-

Sri Lanka cyclone caused $4.1 bn damage: World Bank

Sri Lanka cyclone caused $4.1 bn damage: World Bank

-

Billionaire Ellison offers personal guarantee for son's bid for Warner Bros

-

Tech stocks lead Wall Street higher, gold hits fresh record

Tech stocks lead Wall Street higher, gold hits fresh record

-

Telefonica to shed around 5,500 jobs in Spain

-

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

Cambodia says Thailand launches air strikes after ASEAN meet on border clashes

-

McCullum wants to stay as England coach despite Ashes drubbing

-

EU slams China dairy duties as 'unjustified'

EU slams China dairy duties as 'unjustified'

-

Italy fines Apple nearly 100 mn euros over app privacy feature

-

America's Cup switches to two-year cycle

America's Cup switches to two-year cycle

-

Jesus could start for Arsenal in League Cup, says Arteta

-

EU to probe Czech aid for two nuclear units

EU to probe Czech aid for two nuclear units

-

Strauss says sacking Stokes and McCullum will not solve England's Ashes woes

-

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

Clashing Cambodia, Thailand agree to border talks after ASEAN meet

-

Noel takes narrow lead after Alta Badia slalom first run

-

Stocks diverge as rate hopes rise, AI fears ease

Stocks diverge as rate hopes rise, AI fears ease

-

Man City players face Christmas weigh-in as Guardiola issues 'fatty' warning

-

German Christmas markets hit by flood of fake news

German Christmas markets hit by flood of fake news

-

Liverpool fear Isak has broken leg: reports

-

West Indies captain says he 'let the team down' in New Zealand Tests

West Indies captain says he 'let the team down' in New Zealand Tests

-

Thailand says Cambodia agrees to border talks after ASEAN meet

-

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

Alleged Bondi shooters conducted 'tactical' training in countryside, Australian police say

-

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

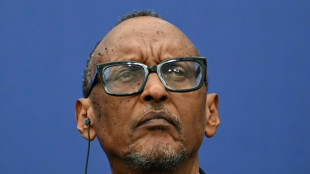

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Parallel Society Reveals Lineup for 2026 Lisbon Edition - A Cross-Genre Mashup of Cultural and Tech Pioneers

Parallel Society Reveals Lineup for 2026 Lisbon Edition - A Cross-Genre Mashup of Cultural and Tech Pioneers

-

Ai4 2026 Announces Dynamic Keynote Panel Featuring Geoffrey Hinton, Fei‑Fei Li & Andrew Ng

-

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

NESR Becomes First Oilfield Services Company to Commission Original Artwork Created from Recycled Produced Water

-

SMX Strikes Joint Initiative with FinGo & Bougainville Refinery Ltd to Deliver Verifiable Identification for Trillion Dollar Gold Market

-

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

Blue Gold and Trust Stamp Execute Strategic LOI to Develop Biometric, Passwordless Wallet Infrastructure for Gold-Backed Digital Assets

-

SK tes Announces Grand Opening of New Shannon Facility, Marking a Milestone for Sustainable Technology in Ireland

-

FDA Officially Confirms Kava is a Food Under Federal Law

FDA Officially Confirms Kava is a Food Under Federal Law

-

Greenliant NVMe NANDrive(TM) SSDs Selected for Major Industrial, Aerospace and Mission Critical Programs

Indebted Evergrande looks to sell Hong Kong headquarters again

Troubled Chinese property developer Evergrande has found a potential buyer for its Hong Kong headquarters, reports said Thursday, days before an expected announcement of the firm's long-awaited restructuring plans.

CK Asset Holdings, founded by Hong Kong billionaire Li Ka-shing, said it had submitted a tender for the 26-storey building, which is currently valued at HK$9 billion ($1.1 billion) according to Hong Kong media.

Evergrande has been involved in restructuring negotiations after racking up $300 billion in liabilities, as Beijing continues its wide-ranging crackdown on excessive debt and rampant consumer speculation in the real estate sector.

The group previously said it was on track to deliver a preliminary restructuring plan by the end of July.

In 2015, when it acquired the headquarters for $1.61 billion, the deal set a record for the single largest transaction for an office building in Hong Kong, as well as the price per square foot, according to the South China Morning Post.

Last October, the building was offered to Chinese state-owned developer Yuexiu for $1.7 billion, but the buyer pulled out over concerns about Evergrande's unresolved indebtedness.

Once a leading light in China's real estate sector, Evergrande has in recent months scrambled to offload assets, with chairman Hui Ka Yan paying off some of its debts using his personal wealth.

In a further sign of turmoil, Evergrande last week ousted its CEO and CFO after an internal investigation into why banks seized over $2 billion from the firm's property services arm.

Evergrande's woes have had knock-on effects throughout China's property sector, with some smaller companies also defaulting on loans and others struggling to find enough cash.

China's real estate firms, long heavily dependent on loans to finance their massive developments, have found themselves in trouble as a push by Beijing to reign in debt has cut cash flows.

Analysts have said that if the property crisis spreads to China's financial system, the shock would be felt far beyond its borders.

But on Thursday, Hong Kong Financial Secretary Paul Chan said the difficulties of Chinese developers would have a "very limited" impact on the financial hub's banking stability.

"We have been monitoring this situation very carefully, and we do not find cause for alarm," Chan said.

Evergrande did not immediately reply to AFP's request for comment.

E.Hall--AT