-

Swiss Von Allmen pips Odermatt to Val Gardena downhill

Swiss Von Allmen pips Odermatt to Val Gardena downhill

-

Vonn claims third podium of the season at Val d'Isere

-

India drops Shubman Gill from T20 World Cup squad

India drops Shubman Gill from T20 World Cup squad

-

Tens of thousands attend funeral of killed Bangladesh student leader

-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

Awake Breast Augmentation: Gruber Plastic Surgery Highlights Live Implant Sizing Under Local Anesthesia With No Sedation for Eligible Patients

-

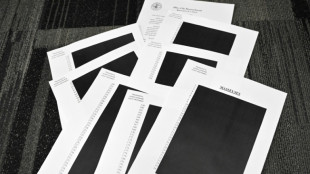

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Spetz Extends and Upsizes Private Placement up to $10 Million Amid Strong Investor Demand

TORONTO, ON / ACCESS Newswire / May 12, 2025 / Spetz Inc. (the "Company" or "Spetz") (CSE:SPTZ)(OTC PINK:DBKSF) would like to announce that the Canadian Securities Exchange has granted an extension, until June 23, 2025, for the Company's current non-brokered private placement financing, which was originally announced on March 24, 2025. In response to strong investor demand, the Company is also pleased to announce that it is upsizing the offering to a maximum of $10 million. The Company anticipates the financing will close in the very near term.

"Investor demand has been very strong, and we're in the final stages of completing this raise," said Mitchell Demeter, CEO and Director of Spetz. "We're excited about the strategic capital coming in and what it will enable us to build moving forward."

The Company also confirms that all common shares of Spetz held directly or indirectly by CEO and Director Mitchell Demeter are subject to a three-year escrow agreement. Under the terms of this agreement, 10% of the escrowed shares will be released upon the filing of a Business Acquisition Report (BAR), with the remaining shares subject to a scheduled release over the following 36 months in accordance with applicable regulations.

Additionally, the Company is pleased to update shareholders that it intends to hold its Annual General Meeting of shareholders in early July. Additional details regarding the final record and meeting date, meeting format, location, and materials will be provided in the upcoming information circular to be prepared and filed in accordance with applicable securities laws.

The Company looks forward to engaging with shareholders and stakeholders as it continues to execute its long-term strategic vision.

About Spetz Inc.

Spetz Inc. is a multinational technology company operating at the intersection of AI-driven marketplaces and blockchain infrastructure. The Company owns and operates the Spetz application, an AI-powered platform connecting consumers with service providers, as well as Sonic Strategy, a blockchain staking and infrastructure company supporting the Sonic ecosystem.

Company Contacts

Investor Relations

Email: [email protected]

Phone: 647-956-6033

Nofar Shigani, CFO

Email: [email protected]

Phone: +972 526238108

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS MARKET REGULATOR (AS THAT TERM IS DEFINED IN THE POLICIES OF THE CSE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-Looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks.

The forward-looking information contained in this release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or solicit an offer to buy securities in any jurisdiction where such an offer, solicitation, or sale would be unlawful. None of the securities issued in connection with the acquisition will be registered under the United States Securities Act of 1933, and they may not be offered or sold in the United States absent registration or an applicable exemption.

We seek Safe Harbor.

SOURCE: Spetz Inc.

View the original press release on ACCESS Newswire

J.Gomez--AT