-

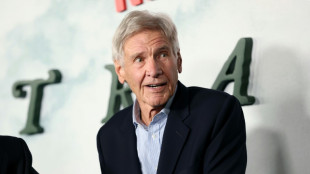

Harrison Ford to get lifetime acting award

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

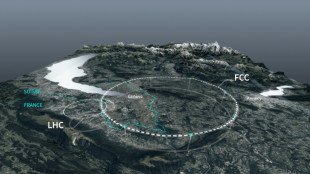

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

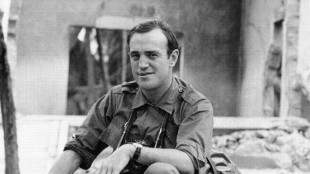

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

| RBGPF | -2.23% | 80.22 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | 3.97% | 15.38 | $ | |

| CMSC | 0.24% | 23.315 | $ | |

| NGG | -0.76% | 76.58 | $ | |

| BTI | 0.1% | 57.225 | $ | |

| BP | -3.16% | 33.415 | $ | |

| AZN | 1.28% | 91.025 | $ | |

| GSK | -0.62% | 48.41 | $ | |

| RIO | 0.66% | 77.7 | $ | |

| RELX | 0.38% | 40.715 | $ | |

| VOD | 0.08% | 12.82 | $ | |

| BCE | -1.03% | 22.915 | $ | |

| CMSD | -0.09% | 23.26 | $ | |

| BCC | 1.4% | 77.372 | $ | |

| JRI | -0.15% | 13.41 | $ |

Equities, oil plunge as US, China crank up trade war

Stock markets tumbled along with oil and the dollar Wednesday as US President Donald Trump's sweeping tariffs against trading partners kicked in, triggering strong retaliation from China.

Beijing slapped a higher 84-percent levy on US goods, sharply accelerating losses on European stock markets in early afternoon trading.

Growing fears of weakened demand sent oil prices to four-year lows, with international benchmark Brent North Sea crude dropping under $60.

Paris and Frankfurt dived almost four percent, also as goods from the European Union now face a 20 percent tariff when entering the United States.

London slumped 3.5 percent, with Britain having been hit with a 10 percent levy on Saturday.

Most Asian and European equities fell back into the red -- Tokyo closed down 3.9 percent -- a day after partially rebounding from sharp sell-offs on hopes that Washington might temper some of the levies.

But any hopes of a last minute roll-back on tariffs were dashed, as the United States hit China -- its major trading partner -- with tariffs now reaching 104 percent.

"The world's largest and second largest economies are now locked in a trade war, and neither nation seems willing to back down," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Beijing warned that China had "firm will and abundant means" to fight a trade war, state news agency Xinhua said.

Speculation that Beijing will unveil stimulus measures helped Shanghai and Hong Kong stocks buck the downward trend in Asian equities.

Pharmaceutical firms took a heavy hit after Trump said he would be announcing a major levy on the sector.

Europe's most valuable company, weight-loss drug maker Novo Nordisk, dived more than seven percent and British pharmaceutical giant AstraZeneca shed six percent.

- Bond yields rise -

"Alarmingly, US Treasury markets are also experiencing an incredibly aggressive selloff... adding to the evidence that they’re losing their traditional haven status," said Jim Reid, managing director at Deutsche Bank.

The sharp rise in yields on US government bonds triggered similar increases to borrowing costs in the UK and Japan, as expectations for global growth and spending diminished.

"It feels like no asset class has been spared as investors continue to price in a growing probability of a US recession," Reid added.

Foreign exchange markets were similarly rattled on Wednesday -- Beijing has allowed the yuan to weaken to a record low against the dollar, while the South Korean won also hit its weakest since 2009 during the global financial crisis.

Safe-haven yen rose more than one percent.

South Korea unveiled a $2 billion emergency support for its crucial export-focused carmakers, warning Trump's 25 percent tariffs on the sector could deal a terrible blow.

To help shore up their economies, India and New Zealand's central banks cut interest rates.

Fears of that Trump's blow to commerce will spark a global recession saw Wall Street reverse healthy opening gains to end deep in the red on Tuesday -- the S&P 500 finished below 5,000 points for the first time in almost a year.

- Key figures around 1115 GMT -

London - FTSE 100: DOWN 3.5 percent at 7,636.04 points

Paris - CAC 40: DOWN 3.8 percent at 6,835.89

Frankfurt - DAX: DOWN 3.9 percent at 19,491.82

Tokyo - Nikkei 225: DOWN 3.9 percent at 31,714.03 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 20,264.49 (close)

Shanghai - Composite: UP 1.3 percent at 3,186.81 (close)

New York - Dow: DOWN 0.8 percent at 37,645.59 (close)

Euro/dollar: UP at $1.1047 from $1.0959

Pound/dollar: UP at $1.2811 from $1.2766

Dollar/yen: DOWN at 144.81 yen from 146.23 yen on Tuesday

Euro/pound: UP at 86.25 pence from 85.78 pence

West Texas Intermediate: DOWN 5.4 percent at $56.36 per barrel

Brent North Sea Crude: DOWN 4.9 percent at $59.68 per barrel

A.Ruiz--AT