-

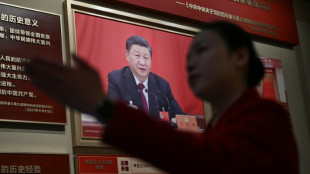

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

Dow, S&P 500 end at records despite AI fears

The Dow and S&P 500 finished at fresh records Thursday while a big drop in Oracle shares dragged the Nasdaq lower and revived worries over pricey artificial intelligence valuations.

The records followed a positive day on European bourses and mixed one in Asia and reflected optimism after the Federal Reserve cut interest rates on Wednesday and offered less hawkish commentary than feared.

Banks and industrial stocks were among the best performing on the blue-chip Dow index, which ended 1.3 percent higher, while the Nasdaq lost 0.3 percent.

"Even as investors were reassured by the Fed's latest rate cut, familiar concerns about AI are still very much top of mind right now," said Deutsche Bank managing director Jim Reid.

Those concerns were reignited after Oracle reported after markets closed on Wednesday that quarterly revenue had fallen short of lofty expectations and revealed a surge in spending on data centers to boost AI capacity.

Shares in the Texas-based company finished down 10.8 percent after dropping even more during the session.

Dave Grecsek of Aspiriant Wealth Management said the market's reaction to Oracle's results underscored its discomfort with aggressive AI investments.

"There's still a lot of apprehension about how sustainable some of these capital spending plans are, what the return on those investments are, and especially now that they're financed with debt," he said.

Markets globally suffered a wobble last month with investors worried over the vast sums poured into AI, with some observers warning of an AI bubble that could burst and cause a market rout.

The Fed, as expected, cut interest rates on Wednesday. But an unusually heavy number of dissents (three) complicates the outlook for monetary policy.

"Investors have shrugged off the Fed's latest reduction in US borrowing costs as it is becoming harder to guess where rates might go next," said AJ Bell investment director Russ Mould.

Fed policymakers were highly divided about whether to cut rates again in 2026 and if so, how often.

But eToro US analyst Bret Kenwell pointed out that Fed Chair Jerome Powell had highlighted the fact that none of the Fed policymakers sees rate hikes in 2026 in their base scenario.

"The lack of an outright hawkish tone from the Fed combined with its third consecutive rate cut could pave the way for a potential year-end rally in equities, provided that next week's macroeconomic data doesn't derail the recent bullish momentum," Kenwell said.

The latest cut in borrowing costs -- to their lowest level in three years -- comes as monetary policymakers try to support the US jobs market, which has been showing signs of weakness for much of the year.

The dollar weakened while oil prices retreated.

Among individual companies, Disney jumped 2.4 percent after announcing a three-year licensing deal with OpenAI that will allow users to create short videos featuring beloved Disney characters through artificial intelligence.

- Key figures at around 2130 GMT -

New York - Dow: UP 1.3 percent at 48,704.01 (close)

New York - S&P 500: UP 0.2 percent at 6,901.00 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,593.86 (close)

London - FTSE 100: UP 0.5 percent at 9,703.16 (close)

Paris - CAC 40: UP 0.8 percent at 8,085.76 (close)

Frankfurt - DAX: UP 0.7 percent at 24,294.61 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 50,148.82 (close)

Hong Kong - Hang Seng Index: FLAT at 25,530.51 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,873.32 (close)

Dollar/yen: DOWN at 155.58 yen from 156.02 yen on Wednesday

Euro/dollar: UP at $1.1741 from $1.1695

Pound/dollar: UP at $1.3394 from $1.3383

Euro/pound: UP at 87.65 pence from 87.39 pence

Brent North Sea Crude: DOWN 1.5 percent at $61.28 per barrel

West Texas Intermediate: DOWN 1.5 percent at $57.60 per barrel

burs-jmb/bgs

R.Chavez--AT