-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

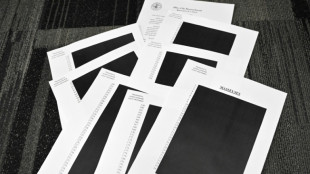

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

-

Poland president accuses Ukraine of not appreciating war support

Poland president accuses Ukraine of not appreciating war support

-

Stocks advance with focus on central banks, tech

US stocks retreat from records as tech giants fall

Wall Street's bull run showed signs of fatigue Tuesday as major indices retreated from records on drops by Amazon, Nvidia and other tech giants.

The pullback followed comments from Federal Reserve Chair Jerome Powell warning that cutting interest rates "too aggressively" could stoke inflation, while the central bank boss also emphasized the need to try to prevent the labor market from softening "unnecessarily."

All three major US indices have finished at records the last three days.

"Today's pullback after fresh record highs could reflect market participants giving credence to valuation concerns amid a historic run, particularly in the mega-cap space, though investors have repeatedly shown a willingness to buy dips throughout this rally," said Briefing.com.

The tech-rich Nasdaq led US indices lower, dropping one percent.

Nvidia, which rallied on Monday after announcing a $100 billion investment in OpenAI to build infrastructure for next-generation artificial intelligence, retreated on Tuesday, losing 2.8 percent.

While "leading tech companies are investing hundreds of billions in generative AI... some investors continue to question if this is money well spent," said David Morrison, senior market analyst at Trade Nation.

Earlier, London ended the day flat and Paris and Frankfurt added barely half of one percent as investors digested purchasing managers' index (PMI) data -- a closely watched gauge of economic health.

The index showed eurozone business activity hit a 16-month high in September, partly driven by solid growth in Germany, while France weighed on performance.

Britain's reading came in below expectations, suggesting the economy is losing momentum, analysts noted, as inflation fears linger.

With trade subdued by a holiday in Japan and an approaching typhoon in Hong Kong, Asian markets mostly drifted as Hong Kong and Shanghai both closed lower.

Taipei jumped more than one percent, with chip titan TSMC soaring over three percent as it tracked US counterpart Nvidia, which announced a $100-billion investment in OpenAI for next-generation artificial intelligence.

Oil prices rose after President Donald Trump called on Europe to completely halt oil imports from the country over the Ukraine war. The US president also threatened sanctions on Russia in a speech that tilted more heavily in support of Ukraine than earlier Trump stances.

- Key figures at around 2050 GMT -

New York - Dow: DOWN 0.2 percent at 46,292.78 (close)

New York - S&P 500: DOWN 0.6 percent at 6,656.92 (close)

New York - Nasdaq Composite: DOWN 1.0 percent at 22,573.47 (close)

London - FTSE 100: FLAT at 9,223.32 (close)

Paris - CAC 40: UP 0.5 percent at 7,872.02 (close)

Frankfurt - DAX: UP 0.4 percent at 23,611.33 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,159.12 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,821.83 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1816 from $1.1803 on Monday

Pound/dollar: UP at $1.3524 from $1.3514

Dollar/yen: DOWN at 147.66 yen from 147.72 yen

Euro/pound: UP at 87.37 pence from 87.34 pence

West Texas Intermediate: UP 1.8 percent at $63.41 per barrel

Brent North Sea Crude: UP 1.6 percent at $67.63 per barrel

A.Williams--AT