-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

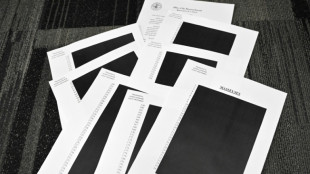

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

-

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

Amorim unfazed by 'Free Mainoo' T-shirt ahead of Villa clash

-

PSG penalty hero Safonov ended Intercontinental win with broken hand

-

French court rejects Shein suspension

French court rejects Shein suspension

-

'It's so much fun,' says Vonn as she milks her comeback

-

Moscow intent on pressing on in Ukraine: Putin

Moscow intent on pressing on in Ukraine: Putin

-

UN declares famine over in Gaza, says 'situation remains critical'

-

Guardiola 'excited' by Man City future, not pondering exit

Guardiola 'excited' by Man City future, not pondering exit

-

Zabystran upsets Odermatt to claim first World Cup win in Val Gardena super-G

First Abu Dhabi Bank and Libre Capital Sign MoU to Explore RWA Collateralised Lending

First Abu Dhabi Bank (FAB) has signed a Memorandum of Understanding (MoU) with Libre Capital, a technology firm specialising in blockchain-based investment infrastructure and backed by Further Ventures, to explore innovative approaches to collateralised lending using public blockchains and tokenised RWAs.

The collaboration will combine Libre's onchain primary issuance infrastructure and lending capabilities with FAB's financial expertise and liquidity to create a fully automated, transparent, and efficient lending ecosystem. By using high-quality tokenised fund assets as collateral, the initiative aims to redefine Net Asset Value (NAV) financing, thereby unlocking new opportunities for accredited and institutional borrowers on public blockchain networks.

This MOU sets the foundation for a multi-phased approach to onchain collateralised lending, with the potential to transform traditional lending paradigms. The initial phase will pilot a credit line for stablecoin lending, backed by tokenised money market funds created by globally recognised asset managers. The system will leverage blockchain technology for automated collateral management, real-time NAV updates via oracles, and smart contract-enabled loan monitoring.

With daily liquidity, seamless fund disbursements, and automated risk management, this initiative positions both organisations as leaders in blockchain-enabled NAV financing. It also paves the way for institutional participation in compliant tokenised markets, thereby bridging the gap between traditional finance and decentralised ecosystems, while ensuring adherence to regulatory requirements across all jurisdictions.

Libre's technology ushers in a new era of frictionless finance by allowing institutional or accredited investors to borrow against their holdings in tokenised financial assets. These assets are pledged to platform lenders and securely locked in smart contract vaults for the loan duration. This innovative lending format delivers unmatched efficiencies, including faster loan disbursement, cost-effectiveness, and complete onchain transparency.

Speaking at the signing, Sameh Al Qubaisi, Group Head of Global Markets, highlighted, "FAB's involvement in this initiative underscores our commitment to drive innovation in the UAE's financial landscape. Through this initiative, FAB aims to enable secure credit facilities backed by tokenised assets, with automated processes ensuring robust risk management and complete regulatory compliance. This venture aligns seamlessly with the UAE's vision to become a global hub for financial and technological excellence."

Dr. Avtar Sehra, founder and CEO of Libre, emphasised, "This partnership epitomises the transformative power of blockchain and RWAs in reimagining capital markets. Together with FAB, we are laying the foundation for a future where access to liquidity is seamless, secure, and globally interconnected."

Faisal Al Hammadi, Managing Partner of Further Ventures, added "At Further Ventures, we strongly believe in the transformative impact that tokenisation will have in reshaping the delivery of financial services. Through this partnership, we demonstrate how the UAE can continue to be a leader in digital asset adoption across institutional use cases."

Early shareholders in Libre include Nomura's Laser Digital and WebN Group.

PR Contact:

Libre Capital

[email protected]

SOURCE: Libre Capital

W.Nelson--AT