-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

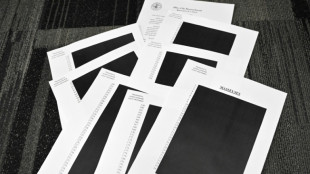

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

SCI Engineered Materials, Inc. Reports 2025 First Quarter Results

COLUMBUS, OH / ACCESS Newswire / May 2, 2025 / SCI Engineered Materials, Inc. ("SCI" or "Company") (OTCQB:SCIA), today reported financial results for the three months ended March 31, 2025.

Jeremy Young, President and Chief Executive Officer, commented "We continued to adapt to fast-changing market conditions throughout the first three months of 2025. Our initiatives included actively managing costs and operating expenses, maintaining greater contact with client companies, adding new customers, and pursuing opportunities to increase the Company's revenue.

There were positive developments during the first quarter of 2025 that should benefit SCI's future performance. Our ongoing commitment to leveraging R&D activities led to the introduction of an indium tin oxide product, which is innovative and desired by current and potential customers seeking an alternative to current materials. Additionally, interest in the Company's capabilities to domestically manufacture products and/or provide specialized bonding services is growing and has accelerated following the announcement of global tariffs last month."

Revenue

Revenue for the three months ended March 31, 2025, was $3,500,232 compared to $8,403,095 last year. Product mix, lower raw material costs and lower volume contributed to the year-over-year decline. Order backlog was $2.5 million at March 31, 2025, and December 31, 2024, respectively.

Gross profit

Gross profit was $1,072,814 for the first quarter of 2025 versus $1,415,116 for the same period last year, a decrease of 24%. Lower raw material costs and lower volume were key factors in the year-over-year decrease.

Operating expenses

The Company's operating expenses decreased 3% to $770,275 for the first three months of 2025 from $796,848 for the same period a year ago. Lower research and development expense and a slight decrease in marketing and sales expense more than offset higher general and administrative (G&A) expense. Higher G&A expense for this year's first quarter was due to the recent addition of staff, higher professional fees, Information Technology consulting services and higher rent compared to the same period last year.

Net interest income

Net interest income increased 13% to $98,130 for the first quarter of 2025 from $87,056 for the same period a year ago due to higher cash and equivalents and investments in marketable securities compared to the first quarter of 2024.

Income taxes

Income tax expense decreased 43% to $90,952 for the three months ended March 31, 2025, from $160,000 a year ago. The Company's effective tax rate was 22.7% for the first quarter of 2025 and 2024, respectively.

Net income

Net income was $309,717 for the first three months of 2025 versus $545,324 for the same period last year. Slightly lower operating expenses for the three months ended March 31, 2025, partially offset the decrease in gross profit compared to the same period last year. Net income per diluted share was $0.07 for the first three months of 2025 compared to $0.12 last year.

Cash and cash equivalents

Cash and cash equivalents were $7,353,420 at March 31, 2025, compared to $6,753,403 at December 31, 2024, an increase of 9%. The Company's investments in marketable securities totaled $3,008,478 at the end of the first quarter of 2025 versus $2,758,478 at December 31, 2024, an increase of 9%.

Debt outstanding

Total debt outstanding was $0 at March 31, 2025, and December 31, 2024, respectively.

About SCI Engineered Materials, Inc.

SCI Engineered Materials is a global supplier and manufacturer of advanced materials for PVD thin film applications and works closely with end users and OEMs to develop innovative, customized solutions. Additional information is available at www.sciengineeredmaterials.com or follow SCI Engineered Materials, Inc. at:

https://www.linkedin.com/company/sci-engineered-materials.-inc

https://www.facebook.com/sciengineeredmaterials/

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. Those statements include, but are not limited to, all statements regarding intent, beliefs, expectations, projections, customer guidance, forecasts, plans of the Company and its management. These forward-looking statements involve numerous risks and uncertainties, including without limitation, other risks and uncertainties detailed from time to time in the Company's Securities and Exchange Commission filings, including the Company's Annual Report on Form 10-K for the year ended December 31, 2024. One or more of these factors has affected and could affect the Company's projections in the future. Therefore, there can be no assurances that the forward-looking statements included in this press release will prove to be accurate. Due to the significant uncertainties in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company, or any other persons, that the objectives and plans of the Company will be achieved. All forward-looking statements made in this press release are based on information presently available to the management of the Company. The Company assumes no obligation to update any forward-looking statements.

Contact: Robert Lentz

614-439-6006

SCI ENGINEERED MATERIALS, INC.

BALANCE SHEETS

ASSETS

MARCH 31, | DECEMBER 31, | |||

2025 | 2024 | |||

(UNAUDITED) | ||||

Current Assets | ||||

Cash and cash equivalents | $ | 7,353,420 | $ | 6,753,403 |

Investments - marketable securities, short term | 509,478 | 509,478 | ||

Accounts receivable, less allowance for doubtful acccounts | 698,668 | 775,288 | ||

Inventories | 1,191,064 | 1,432,914 | ||

Prepaid purchase orders and expenses | 143,022 | 238,834 | ||

Total current assets | 9,895,652 | 9,709,917 | ||

Property and Equipment, at cost | 9,974,822 | 9,904,028 | ||

Less accumulated depreciation | (7,723,048 | ) | (7,632,946 | ) |

Property and equipment, net | 2,251,774 | 2,271,082 | ||

Investments, net - marketable securities, long term | 2,499,000 | 2,249,000 | ||

Right of use asset, net | 1,195,470 | 1,236,572 | ||

Other assets | 65,160 | 66,394 | ||

Total other assets | 3,759,630 | 3,551,966 | ||

TOTAL ASSETS | $ | 15,907,056 | $ | 15,532,965 |

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||

Current Liabilities | ||||

Operating lease, short term | $ | 184,183 | $ | 174,863 |

Accounts payable | 458,277 | 419,209 | ||

Customer deposits | 538,035 | 337,873 | ||

Accrued expenses | 314,366 | 532,260 | ||

Total current liabilities | 1,494,861 | 1,464,205 | ||

Deferred tax liability | 205,789 | 121,649 | ||

Operating lease, long term | 1,011,287 | 1,061,709 | ||

Total liabilities | 2,711,937 | 2,647,563 | ||

Total Shareholders' Equity | 13,195,119 | 12,885,402 | ||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 15,907,056 | $ | 15,532,965 |

SCI ENGINEERED MATERIALS, INC.

STATEMENTS OF INCOME

(UNAUDITED)

THREE MONTHS ENDED MARCH 31, | ||||||

2025 | 2024 | |||||

Revenue | $ | 3,500,232 | $ | 8,403,095 | ||

Cost of revenue | 2,427,418 | 6,987,979 | ||||

Gross profit | 1,072,814 | 1,415,116 | ||||

General and administrative expense | 547,821 | 482,261 | ||||

Research and development expense | 102,267 | 185,235 | ||||

Marketing and sales expense | 120,187 | 129,352 | ||||

Income from operations | 302,539 | 618,268 | ||||

Interest income, net | 98,130 | 87,056 | ||||

Income before provision for income taxes | 400,669 | 705,324 | ||||

Income tax expense | 90,952 | 160,000 | ||||

NET INCOME | $ | 309,717 | $ | 545,324 | ||

Earnings per share - basic and diluted | ||||||

Income per common share | ||||||

Basic | $ | 0.07 | $ | 0.12 | ||

Diluted | $ | 0.07 | $ | 0.12 | ||

Weighted average shares outstanding | ||||||

Basic | 4,568,127 | 4,534,801 | ||||

Diluted | 4,572,491 | 4,567,707 | ||||

SCI ENGINEERED MATERIALS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(UNAUDITED)

2025 | 2024 | ||||

CASH PROVIDED BY (USED IN): | |||||

Operating activities | $ | 933,353 | $ | (11,694 | ) |

Investing activities | (333,336 | ) | (176,534 | ) | |

Financing activities | - | (20,439 | ) | ||

NET INCREASE (DECREASE) IN CASH | 600,017 | (208,667 | ) | ||

CASH - Beginning of period | 6,753,403 | 5,673,994 | |||

CASH - End of period | $ | 7,353,420 | $ | 5,465,327 | |

SOURCE: SCI Engineered Materials, Inc.

View the original press release on ACCESS Newswire

Ch.Campbell--AT