-

Emery defends failure to shake hands with Arteta after Villa loss to Arsenal

Emery defends failure to shake hands with Arteta after Villa loss to Arsenal

-

China says to impose extra 55% tariffs on some beef imports

-

Japanese women MPs want more seats, the porcelain kind

Japanese women MPs want more seats, the porcelain kind

-

Silver slips lower in mixed end to Asia trading year

-

Guinea junta chief Doumbouya elected president: election commission

Guinea junta chief Doumbouya elected president: election commission

-

Pistons pound Lakers as James marks 41st birthday with loss

-

Taiwan coastguard says Chinese ships 'withdrawing' after drills

Taiwan coastguard says Chinese ships 'withdrawing' after drills

-

France's homeless wrap up to survive at freezing year's end

-

Leftist Mamdani to take over as New York mayor under Trump shadow

Leftist Mamdani to take over as New York mayor under Trump shadow

-

French duo stripped of Sydney-Hobart race overall win

-

Thailand releases 18 Cambodian soldiers held since July

Thailand releases 18 Cambodian soldiers held since July

-

Tiny tech, big AI power: what are 2-nanometre chips?

-

Libyans savour shared heritage at reopened national museum

Libyans savour shared heritage at reopened national museum

-

Asia markets mixed in final day of 2025 trading

-

Global 'fragmentation' fuelling world's crises: UN refugee chief

Global 'fragmentation' fuelling world's crises: UN refugee chief

-

Difficult dance: Cambodian tradition under threat

-

Regional temperature records broken across the world in 2025

Regional temperature records broken across the world in 2025

-

'Sincaraz' set to dominate as 2026 tennis season kicks off

-

Bulgaria readies to adopt the euro, nearly 20 years after joining EU

Bulgaria readies to adopt the euro, nearly 20 years after joining EU

-

Trump v 'Obamacare': US health costs set to soar for millions in 2026

-

Isiah Whitlock Jr., 'The Wire' actor, dies at 71

Isiah Whitlock Jr., 'The Wire' actor, dies at 71

-

SoftBank lifts OpenAI stake to 11% with $41bln investment

-

Bangladesh mourns ex-PM Khaleda Zia with state funeral

Bangladesh mourns ex-PM Khaleda Zia with state funeral

-

TSMC says started mass production of 'most advanced' 2nm chips

-

Australian cricket great Damien Martyn 'in induced coma'

Australian cricket great Damien Martyn 'in induced coma'

-

Guinea junta chief Doumboya elected president: election commission

-

Apex Provides Recap of 2025 Regional Exploration Drilling and Priority Follow Up Targets at the Cap Critical Minerals Project

Apex Provides Recap of 2025 Regional Exploration Drilling and Priority Follow Up Targets at the Cap Critical Minerals Project

-

Guardian Metal Resources PLC Announces Total Voting Rights

-

Caballero defends Maresca after Palmer substitution sparks jeers

Caballero defends Maresca after Palmer substitution sparks jeers

-

Depleted Man Utd 'lack quality', says Amorim

-

'We know what we want': Arteta eyes title after Arsenal thrash Villa

'We know what we want': Arteta eyes title after Arsenal thrash Villa

-

Arsenal end Villa winning run, Man Utd, Chelsea stumble

-

Arsenal crush Villa to make statement in title race

Arsenal crush Villa to make statement in title race

-

Senegal top AFCON group ahead of DR Congo as Tanzania make history

-

Maresca in the firing line as Chelsea stumble against Bournemouth

Maresca in the firing line as Chelsea stumble against Bournemouth

-

Stocks mixed, silver rebounds as 2025 trading winds down

-

Senegal top AFCON group, DR Congo to face Algeria in last 16

Senegal top AFCON group, DR Congo to face Algeria in last 16

-

Norway's Magnus Carlsen wins 20th world chess title

-

Patriots star Diggs facing assault charges: reports

Patriots star Diggs facing assault charges: reports

-

Journalist Tatiana Schlossberg, granddaughter of JFK, dies at 35

-

Rio receives Guinness record for biggest New Year's bash

Rio receives Guinness record for biggest New Year's bash

-

Jokic out for four weeks after knee injury: Nuggets

-

World bids farewell to 2025, a year of Trump, truces and turmoil

World bids farewell to 2025, a year of Trump, truces and turmoil

-

Far-right leader Le Pen to attend Brigitte Bardot's funeral

-

Drones dive into aviation's deepest enigma as MH370 hunt restarts

Drones dive into aviation's deepest enigma as MH370 hunt restarts

-

German dog owners sit out New Year's Eve chaos in airport hotels

-

Tanzania hold Tunisia to end 45-year wait for AFCON knockout spot

Tanzania hold Tunisia to end 45-year wait for AFCON knockout spot

-

10 countries warn of 'catastrophic' Gaza situation

-

Performers cancel concerts at Kennedy center after Trump renaming

Performers cancel concerts at Kennedy center after Trump renaming

-

Stocks higher, silver rebounds as 2025 trading winds down

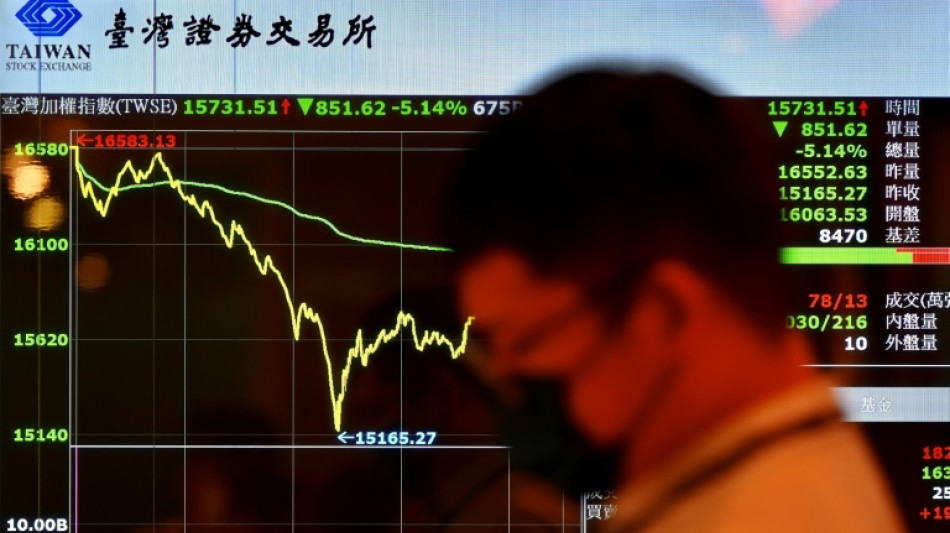

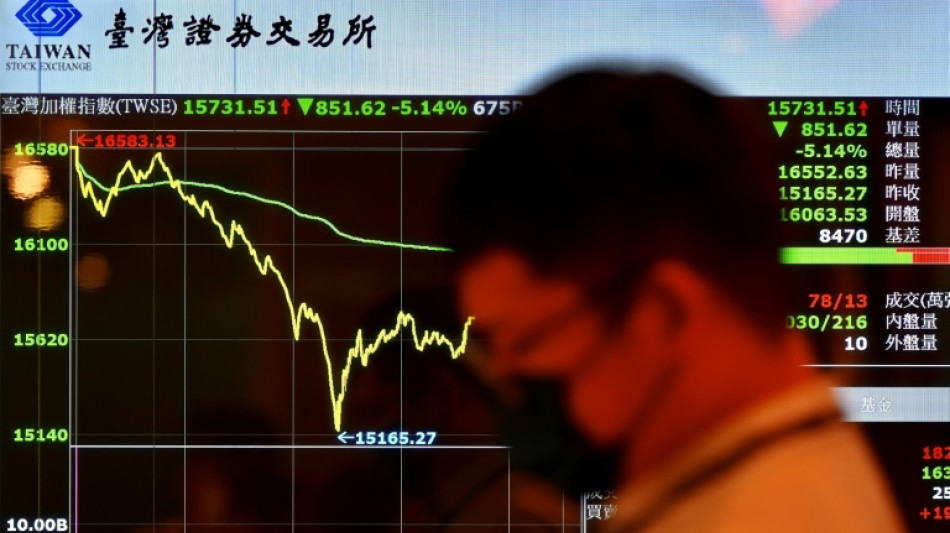

Stocks, oil prices sink further as Trump stands firm over tariffs

Stock markets and oil prices collapsed further on a black Monday for markets as US President Donald Trump stood firm over his tariffs despite recession fears.

Trading floors across Asia and Europe were overcome by waves of further selling after last week's sharp losses.

Hong Kong's drop of 13.2 percent Monday was its worst in nearly three decades.

Trillions of dollars have been wiped off combined stock market valuations in recent sessions.

Taipei stocks suffered their worst fall on record Monday, tanking 9.7 percent, while Frankfurt dived as much as 10 percent and Tokyo closed down by almost eight percent.

Hong Kong's loss was exaggerated as the index had been closed Friday for a public holiday.

Wall Street futures suffered another drubbing, while bitcoin tumbled.

The dollar was steadier after sharp losses last week.

"The carnage in global equity markets has continued," noted Thomas Mathews, Asia Pacific head of markets at Capital Economics.

He said Trump could still pare back his tariffs.

"But, if he doesn't, equities could get a lot sicker yet."

A 10-percent "baseline" tariff on imports from around the world took effect Saturday.

However, a slew of countries will be hit by higher duties from Wednesday, with levies of 34 percent for Chinese goods and 20 percent for EU products.

Countries mostly have been scrambling to blunt the new US tariffs without retaliating, but Beijing is responding in kind, escalating the trade war between the world's two biggest economies.

Beijing announced last week its own 34-percent tariff on US goods, which will come into effect on Thursday.

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

Wall Street's three main indices dived almost six percent Friday.

- No sector spared -

Monday's savage selling was across the board, with no sector spared.

Tech firms, carmakers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba tanked 18 percent and rival JD.com shed 15.5 percent, while Japanese tech investment giant SoftBank dived more than 12 percent and Sony gave up 10 percent.

Hong Kong's 13-percent drop marked its worst day since 1997 during the Asian financial crisis.

Shanghai shed more than seven percent, with China's state-backed fund Central Huijin Investment vowing to help ensure "stable operations" of the market.

Singapore plunged nearly eight percent, while Seoul gave up more than five percent, triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Sydney, Wellington, Manila and Mumbai were also deep in the red, while London and Paris both dropped nearly four percent in midday deals.

Milan and Madrid each shed more than four percent, with all sectors also affected across Europe.

Concerns about future energy demand saw oil prices sink about three percent, having dropped some seven percent Friday.

Both main contracts are now sitting at their lowest levels since 2021.

The Kremlin said it was monitoring the plummeting price of oil -- on which Russia's economy is highly dependent.

- Key figures around 1045 GMT -

London - FTSE 100: DOWN 3.4 percent at 7,779.08 points

Paris - CAC 40: DOWN 3.9 percent at 6,987.91

Frankfurt - DAX: DOWN 3.7 percent at 19,881.07

Tokyo - Nikkei 225: DOWN 7.8 percent at 31,136.58 (close)

Hong Kong - Hang Seng Index: DOWN 13.2 percent at 19,828.30 (close)

Shanghai - Composite: DOWN 7.3 percent at 3,096.58 (close)

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

West Texas Intermediate: DOWN 2.7 percent at $60.27 per barrel

Brent North Sea Crude: DOWN 2.6 percent at $63.85 per barrel

Euro/dollar: UP at $1.0972 from $1.0962 on Friday

Pound/dollar: DOWN at $1.2849 from $1.2893

Dollar/yen: DOWN at 146.45 yen from 146.98 yen

Euro/pound: UP at 85.37 pence from 85.01 pence

burs-bcp/ajb/rl

Ch.Campbell--AT