-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

EON Resources Inc. Reports Management and Directors Buy an Additional 282,000 Shares of EON Class A Common Stock for a Total of 1,561,000 Shares Bought in 2025 and a Total Ownership of Over 5 million Shares

EON Resources Inc. Reports Management and Directors Buy an Additional 282,000 Shares of EON Class A Common Stock for a Total of 1,561,000 Shares Bought in 2025 and a Total Ownership of Over 5 million Shares

-

Heirs Energies Agrees $750m Afreximbank Financing to Drive Long-Term Growth

-

Black Book Poll: "Governed AI" Emerges as the Deciding Factor in 2026 NHS Procurement

Black Book Poll: "Governed AI" Emerges as the Deciding Factor in 2026 NHS Procurement

-

Hemogenyx Pharmaceuticals PLC Announces Update on Admission of Shares

-

Pantheon Resources PLC Announces Shareholder Letter and Corporate Update on Dubhe-1

Pantheon Resources PLC Announces Shareholder Letter and Corporate Update on Dubhe-1

-

Tocvan Begins Trenching Material for the Pilot Mine and Pushes Ahead With Infrastructure Development

-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

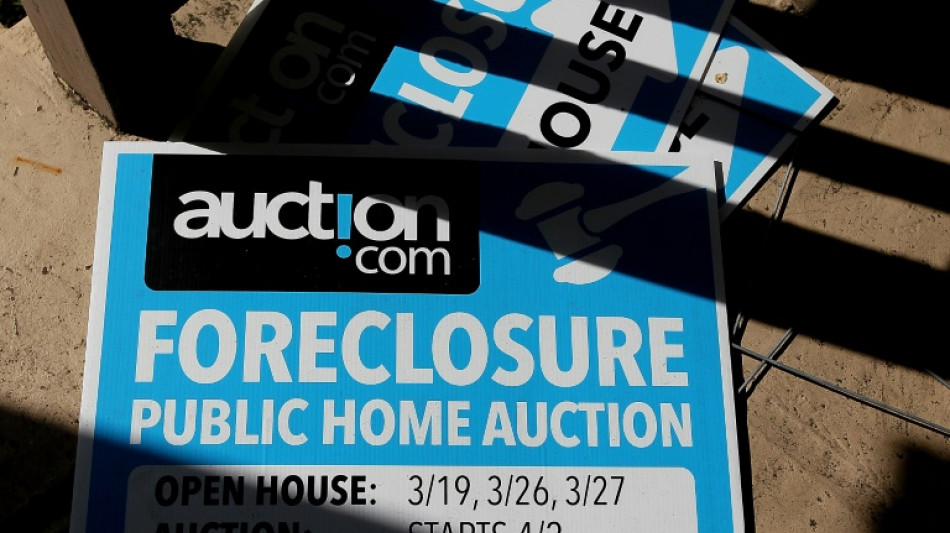

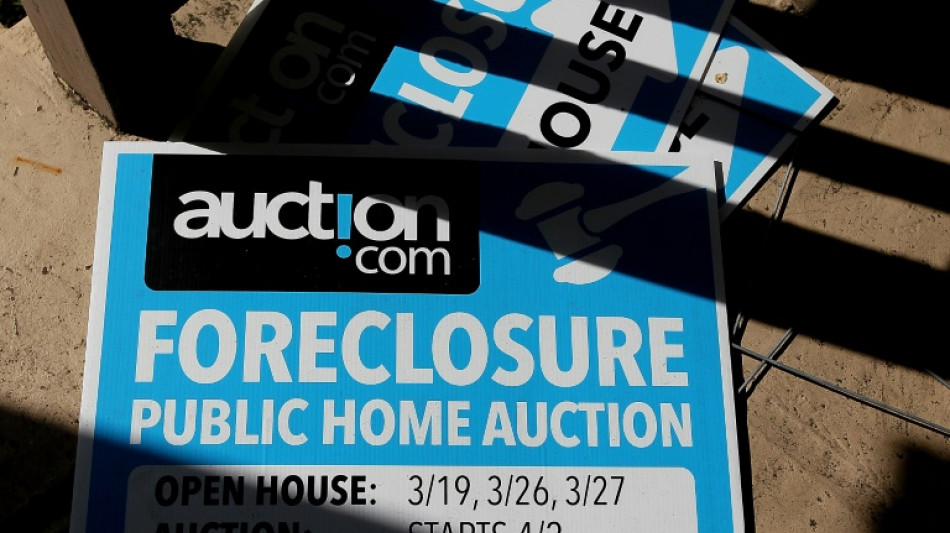

US loan delinquencies creep up amid high debt loads: report

US households have continued to take on more debt, in part to deal with soaring prices, a report showed Tuesday, while cases of borrowers unable to pay loans are creeping up in a troubling sign of things to come.

Facing the biggest surge in inflation in more than four decades, which is squeezing families trying to make ends meet, the New York Federal Reserve Bank's latest report shows credit card balances in the April-June quarter surged by the most in 20 years.

Total household debt posted a two percent increase in the latest three months, and is now $2 trillion more than the pre-pandemic level, the report showed.

While family finances remain in good shape for now -- helped by government aid and the ban on foreclosures -- researchers caution that the era of historically low delinquencies is coming to an end, especially among those with lower credit scores known as "subprime borrowers."

"The second quarter of 2022 showed robust increases in mortgage, auto loan, and credit card balances, driven in part by rising prices," said Joelle Scally, of the New York Fed's Center for Microeconomic Data.

"While household balance sheets overall appear to be in a strong position, we are seeing rising delinquencies among subprime and low-income borrowers with rates approaching pre-pandemic levels."

Delinquency rates remain low and an increase is to be expected as the moratoria on foreclosures end, but the report warns that data point to potential trouble ahead for communities that "are experiencing the economy differently."

"We are seeing a hint of the return of the delinquency and hardship patterns we saw prior to the pandemic," New York Fed researchers said in a blog post.

Total household debt rose $312 billion in the quarter to $16.15 trillion, and the biggest component -- mortgages -- jumped $207 billion to just under $11.4 trillion, the report said. However, the amount of new home loans fell, amid rising lending rates.

Credit card balances (up $46 billion) and auto loans (up $33 billion to $1.5 trillion) were impacted by rising prices, the report said.

Meanwhile, student loans, which still benefit from pandemic forbearance programs, were essentially flat at $1.6 trillion.

A.O.Scott--AT