-

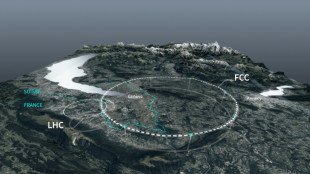

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

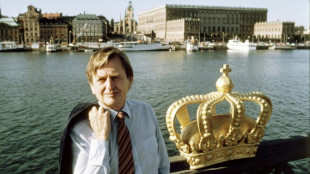

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

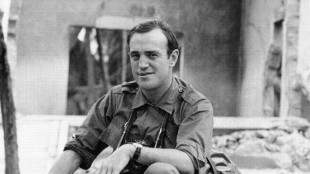

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Automakers hold their breath on Trump's erratic US tariffs

US President Donald Trump's aggressive but fast-changing trade policy has foisted difficult questions on carmakers that they have not yet been forced to answer.

While Trump has retreated from some of his most onerous tariffs, carmakers are on the hook for 25 percent levies on auto imports that went into effect on April 3.

But so far, the effects of that levy have been muffled because carmakers are still selling vehicles from inventory. Auto companies and industry watchers expect this dynamic to persist for at least a few more weeks.

But if the tariffs stay in place -- a big if given Trump's tendency to reverse course -- automakers will need to decide how much of the hit to absorb and how much to pass on.

"No one in this entire value chain can just absorb it," Kjell Gruner, president of Volkswagen Group of America, said Tuesday.

"We can't say, 'Oh the customers need to swallow it.' That price increase would be too high," Gruner told an industry conference. "We can't also say the dealers need to. Nor can we."

A priority is clear communication to customers, said Gruner, adding that pricing changes would not be made overnight.

Tariff talk dominated Tuesday's Automotive Forum held just ahead of the annual New York International Auto Show.

Since returning to the White House in January, Trump's myriad tariff announcements have been at the center of his administration's economic policy.

Trump reversed course last Wednesday on the most onerous of his "reciprocal" tariffs for every country except China following upheaval in financial markets.

But other tariffs have stayed in place, such as a 25 percent levy on steel and aluminum imports, which affects automakers, along with the direct levy on automobile imports.

On Monday, Trump opened the door to walking back his 25 percent tariff on all auto imports, saying he was "looking at something to help some of the car companies."

One of Trump's aims with tariffs is to boost US manufacturing.

But industry experts note that automobile capital investments are multi-year commitments that require confidence in a stable commercial environment -- something undermined by constant changes in policy.

Patrick Manzi, chief economist at the National Automobile Dealers Association, opened Tuesday's proceedings with a downcast outlook on the economy.

"I expect to see consumers holding off on big-ticket items," said Manzi, who has raised his odds for a US recession to 60 percent.

- Aggressive pricing -

Automakers emphasized their commitment to US investments, with Volvo touting its ramping of production at a South Carolina factory and Nissan pointing to a recent decision to maintain a second shift at a Tennessee assembly plant as the companies seek to boost US output.

Hyundai North America chief Randy Parker pointed to the South Korean conglomerate's announcement of a $21 billion new steel plant in Louisiana announced last month at a White House event with Trump.

Parker, who quipped that US tariff policy might have changed since he last checked his phone, described the company's strategy as "quite simple."

"Our plan is to sell cars period," he said. "Sell like hell."

Hyundai has promised to hold prices steady in the short run, joining other brands like Nissan and Ford that have announced consumer-friendly pricing actions amid the tariffs.

These moves contributed to a surge in US auto sales in March as shoppers fast-forwarded purchases to get ahead of tariffs.

These trends have continued thus far into April, said Thomas King, president of the data and analytics division at JD Power.

King does not expect the US car market to see a significant hit from tariffs until the third quarter.

But by the fourth quarter, King expects auto prices to be up around five percent due to the tariffs, resulting in about an eight percent drop in US auto sales.

These figures are based on the current economic outlook.

"If we were to have a recession, it would be obviously a bigger gap," King said.

M.O.Allen--AT