-

New photo dump fuels Capitol Hill push on Epstein files release

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

Assange files complaint against Nobel Foundation over Machado win

-

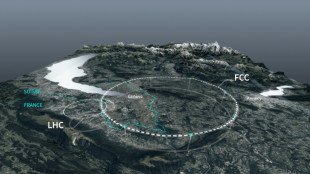

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

US strike on alleged drug boat in Pacific kills four

-

Thailand strikes building in Cambodia's border casino hub

-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

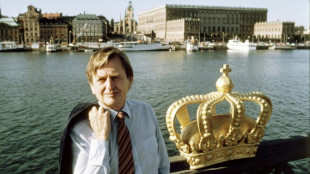

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

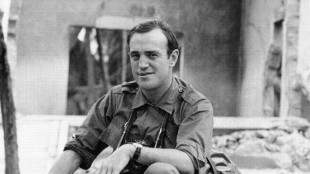

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

UBS against the clock in Credit Suisse takeover talks

UBS was up against the clock Sunday in talks to finalise a mammoth takeover of its troubled rival Swiss bank Credit Suisse and reassure investors before the markets reopen.

Switzerland's biggest bank UBS is being urged by the authorities to get a deal over the line, in a bid to avoid a wave of contagious panic on the markets Monday.

The wealthy Alpine nation's largest banks were in urgent negotiations this weekend with the country's banking and regulatory authorities, several media outlets reported.

The generally well-informed tabloid Blick said UBS will buy Credit Suisse in a deal to be sealed on Sunday during an exceptional meeting in Bern, bringing together the Swiss government and the banks' executives.

A merger of this scale, involving swallowing up all or part of a bank arousing growing investor unease, would normally take months. UBS will have had a few days.

However, the Swiss authorities felt they had no choice but to push UBS into overcoming its reluctance, due to the enormous pressure exerted by Switzerland's major economic and financial partners, fearing for their own financial centres, said Blick.

"Everything points to a Swiss solution this Sunday. And when the stock market opens on Monday, Credit Suisse could be a thing of the past," the newspaper said.

- 'Merger of the century' -

Credit Suisse, the country's SNB central bank and the Swiss financial watchdog FINMA all declined to comment when contacted by AFP about the possibility of a UBS takeover.

The Swiss government held an urgent meeting to discuss the situation late Saturday in the capital Bern. The government's spokesman refused to comment on the talks, Swiss news agency ATS reported.

An acquisition of this size is dauntingly complex.

UBS would require public guarantees to cover legal costs and potential losses, according to a report by Bloomberg, citing anonymous sources.

The SonntagsZeitung newspaper called it "the merger of the century".

"The unthinkable becomes true: Credit Suisse is about to be taken over by UBS," the weekly said.

The government, FINMA and the SNB "see no other option", it claimed.

"The pressure from abroad had become too great -- and the fear that the reeling Credit Suisse could trigger a global financial crisis," it said.

- Too big to fail? -

Like UBS, Credit Suisse is one of 30 banks around the world deemed to be Global Systemically Important Banks -- of such importance to the international banking system that they are deemed too big to fail.

But the market movement seemed to suggest the bank was being perceived as a weak link in the chain.

"We are now awaiting a definitive and structural solution to the problems of this bank," French Finance Minister Bruno Le Maire told Le Parisien newspaper. "We remain extremely vigilant."

According to the Financial Times newspaper, Credit Suisse customers withdrew 10 billion Swiss francs ($10.8 billion) in deposits in a single day late last week -- a measure of how far trust in the bank has fallen.

After a turbulent week on the stock market, which forced the SNB to step in with a $54 billion lifeline, Credit Suisse was worth just over $8.7 billion by Friday evening -- precious little for a bank considered one of 30 key institutions worldwide.

FINMA and the SNB have said that Credit Suisse "meets the capital and liquidity requirements" imposed on such banks, but mistrust remains.

- Stock market plunge -

Amid fears of contagion after the collapse of two banks in the United States, Credit Suisse's share price plunged by more than 30 percent on Wednesday to a new record low of 1.55 Swiss francs.

After recovering some ground on Thursday, Credit Suisse shares closed down eight percent on Friday at 1.86 Swiss francs each as the Zurich-based lender struggled to retain investor confidence.

Credit Suisse has been plagued by a series of scandals in recent years. Shares were worth 12.78 Swiss francs in February 2021.

In 2022, the bank suffered a net loss of $7.9 billion, and expects a "substantial" pre-tax loss this year.

"This is a bank that never seems to get its house in order," IG analyst Chris Beauchamp commented in a market note this week.

The notion of Switzerland's biggest banks joining forces has cropped up over the years but has generally been dismissed due to competition issues and risks to the Swiss financial system's stability.

"The Credit Suisse management, even if forced to do so by the authorities, would only choose (this option) if they have no other solution," said David Benamou, chief investment officer of Paris-based Axiom Alternative Investments.

P.Hernandez--AT