-

US Justice Dept releasing new batch of Epstein files

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

-

Israel to partially reopen Gaza's Rafah crossing on Sunday

Israel to partially reopen Gaza's Rafah crossing on Sunday

-

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

Social media fuels surge in UK men seeking testosterone jabs

-

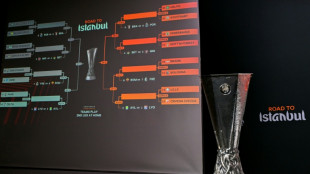

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

-

Alcaraz defends controversial timeout after beaten Zverev fumes

Alcaraz defends controversial timeout after beaten Zverev fumes

-

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

-

Everton winger Grealish set to miss rest of season in World Cup blow

-

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

-

Arteta focuses on the positives despite Arsenal stumble

-

Fijian Drua sign France international back Vakatawa

Fijian Drua sign France international back Vakatawa

-

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

-

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

-

Turkey leads Iran diplomatic push as Trump softens strike threat

-

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

-

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

-

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

-

Slot warns Liverpool 'can't afford mistakes' in top-four scrap

-

Paris show by late Martin Parr views his photos through political lens

Paris show by late Martin Parr views his photos through political lens

-

'Believing' Alcaraz outlasts Zverev in epic to reach maiden Melbourne final

| RBGPF | 1.65% | 83.78 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| RYCEF | -2.69% | 16 | $ | |

| NGG | -0.33% | 84.77 | $ | |

| CMSC | -0.02% | 23.69 | $ | |

| AZN | 0.38% | 92.94 | $ | |

| GSK | 1.03% | 51.18 | $ | |

| BP | 0.09% | 38.075 | $ | |

| BTI | -0.47% | 59.93 | $ | |

| RIO | -3.08% | 92.29 | $ | |

| VOD | -0.55% | 14.63 | $ | |

| BCE | 0.1% | 25.51 | $ | |

| JRI | 0.23% | 12.985 | $ | |

| BCC | -1.31% | 79.132 | $ | |

| RELX | -1.25% | 35.72 | $ | |

| CMSD | 0.05% | 24.073 | $ |

US banks fight crypto's push into Main Street

The banking industry is pushing back against White House-aligned crypto companies seeking to expand their business to Main Street customers in the United States.

At the heart of the battle being waged by some of Washington's most powerful lobbies is control over several trillions of dollars in banking deposits and a debate over whether crypto companies can offer an alternative place to stash cash.

The crypto industry has long had a complicated and adversarial relationship with traditional banks, a distrust dating back to the birth of the crypto movement in the wake of the 2008 financial crisis. Crypto believers fear that banks are trying to derail their rise.

The current battle centers on draft legislation -- the Clarity Act -- that would allow crypto players to offer cash rewards to stablecoin holders, boosting their ability to lure customers away from traditional banks.

According to the American Banking Association, these incentives would endanger the $6.6 trillion in deposits parked in traditional banks, especially lenders smaller than the national giants JPMorgan Chase or Bank of America.

These deposits are the lifeblood of the economy, especially in areas outside major cities, where local banks use them to finance loans to individuals, small businesses and farmers.

"Community banks make 60 percent of all the small business loans in this country," Independent Community Bankers of America CEO Rebeca Romero Rainey told AFP. "They make 80 percent of all agriculture loans. If they don't have those deposits, where are the funds coming from to fund those loans?"

Stablecoins are cryptocurrencies designed to maintain steady value by being pegged to traditional assets like cash or US government bonds -- meaning they can be used reliably for transactions and transfers while bypassing banks.

The crypto industry touts them as proof that crypto businesses can be trusted and aren't necessarily high-risk or vulnerable to scams.

For Bhau Kotecha, CEO and co-founder of platform Paxos Labs, banning stablecoins from offering interest "would narrow the use cases that make stablecoins compelling for mainstream adoption."

The key player in the battle is Coinbase and its CEO Brian Armstrong, who has led efforts to rehabilitate crypto's reputation after years of scandals and a Biden administration notably skeptical of crypto's benefits.

In the runup to the 2024 election, Armstrong and Silicon Valley venture capital firm Andreessen Horowitz helped raise tens of millions of dollars for the Trump campaign and lawmakers on both sides of the aisle to change Washington's stance on crypto.

The gamble paid off with the Republican sweep in November 2024.

Since Donald Trump's victory, crypto companies have seen their power and influence surge. Trump and his wife Melania each have their crypto coins, and his sons are heavily invested in the industry. One bill -- the GENIUS Act -- has already been signed into law, giving stablecoins long-sought legal recognition.

But with the Clarity Act -- a broader proposal setting the rules of the road for digital assets -- the crypto industry is moving onto the banking industry's turf.

- Beware of the midterms -

For banks, the risk of customers diverting deposits to stablecoins and potentially gutting their core business was too grave a threat.

After their concerns were heard, the Senate Banking Committee was poised last month to pass a version of the bill that would ban stablecoins from paying interest.

An irate Armstrong maneuvered to have the bill pulled, and the Clarity Act is now stuck in limbo.

"We'd rather have no bill than a bad bill," Armstrong wrote on X.

The banks counter that if the crypto industry wants to operate as banks, they should apply for banking licenses and be regulated like any other lender.

The White House remains confident the bill can get back on track, and warns of the consequences if the opportunity is missed and the Democratic party wins midterm elections in November.

"You might not love every part of the CLARITY Act, but I can guarantee you'll hate a future Dem version even more," said Patrick Witt, who coordinates crypto policy at the White House.

H.Thompson--AT