-

Protests in Bangladesh as India cites security concerns

Protests in Bangladesh as India cites security concerns

-

European stocks rise before central bank decisions on rates

-

Tractors clog Brussels in anger at EU-Mercosur trade deal

Tractors clog Brussels in anger at EU-Mercosur trade deal

-

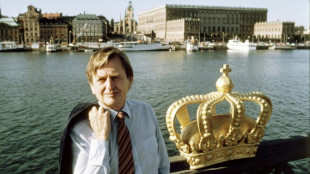

Not enough evidence against Swedish PM murder suspect: prosecutor

-

Nepal's ousted PM Oli re-elected as party leader

Nepal's ousted PM Oli re-elected as party leader

-

British energy giant BP extends shakeup with new CEO pick

-

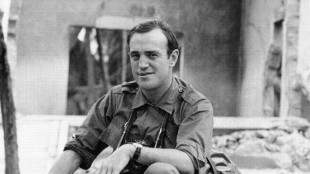

Pulitzer-winning combat reporter Peter Arnett dies at 91

Pulitzer-winning combat reporter Peter Arnett dies at 91

-

EU kicks off crunch summit on Russian asset plan for Ukraine

-

Lyon humbled to surpass childhood hero McGrath's wicket tally

Lyon humbled to surpass childhood hero McGrath's wicket tally

-

Sri Lanka plans $1.6 bn in cyclone recovery spending in 2026

-

England vow to keep 'fighting and scrapping' as Ashes slip away

England vow to keep 'fighting and scrapping' as Ashes slip away

-

'Never enough': Conway leans on McKenzie wisdom in epic 300 stand

-

Most Asian markets track Wall St lower as AI fears mount

Most Asian markets track Wall St lower as AI fears mount

-

Cambodia says Thailand bombs casino hub on border

-

Thai queen wins SEA Games gold in sailing

Thai queen wins SEA Games gold in sailing

-

England Ashes dreams on life-support as Australia rip through batting

-

Masterful Conway, Latham in 323 opening stand as West Indies wilt

Masterful Conway, Latham in 323 opening stand as West Indies wilt

-

Danish 'ghetto' tenants hope for EU discrimination win

-

Cricket Australia boss slams technology as Snicko confusion continues

Cricket Australia boss slams technology as Snicko confusion continues

-

Conway and Latham's 323-run opening stand batters hapless West Indies

-

Alleged Bondi shooters holed up in hotel for most of Philippines visit

Alleged Bondi shooters holed up in hotel for most of Philippines visit

-

Japan govt sued over 'unconstitutional' climate inaction

-

US approves $11 billion in arms sales to Taiwan: Taipei

US approves $11 billion in arms sales to Taiwan: Taipei

-

England battle to save Ashes as Australia rip through top-order

-

Guarded and formal: Pope Leo XIV sets different tone

Guarded and formal: Pope Leo XIV sets different tone

-

What to know about the EU-Mercosur deal

-

Trump vows economic boom, blames Biden in address to nation

Trump vows economic boom, blames Biden in address to nation

-

Conway 120 as New Zealand in command at 216-0 against West Indies

-

Taiwan eyes fresh diplomatic ties with Honduras

Taiwan eyes fresh diplomatic ties with Honduras

-

ECB set to hold rates but debate swirls over future

-

Asian markets track Wall St lower as AI fears mount

Asian markets track Wall St lower as AI fears mount

-

EU holds crunch summit on Russian asset plan for Ukraine

-

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

Australia PM vows to stamp out hatred as nation mourns youngest Bondi Beach victim

-

Australian PM vows hate speech crackdown after Bondi Beach attack

-

Turkmenistan's battle against desert sand

Turkmenistan's battle against desert sand

-

Ukraine's Zelensky in Poland for first meeting with nationalist president

-

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

England in disarray at 59-3 in crunch Test as Lyon, Cummins pounce

-

Japan faces lawsuit over 'unconstitutional' climate inaction

-

Migrants forced to leave Canada after policy change feel 'betrayed'

Migrants forced to leave Canada after policy change feel 'betrayed'

-

What's next for Venezuela under the US oil blockade?

-

Salvadorans freed with conditional sentence for Bukele protest

Salvadorans freed with conditional sentence for Bukele protest

-

Brazil Congress passes bill to cut Bolsonaro prison term

-

Cricket Australia boss slams technology 'howler' in Ashes Test

Cricket Australia boss slams technology 'howler' in Ashes Test

-

New Zealand 83-0 at lunch on day one of third West Indies Test

-

Ecuadorean footballer Mario Pineida shot and killed

Ecuadorean footballer Mario Pineida shot and killed

-

US government admits liability in deadly DC air collision

-

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

Wasatch Property Management Launches Fully Integrated AI Voice Agent, Elevating the Prospect Experience Across Its Portfolio

-

Classover Advances Next-Generation AI Tutor: Real-Time Adaptive Instruction for K-12 at Scale

-

Hemogenyx Pharmaceuticals PLC - Issue of Equity

Hemogenyx Pharmaceuticals PLC - Issue of Equity

-

SolePursuit Capital Syndicate Establishes Strategic Coordination Office and Appoints Laurence Kingsley as Head

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | -2.23% | 80.22 | $ | |

| CMSC | -0.34% | 23.26 | $ | |

| JRI | -0.6% | 13.43 | $ | |

| NGG | 1.8% | 77.16 | $ | |

| RIO | 1.55% | 77.19 | $ | |

| RELX | -0.64% | 40.56 | $ | |

| BCC | 0.59% | 76.29 | $ | |

| BTI | -0.21% | 57.17 | $ | |

| GSK | -0.14% | 48.71 | $ | |

| BCE | -0.78% | 23.15 | $ | |

| RYCEF | 1.48% | 14.86 | $ | |

| AZN | -1.66% | 89.86 | $ | |

| CMSD | -0.43% | 23.28 | $ | |

| BP | 2.06% | 34.47 | $ | |

| VOD | 0.86% | 12.81 | $ |

Auction to be held on Russia debt default insurance

An auction to pay out insurance on Russia's unpaid debt was due to take place on Monday, an event formally marking the sanctions-hit country's first foreign default in more than a century.

Moscow was unable to transfer funds to creditors in June due to Western sanctions over its invasion of Ukraine.

The failure to pay its debt kicked off a complicated process to compensate investors who bought credit default swaps (CDS), a sort of insurance that bondholders purchase to protect against default by borrowers.

But the auction was repeatedly delayed as organisers had to ensure that the sanctions would not block the CDS payouts.

The country last defaulted on its foreign debt in 1918, when Bolshevik revolution leader Vladimir Lenin refused to recognise the massive debts of the deposed tsar's regime.

Russia defaulted on domestic debt in 1998 when, due to a drop in commodity prices, it faced a financial squeeze that prevented it from propping up the ruble and paying off debts that accumulated during the first war in Chechnya.

The latest default follows a series of unprecedented Western sanctions that have isolated Russia from the global financial system, including a freeze on Moscow's $300 billion in foreign currency reserves held abroad.

Russia lost the last avenue to service its foreign-currency loans after the United States removed an exemption in May that had allowed US investors to receive Moscow's payments.

Russian authorities have insisted throughout that they have the funds to honour the country's debt, calling the predicament a "farce" and accusing the West of pushing an "artificial" default.

Moscow's foreign currency debt is relatively low, at around $40 billion.

But the sanctions prevented it from paying bond holders in June.

- 'Credit event' -

International ratings agencies, the institutions that decide whether are country is in default, were unable to officially declare whether Russia was in default due to sanctions prohibiting them from covering Moscow's debt.

But Moody's ratings agency released a less formal "issuer comment" saying missed payments on interest totalling $100 million amounted to a default.

The official ruling was therefore left in the hands of a little-known panel of investors, the Credit Derivatives Determinations Committee (CDDC), which organises CDS auctions.

In late June, the London-based CDDC -- made up of 15 leading banks and financial firms -- declared that Russia's missed payment constituted a "credit event".

CDS auctions are usually held around 30 days after the committee declares a credit event, but doubts over whether the sanctions allowed the process to take place caused the three-month delay.

Foreign investors are no longer able to trade Russian bonds, and the auctions are essentially transactions involving such assets.

But the US Treasury Department issued a waiver in July to allow the auction on eight Russian bonds to take place this month.

JPMorgan, the investment firm, says the CDS against Russian default are worth almost $2.4 billion.

The auction takes place in two stages. The first stage will set an initial price on the eight bonds, which will serve as a base to fix the final price for compensation in a second stage open more widely to investors.

The CDDC said the settlement dates for the auction could be slightly delayed due to a bank holiday for the funeral of Queen Elizabeth II on September 19.

W.Morales--AT