 additional shares of common stock at the public offering price, less underwriting discounts and commissions.

Such selling stockholders will receive all of the proceeds from this offering. Loar is not selling any shares of common stock in this offering and will not receive any proceeds from this offering.

Jefferies and Morgan Stanley are acting as lead book runners for the proposed offering. Blackstone is acting as co-manager.

An automatic shelf registration statement (including a base prospectus) relating to this offering of common stock was filed by Loar with the Securities and Exchange Commission (the "SEC") on May 1, 2025 and became effective upon filing. The proposed offering of these shares will be made only by means of a prospectus supplement and accompanying base prospectus related to the offering filed with the SEC. A copy of the preliminary prospectus supplement and accompanying base prospectus may be obtained by contacting Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, NY 10022, by telephone at (877) 821-7388 or by email at [email protected]; and Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

About Loar

Loar Holdings Inc. is a diversified manufacturer and supplier of niche aerospace and defense components that are essential for today's aircraft and aerospace and defense systems. Loar has established relationships across leading aerospace and defense original equipment manufacturers and Tier Ones worldwide.

Forward-Looking Statements

This press release contains forward-looking statements, including statements regarding the public offering. These statements are not historical facts but rather are based on Loar's current expectations and projections regarding its business, operations and other factors relating thereto. Words such as "may," "will," "could," "would," "should," "anticipate," "predict," "potential," "continue," "expects," "intends," "plans," "projects," "believes," "estimates" and similar expressions are used to identify these forward-looking statements. Such forward-looking statements include, but are not limited to, statements relating to the proposed public offering, including the size and timing of such offering. These statements are only predictions and as such are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, uncertainties related to market conditions, volatility in the price of Loar's common stock, and other factors relating to Loar's business described in the prospectus included in Loar's Registration Statement on Form S-3, as it may be amended from time to time, and a related preliminary prospectus supplement related to the offering filed with the SEC, including Loar's latest Annual Report on Form 10-K, including under the caption "Risk Factors," and Loar's subsequent filings with the SEC incorporated by reference therein. Any forward-looking statement in this press release speaks only as of the date of this release. Loar undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws.

CONTACT:

Ian McKillop

Loar Holdings Investor Relations

[email protected]

SOURCE: Loar Group Inc.

View the original press release on ACCESS Newswire

W.Moreno--AT