-

Julio Iglesias, the Spanish crooner who won global audience

Julio Iglesias, the Spanish crooner who won global audience

-

'We can't make ends meet': civil servants protest in Ankara

-

UK prosecutors appeal Kneecap rapper terror charge dismissal

UK prosecutors appeal Kneecap rapper terror charge dismissal

-

UK police chief blames AI for error in evidence over Maccabi fan ban

-

Oil prices extend gains on Iran unrest

Oil prices extend gains on Iran unrest

-

France bans 10 UK far-right activists over anti-migrant actions

-

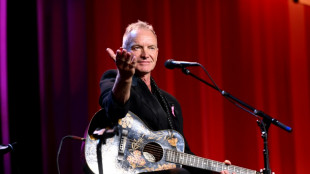

Every cent you take: Sting, ex-Police band mates in royalty battle

Every cent you take: Sting, ex-Police band mates in royalty battle

-

Thailand crane collapses onto train, killing 32

-

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

Amateur stuns star-studded field to win 'One Point Slam' in Melbourne

-

Italian influencer Ferragni awaits verdict in Christmas cake fraud trial

-

Louvre and other French museums fare hikes for non-European visitors

Louvre and other French museums fare hikes for non-European visitors

-

Japan's Takaichi to dissolve parliament for snap election

-

Dutch court hears battle over Nexperia

Dutch court hears battle over Nexperia

-

World-first ice archive to guard secrets of melting glaciers

-

Ted Huffman, the New Yorker aiming to update top French opera festival

Ted Huffman, the New Yorker aiming to update top French opera festival

-

Ofner celebrates early then loses in Australian Open qualifying

-

Singer Julio Iglesias accused of 'human trafficking' by former staff

Singer Julio Iglesias accused of 'human trafficking' by former staff

-

Luxury retailer Saks Global files for bankruptcy

-

Asian markets mostly up with politics bump for Tokyo

Asian markets mostly up with politics bump for Tokyo

-

Iran vows fast trials over protests after Trump threat

-

China's trade surplus hit record $1.2 trillion in 2025

China's trade surplus hit record $1.2 trillion in 2025

-

Trail goes cold in UK abandoned babies mystery

-

Japan's Takaichi set to call February snap election: media

Japan's Takaichi set to call February snap election: media

-

Scientist wins 'Environment Nobel' for shedding light on hidden fungal networks

-

From bricklayer to record-breaker: Brentford's Thiago eyes World Cup berth

From bricklayer to record-breaker: Brentford's Thiago eyes World Cup berth

-

Keys overcomes serve demons to win latest Australian Open warm-up

-

As world burns, India's Amitav Ghosh writes for the future

As world burns, India's Amitav Ghosh writes for the future

-

Actor Kiefer Sutherland arrested for assaulting ride-share driver

-

Gilgeous-Alexander shines as Thunder halt Spurs losing streak

Gilgeous-Alexander shines as Thunder halt Spurs losing streak

-

West Bank Bedouin community driven out by Israeli settler violence

-

Asian markets mixed, Tokyo up on election speculation

Asian markets mixed, Tokyo up on election speculation

-

US official says Venezuela freeing Americans in 'important step'

-

2025 was third hottest year on record: EU, US experts

2025 was third hottest year on record: EU, US experts

-

Japan, South Korea leaders drum up viral moment with K-pop jam

-

LA28 organizers promise 'affordable' Olympics tickets

LA28 organizers promise 'affordable' Olympics tickets

-

K-pop heartthrobs BTS to kick off world tour in April

-

Danish foreign minister heads to White House for high-stakes Greenland talks

Danish foreign minister heads to White House for high-stakes Greenland talks

-

US allows Nvidia to send advanced AI chips to China with restrictions

-

Sinner in way as Alcaraz targets career Grand Slam in Australia

Sinner in way as Alcaraz targets career Grand Slam in Australia

-

Rahm, Dechambeau, Smith snub PGA Tour offer to stay with LIV

-

K-pop heartthrobs BTS to begin world tour from April

K-pop heartthrobs BTS to begin world tour from April

-

Boeing annual orders top Airbus for first time since 2018

-

Bonk, Inc. Kicks Off 2026 with 40% Surge in Daily Revenue Velocity; BONK.fun Generates Over $1.5 Million in First 11 Days

Bonk, Inc. Kicks Off 2026 with 40% Surge in Daily Revenue Velocity; BONK.fun Generates Over $1.5 Million in First 11 Days

-

Aspire Biopharma Announces Reverse Stock Split

-

GridAI and the New Operating Reality of the Electric Grid

GridAI and the New Operating Reality of the Electric Grid

-

Digital Landia's AgenticPet Hits 1,000 Beta Users in Under Three Days of Public Launch

-

Dr. Kirk Lozada's Insights on Why Rhinoplasty Should Never Depend on a Single Technique

Dr. Kirk Lozada's Insights on Why Rhinoplasty Should Never Depend on a Single Technique

-

Vero To Attend 2026 AFSA Vehicle Finance Conference & Expo In Las Vegas

-

Tresic Launches Intelligence Cloud to Help CSPs and MSPs Turn UCaaS/CCaaS Into "Connectivity + Intelligence" - With 2X+ Revenue Potential

Tresic Launches Intelligence Cloud to Help CSPs and MSPs Turn UCaaS/CCaaS Into "Connectivity + Intelligence" - With 2X+ Revenue Potential

-

Peer To Peer Network Announces Beta Program Success, Establishes Scalable Onboarding Framework

Oil prices extend gains on Iran unrest

Oil prices rose further Wednesday on the political instability in major crude producer Iran, helping safe-haven gold to a new record high and weighing on the dollar.

European and Asian stock markets mostly gained, with speculation about a possible snap election in Japan pushing up Tokyo shares.

Wall Street stocks retreated Tuesday as markets weighed muted US inflation data, mixed bank earnings and concerns surrounding the US probe into Federal Reserve boss Jerome Powell.

Much attention among traders remained on Iran, where a funeral ceremony began in Tehran on Wednesday for over 100 members of the security forces and other "martyrs" killed in the wave of protests, state television said.

"Traders are closely watching the political unrest in Iran and possible US intervention, which could threaten disruption to the country's... oil production," noted Helge Andre Martinsen, senior energy analyst at DNB Carnegie.

In equities trading, Tokyo closed up 1.5 percent as the yen slumped to its lowest value since mid-2024 with media reports saying that Prime Minister Sanae Takaichi planned to hold an election as soon as February 8.

Takaichi's cabinet -- riding high in opinion polls -- has approved a record 122.3-trillion-yen ($768 billion) budget for the fiscal year from April 2026.

She has vowed to get parliamentary approval as soon as possible to address inflation and shore up the world's fourth-largest economy.

"We are seeing a shift in sentiment that could see European and Asian equities gain ground on their US counterparts," noted Joshua Mahony, chief market analyst at Scope Markets.

London and Paris were up slightly nearing the half-way stage Wednesday, while Frankfurt fell.

Traders are awaiting a possible US Supreme Court ruling on Wednesday on the legality of US President Donald Trump's sweeping tariffs.

A ruling against the government would prove a temporary setback to its economic and fiscal plans, although officials have noted that tariffs can be reimposed by other means.

It comes as China said its trade last year reached a "new historical high", surpassing 45 trillion yuan ($6.4 trillion) for the first time.

Global demand for Chinese goods has held firm despite a slump in exports to the United States after Trump hiked tariffs.

Other trade partners more than filled the gap, increasing Chinese exports overall by 5.5 percent in 2025.

"We expect this resilience to continue through 2026," said Zichun Huang, China economist at Capital Economics.

On the corporate front, British energy giant BP revealed a write-down of up to $5 billion linked to its energy transition efforts that will be reflected in the company's upcoming annual results.

Its share price was down 0.8 percent approaching midday in London.

- Key figures at around 1130 GMT -

London - FTSE 100: UP 0.3 percent at 10,161.60 points

Paris - CAC 40: UP 0.1 percent at 8,356.49

Frankfurt - DAX: DOWN 0.4 percent at 25,328.90

Tokyo - Nikkei 225: UP 1.5 percent at 54,341.23 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,999.81 (close)

Shanghai - Composite: DOWN 0.3 percent at 4,126.09 (close)

New York - Dow: DOWN 0.8 percent at 49,191.99 (close)

Euro/dollar: UP at $1.1650 from $1.1643 on Tuesday

Pound/dollar: UP at $1.3449 from $1.3426

Dollar/yen: DOWN at 158.76 yen from 159.15 yen

Euro/pound: DOWN at 86.64 pence from 86.71 pence

Brent North Sea Crude: UP 1.4 percent at $66.40 per barrel

West Texas Intermediate: UP 1.4 percent at $62.02 per barrel

burs-bcp/ajb/rl

Ch.Campbell--AT