-

England 'flat' as Crawley admits Australia a better side

England 'flat' as Crawley admits Australia a better side

-

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

US strikes Islamic State group in Syria after deadly attack on troops

-

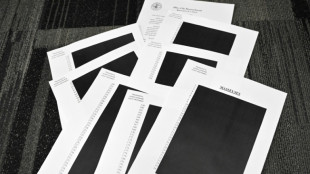

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Netlist Reports First Quarter 2025 Results

IRVINE, CA / ACCESS Newswire / May 6, 2025 / Netlist, Inc. (OTCQB:NLST) today reported financial results for the first quarter ended March 29, 2025.

Recent Highlights:

Revenue for the first quarter of 2025 was $29.0 million.

Operating Expenses for the first quarter decreased by 39% to $11.1 million compared to $18.1 million for last year's first quarter.

"First quarter results were in line with our expectations. The memory market remains poised for significant growth driven by the industry's transition to HBM and DDR5 memory for AI. Netlist is well-positioned to capitalize on this through new product development and its intellectual property portfolio," said Chief Executive Officer, C.K. Hong.

Net sales for the first quarter ended March 29, 2025 were $29.0 million, compared to net sales of $35.8 million for the first quarter ended March 30, 2024. Gross profit for the first quarter ended March 29, 2025 was $1.3 million, compared to a gross profit of $0.7 million for the first quarter ended March 30, 2024.

Net loss for the first quarter ended March 29, 2025 was ($9.5) million, or ($0.03) per share, compared to a net loss of ($17.0) million in the same period of prior year, or ($0.07) per share. These results include stock-based compensation expense of $1.0 million and $1.4 million for the quarters ended March 29, 2025 and March 30, 2024, respectively.

As of March 29, 2025, cash, cash equivalents and restricted cash were $25.6 million, total assets were $32.4 million, working capital deficit was ($15.0) million, and stockholders' deficit was ($13.7) million.

Conference Call Information

C.K. Hong, Chief Executive Officer, and Gail Sasaki, Chief Financial Officer, will host an investor conference call today, May 6, 2025 at 12:00 p.m. Eastern Time to review Netlist's results for the first quarter ended March 29, 2025. The live webcast and archived replay of the call can be accessed for 90 days in the Investors section of Netlist's website at www.netlist.com.

About Netlist

Netlist is a leading innovator in advanced memory and storage solutions. With a rich portfolio of patented technologies, Netlist's inventions are foundational to the advancement of AI which is revolutionizing computing. To learn more about Netlist, please visit www.netlist.com.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this news release include, without limitation, statements about Netlist's ability to execute on its strategic initiatives, the results of pending litigations and Netlist's ability to successfully defend its intellectual property. Forward-looking statements are statements other than historical facts and often address future events or Netlist's future performance and reflect management's present expectations regarding future events and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by any forward-looking statements. These risks, uncertainties and other factors include, among others: risks that Samsung will appeal the final orders by the trial court for the Samsung litigations, risks that Micron will appeal the final judgment by the trial court (appeals in general could cause a lengthy delay in Netlist's ability to collect damage awards, could overturn the verdicts or reduce the damages awards); risks that Netlist will suffer adverse outcomes in its litigation with Samsung, Micron or Google or in its various other active proceedings to defend the validity of its patents; risks related to Netlist's plans for its intellectual property, including its strategies for monetizing, licensing, expanding, and defending its patent portfolio; risks associated with patent infringement litigation initiated by Netlist, or by others against Netlist, as well as the costs and unpredictability of any such litigation; risks associated with Netlist's product sales, including the market and demand for products sold by Netlist and its ability to successfully develop and launch new products that are attractive to the market; the success of product, joint development and licensing partnerships; the competitive landscape of Netlist's industry; and general economic, political and market conditions, including the ongoing conflicts between Russia and Ukraine and Israel and Palestine, factory slowdowns and/or shutdowns, and changes in international tariff policies. All forward-looking statements reflect management's present assumptions, expectations and beliefs regarding future events and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed in or implied by any forward-looking statements. These and other risks and uncertainties are described in Netlist's Annual Report on Form 10-K for the fiscal year ended December 28, 2024 filed with the SEC on March 28, 2025, and the other filings it makes with the U.S. Securities and Exchange Commission from time to time, including any subsequently filed quarterly and current reports. In particular, you are encouraged to review the Company's Quarterly Report on Form 10-Q for the quarter ended March 29, 2025 that will be filed with the SEC for any revisions or updates to the information in this release. In light of these risks, uncertainties and other factors, these forward-looking statements should not be relied on as predictions of future events. These forward-looking statements represent Netlist's assumptions, expectations and beliefs only as of the date they are made, and except as required by law, Netlist undertakes no obligation to revise or update any forward-looking statements for any reason.

Investor Relations Contacts:

Mike Smargiassi |

The Plunkett Group |

(212) 739-6729 |

Gail M. Sasaki |

Netlist, Inc., Chief Financial Officer |

(949) 435-0025 |

NETLIST, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands) (Unaudited)

March 29, | December 28, | |||||||

2025 | 2024 | |||||||

ASSETS | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 14,430 | $ | 22,507 | ||||

Restricted cash | 11,150 | 12,100 | ||||||

Accounts receivable, net | 1,920 | 1,671 | ||||||

Inventories | 2,253 | 2,744 | ||||||

Prepaid expenses and other current assets | 789 | 733 | ||||||

Total current assets | 30,542 | 39,755 | ||||||

Property and equipment, net | 464 | 517 | ||||||

Operating lease right-of-use assets | 962 | 1,101 | ||||||

Other assets | 456 | 466 | ||||||

Total assets | $ | 32,424 | $ | 41,839 | ||||

LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 38,651 | $ | 42,307 | ||||

Revolving line of credit | 1,573 | 1,230 | ||||||

Accrued payroll and related liabilities | 935 | 808 | ||||||

Deferred revenue | 1,594 | 40 | ||||||

Other current liabilities | 2,421 | 2,675 | ||||||

Long-term debt due within one year | 358 | - | ||||||

Total current liabilities | 45,532 | 47,060 | ||||||

Operating lease liabilities | 491 | 641 | ||||||

Other liabilities | 73 | 186 | ||||||

Total liabilities | 46,096 | 47,887 | ||||||

Commitments and contingencies | ||||||||

Stockholders' equity (deficit): | ||||||||

Preferred stock | - | - | ||||||

Common stock | 275 | 273 | ||||||

Additional paid-in capital | 333,228 | 331,367 | ||||||

Accumulated deficit | (347,175 | ) | (337,688 | ) | ||||

Total stockholders' deficit | (13,672 | ) | (6,048 | ) | ||||

Total liabilities and stockholders' deficit | $ | 32,424 | $ | 41,839 | ||||

NETLIST, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts) (Unaudited)

Three Months Ended | ||||||

March 29, | March 30, | |||||

2025 | 2024 | |||||

Net sales | $ | 28,975 | $ | 35,807 | ||

Cost of sales(1) | 27,675 | 35,092 | ||||

Gross profit | 1,300 | 715 | ||||

Operating expenses: | ||||||

Research and development(1) | 893 | 2,441 | ||||

Intellectual property legal fees | 7,027 | 12,540 | ||||

Selling, general and administrative(1) | 3,147 | 3,116 | ||||

Total operating expenses | 11,067 | 18,097 | ||||

Operating loss | (9,767 | ) | (17,382 | ) | ||

Other income, net: | ||||||

Interest income, net | 220 | 377 | ||||

Other income, net | 60 | 38 | ||||

Total other income, net | 280 | 415 | ||||

Loss before provision for income taxes | (9,487 | ) | (16,967 | ) | ||

Provision for income taxes | - | 1 | ||||

Net loss | $ | (9,487 | ) | $ | (16,968 | ) |

Loss per common share: | ||||||

Basic and diluted | $ | (0.03 | ) | $ | (0.07 | ) |

Weighted-average common shares outstanding: | ||||||

Basic and diluted | 272,379 | 254,931 | ||||

(1) Amounts include stock-based compensation expense as follows: | ||||||

Cost of sales | $ | 8 | $ | 21 | ||

Research and development | 208 | 362 | ||||

Selling, general and administrative | 755 | 991 | ||||

Total stock-based compensation | $ | 971 | $ | 1,374 | ||

SOURCE: Netlist, Inc.

View the original press release on ACCESS Newswire

T.Wright--AT