-

Surprise appointment Riera named Frankfurt coach

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

US Justice Dept releases new batch of documents, images, videos from Epstein files

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

Eurozone growth beats 2025 forecasts despite Trump woes

-

Israel to partially reopen Gaza's Rafah crossing on Sunday

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

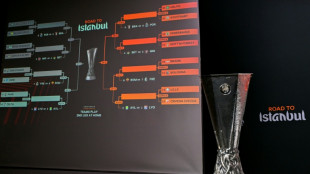

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Alcaraz defends controversial timeout after beaten Zverev fumes

-

New Dutch government pledges ongoing Ukraine support

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

With Just 3 Days Remaining, Tax1099 Urges Businesses to File 2025 IRS Information Returns Before Feb. 2 Deadline

With the deadline three days away, businesses must act now to meet the February 2 filing requirement and avoid penalties.

FAYETTEVILLE, AR AND DALLAS, TX / ACCESS Newswire / January 30, 2026 / There are three days remaining for businesses and tax professionals to complete their 2025 IRS information return filings. The deadline for submitting the return is February 2, 2026.

Tax1099, an award-winning IRS-authorized e-filing platform, is providing the tools and support necessary to complete 2025 TY filings accurately and on time, helping avoid penalties and last-minute processing issues.

Updated Deadline Reminder & IRS Rule

The original 1099 filing deadline is January 31, which falls on a weekend this year. Under IRS rules, the official filing date for the 2025 tax year is therefore shifted to the next business day, i.e., Monday, February 2, 2026.

Forms Affected by the Feb. 2, 2026, Deadline

With just three days left to file, here's a quick reminder of the commonly filed forms that are due by Feb 2, 2026:

Form Name | Deadline Type |

Recipient copy delivery and IRS filing | |

1099-MISC, 1099-INT, 1099-DIV, 1099-R, 1099-G | Recipient copy delivery |

Employee copy delivery and SSA filing | |

Form 1095-B, Form 1095-C | Recipient copy delivery |

Form 940, 941 (Q4), 944, 945 | IRS filing |

Consequences of Missing the Feb 2, 2026, Deadline

Businesses that fail to file on time may face significant IRS penalties and compliance issues.

The penalties for late filing of information returns start at $60 per form (for filing that is up to 30 days late) and can go up to $340 per form if filed after August 31. Intentional disregard or willful failure to file can cost $680 per form, with no maximum limit.

Beyond penalties, businesses that don't file on time also face additional compliance notices and corrections. Receiving IRS notices and the follow-up steps required to resolve the issue can take time and require additional effort.

How Tax1099 Helps Last-Minute Filers

For last-minute filers, having the right tools in place can make the difference between on-time compliance and costly penalties. Tax1099, an award-winning e-filing platform, helps last-minute filers file their information returns accurately.

File 1099s in minutes with a guided, end-to-end e-filing workflow

Upload or integrate data easily via Excel, CSV, or accounting software

Reduce rejections with real-time TIN Matching before submission

Handle bulk filings efficiently with built-in user management tools

Stay compliant using Tax1099 AI Copilot to flag issues early

Store filing records securely for up to four years for audit readiness

About Zenwork Tax1099

Tax1099, an IRS-authorized e-filing service, simplifies tax compliance for over 750,000 businesses and 70,000 CPA firms nationwide. Supporting 40+ federal and state-compliant forms, including Form 941, Tax1099 offers robust features like bulk filing, TIN matching, API integration, and 24/7 support. Backed by over 10 years of experience in tax processing and customer service, the platform offers a suite of capabilities to suit diverse needs. Learn more at www.tax1099.com

About Zenwork Inc.

Zenwork Inc., the parent company of Tax1099, is a leader in digital tax compliance and regulatory reporting. The company leverages automation to revolutionize business tax compliance, providing a modern SaaS and API platform that adapts to evolving regulatory reporting requirements, risk mitigation, and compliance needs.

Learn more about Zenwork and its products at www.zenwork.com , www.tax1099.com, and www.compliancely.com

Contact:

Ed Pratt

Zenwork Inc.

[email protected]

SOURCE: Zenwork Inc.

View the original press release on ACCESS Newswire

O.Brown--AT