-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Heirs Energies Agrees $750m Afreximbank Financing to Drive Long-Term Growth

Heirs Energies Agrees $750m Afreximbank Financing to Drive Long-Term Growth

-

Black Book Poll: "Governed AI" Emerges as the Deciding Factor in 2026 NHS Procurement

-

Hemogenyx Pharmaceuticals PLC Announces Update on Admission of Shares

Hemogenyx Pharmaceuticals PLC Announces Update on Admission of Shares

-

Pantheon Resources PLC Announces Shareholder Letter and Corporate Update on Dubhe-1

-

Tocvan Begins Trenching Material for the Pilot Mine and Pushes Ahead With Infrastructure Development

Tocvan Begins Trenching Material for the Pilot Mine and Pushes Ahead With Infrastructure Development

-

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

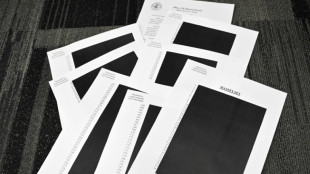

Trump administration denies cover-up over redacted Epstein files

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

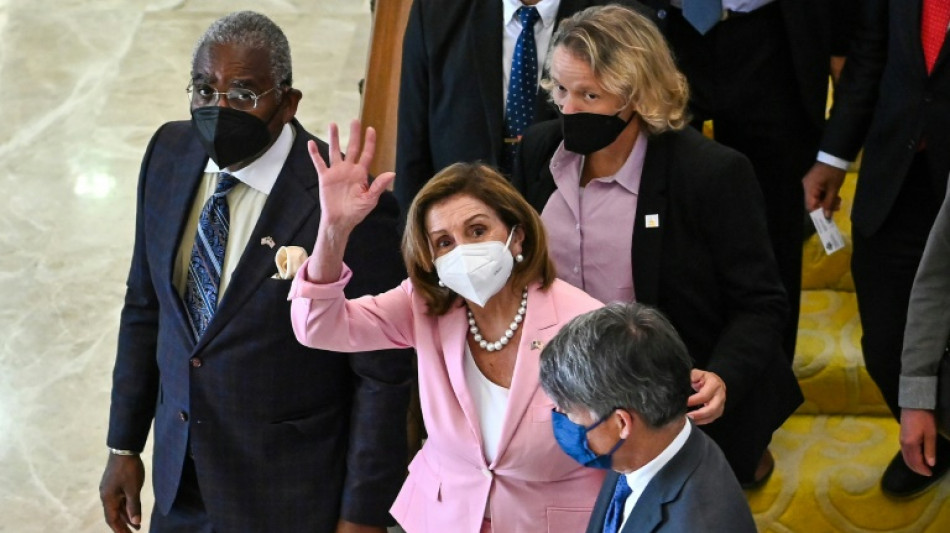

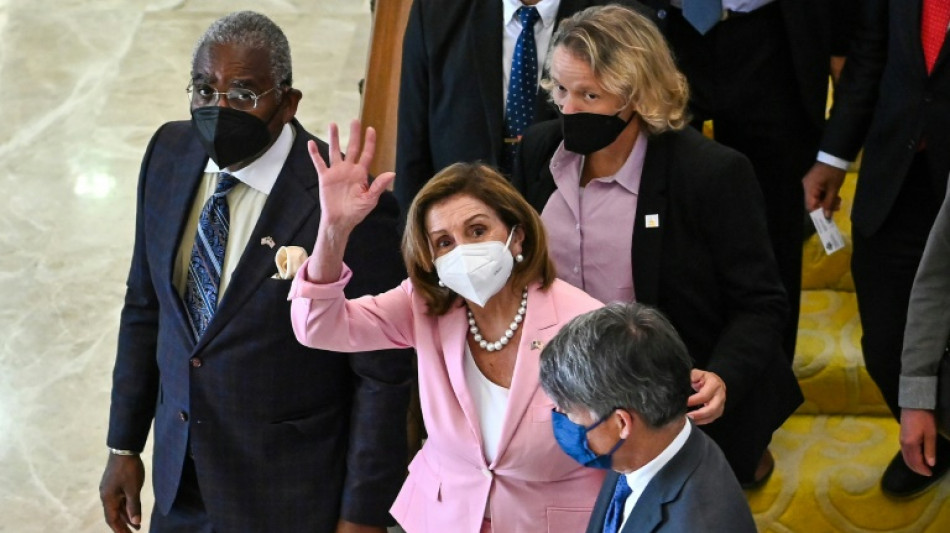

Stock markets rise after Pelosi's Taiwan trip

Global stocks mostly rose on Wednesday as investor concerns over US-China tensions eased following House Speaker Nancy Pelosi's trip to Taiwan.

Oil prices also marginally rose after the OPEC+ oil cartel, led by Saudi Arabia and Russia, agreed a small increase in production.

The decision to raise production by 100,000 barrels per day for September is likely to disappoint US President Joe Biden, who had lobbied for a big hike to tame soaring energy prices, analysts said.

Analyst Edward Gardner, of Capital Economics, warned however that "as has become increasingly glaring recently, though, an increase in quotas is not the same as an increase in production."

Output is supposed to have returned to pre-Covid levels, but only on paper, as some members of the 23-nation group have struggled to meet their quotas.

The main contracts were only slightly higher, with Brent -- the international benchmark -- rising just over $100.

- 'Rollercoaster ride'-

Traders also nervously watched for reactions -- so far -- to Pelosi's visit to Taiwan, which China considers a part of its territory.

"What China didn't do has seemingly been the focal point," said Patrick O'Hare, at Briefing.com.

"China didn't take any action that would necessitate a military response from the US. That understanding has sparked a measure of relief for investors as Speaker Pelosi heads to South Korea," he said.

The highest profile trip to Taiwan in 25 years by a US politician was met with condemnation from Beijing, which vowed "punishment".

"This week was already shaping up to be another rollercoaster ride and Pelosi's trip just added another layer of event risk for the markets," Craig Erlam, an analyst at OANDA, said.

News of the visit had sent shivers on Tuesday through trading floors that were already on edge over the Ukraine war, surging inflation, rising interest rates and slowing economic growth.

However, most equity markets edged upwards on Wednesday.

London nudged higher on the eve of a widely-expected half-point interest rate hike by the Bank of England.

"There has been a lot of fear but no material effect," AvaTrade analyst Naeem Aslam told AFP, when questioned about the markets impact of Pelosi's visit.

"Hence, we see equities holding on to their gains and moving higher."

- Rate hikes -

Analysts are also keen to find out what the White House's response will be, particularly ahead of mid-term elections in November, with anti-China rhetoric playing well with voters but Biden keen not to further harm economic ties.

SPI Asset Management's Stephen Innes added that the US administration was probably not likely to cut Trump-era tariffs before then.

Wednesday's broadly positive performance followed a drop on Wall Street, where the Taiwan news was compounded by a series of hawkish comments from Federal Reserve officials indicating more big interest rate hikes could still be in the pipeline.

- Key figures at around 1350 GMT -

London - FTSE 100: UP 0.3 percent at 7,434.31 points

Frankfurt - DAX: UP 0.4 percent at 13,496.38

Paris - CAC 40: UP 0.7 percent at 6,453.31

EURO STOXX 50: UP 0.8 percent at 3,713.60

New York - Dow: UP 0.7 percent at 32,631.29

Tokyo - Nikkei 225: UP 0.5 percent at 27,741.90 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 19,767.09 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,163.67 (close)

Taipei - TAIEX: DOWN 0.2 percent at 14,777.02 (close)

Dollar/yen: UP at 133.61 yen from 133.10 yen Tuesday

Euro/dollar: UP at $1.0175 from $1.0166

Pound/dollar: DOWN at $1.2160 from $1.2170

Euro/pound: UP at 83.65 pence from 83.57 pence

Brent North Sea crude: UP 0.2 percent at $100.75 per barrel

West Texas Intermediate: UP 0.1 percent at $94.52 per barrel

burs/rfj-kjm/lth

W.Morales--AT