-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

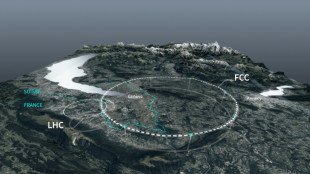

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

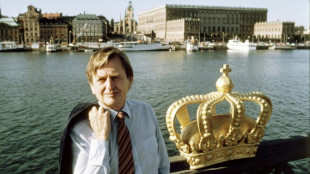

Not enough evidence against Swedish PM murder suspect: prosecutor

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

British energy giant BP extends shakeup with new CEO pick

-

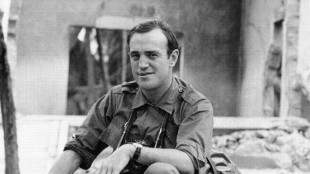

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

| RYCEF | 3.97% | 15.38 | $ | |

| CMSC | 0.09% | 23.28 | $ | |

| RBGPF | -2.23% | 80.22 | $ | |

| NGG | -0.74% | 76.592 | $ | |

| BP | -3.12% | 33.428 | $ | |

| AZN | 1.23% | 90.975 | $ | |

| RELX | 0.42% | 40.73 | $ | |

| RIO | 0.68% | 77.72 | $ | |

| BTI | 0.08% | 57.215 | $ | |

| GSK | -0.54% | 48.45 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| VOD | 0.16% | 12.83 | $ | |

| CMSD | 0.09% | 23.3 | $ | |

| JRI | -0.09% | 13.418 | $ | |

| BCC | 1.62% | 77.55 | $ | |

| BCE | -1.11% | 22.895 | $ |

Global stocks mixed as investors digest high US yields, China challenges

Global stocks saw a mixed day of trading Friday as investors contemplated the prospect that interest rates could remain higher for longer and on concerns over China's economy.

Stocks on Wall Street finished largely flat as investors snapped up more attractive government bonds with higher yields.

The Dow Jones Industrial Average finished up slightly, while the S&P was flat and the Nasdaq fell.

Meanwhile, the yield on the 10-year US Treasury note eased off highs seen earlier this week, when it was briefly flirting with a new 15-year high.

"There are a lot of investors looking at the yields and they are starting to get very attractive," financial advisor Tom Cahill from Ventura Wealth Management told AFP.

"They are stepping in to do some buying of the bonds and of course that drives down yields -- and that's better for stocks," he added.

In the eurozone, Paris and Frankfurt ended the week in the red.

In London, the FTSE 100 also closed lower, as a wet July dampened UK retail sales, which fell more than expected last month, official data showed.

Traders have been spooked after minutes from the US central bank's July meeting hinted that further increases in borrowing costs could lie ahead, as policymakers grapple with inflation.

While inflation in the United States has come down sharply in recent months, it remains above the Fed's long-term target of two percent.

Some decision-makers at the Fed have suggested its two percent goal can only be achieved and maintained by pushing interest rates higher.

Fed chief Jerome Powell's speech at next week's annual Jackson Hole economic symposium in Wyoming will be closely followed for clues about the bank's plans.

- Anxious eye on China -

Asian markets were well in the red, too, including Hong Kong, which was down for a sixth consecutive trading day.

Investors are also keeping an eye on China, where authorities are struggling to get a grip on the economy as its recovery from Covid peters out.

And the property crisis is also back in the headlines.

On Thursday, Chinese property giant Evergrande Group filed for bankruptcy protection in the United States, a measure that protects its US assets while it attempts to push through a restructuring.

That comes days after Country Garden, another major Chinese developer, said there were "major uncertainties in the redemption of corporate bonds," suggesting it could default on a bond payment next month.

There are now concerns about property firms backed by the government, with Bloomberg reporting that many are warning of widespread losses.

It said 18 of the 38 state-owned enterprise builders traded in Hong Kong and China had posted preliminary losses in the first half of the year, compared with 11 that warned of full-year losses in 2022.

"China's property slowdown is already hurting all developers, including the large government-linked ones," said Zerlina Zeng of CreditSights Singapore.

"We do not expect the situation to materially improve in the second half."

- Key figures around 2030 GMT -

New York - Dow: UP 0.1 percent at 34,500.66 (close)

New York - S&P: FLAT at 4,369.71 (close)

New York - Nasdaq: DOWN 0.2 percent at 13,290.78 (close)

London - FTSE 100: DOWN 0.7 percent at 7,262.43 (close)

Frankfurt - DAX: DOWN 0.7 percent at 15,574.26 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,164.11 (close)

EURO STOXX 50: DOWN 0.4 percent at 4,212.95

Tokyo - Nikkei 225: DOWN 0.6 percent at 31,450.76 (close)

Hong Kong - Hang Seng Index: DOWN 2.1 percent at 17,950.85 (close)

Shanghai - Composite: DOWN 1.0 percent at 3,131.95 (close)

Euro/dollar: DOWN at $1.0874 from $1.0878 on Thursday

Pound/dollar: DOWN at $1.2736 from $1.2745

Euro/pound: UP at 85.37 pence from 85.29 pence

Dollar/yen: DOWN at 145.32 from 145.79 yen

West Texas Intermediate: UP 1.1 percent at $81.25 per barrel

Brent North Sea crude: UP 0.8 percent at $84.80 per barrel

D.Lopez--AT