-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

-

European stocks rise as oil tumbles, while tech worries weigh on New York

European stocks rise as oil tumbles, while tech worries weigh on New York

-

England captain Itoje on bench for Six Nations opener against Wales

-

Rahm says golfers should be 'free' to play where they want after LIV defections

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

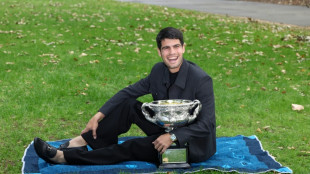

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

US Fed expected to make third straight rate cut despite divisions

The US Federal Reserve is expected to deliver a further interest rate cut Wednesday despite divisions among its ranks, with chief Jerome Powell's ability to secure support from fellow policymakers put to the test.

Financial markets expect a third consecutive 25 basis points reduction, bringing levels to a range between 3.50 percent and 3.75 percent. This would be the lowest in around three years.

But fissures within the Fed have grown even as policymakers slashed rates twice in recent months to boost the weakening employment market -- and the central bank faces a turbulent year ahead.

Officials opened their second day of deliberations at 9:00 am (1400 GMT), with their decision to be unveiled later Wednesday.

"We look for at least two dissents in favor of no action and one in favor of a larger cut," said Michael Feroli, chief US economist at JP Morgan.

"There are almost equally compelling reasons to cut and to hold," he added in a recent note.

The Fed's rate-setting committee consists of 12 voting members -- including seven members of the board of governors, the New York Fed president and a rotation of reserve bank presidents -- who take a majority vote in deciding the path of rates.

Powell noted in October that inflation separate from President Donald Trump's tariffs is not too far from officials' two-percent target.

But goods costs have risen on Trump's sweeping levies, and some officials are concerned that higher prices could become persistent.

The Fed pursues maximum employment and stable prices, although these goals can sometimes be in conflict. Lower rates typically stimulate the economy while higher levels hold back activity and tamp down inflation.

- 'Risk management' -

Powell will likely be able to "persuade several hesitant policymakers to support a third consecutive 'risk management' rate cut," said EY-Parthenon chief economist Gregory Daco.

The most recent available figures confirmed a slowdown in the jobs market, while a government shutdown from October to mid-November delayed the publication of more updated federal data.

But Daco also expects Powell to signal "firmly that additional easing is unlikely before next spring," unless there is material weakening in the economy.

This is because rates are close to "neutral," a level that neither stimulates nor restricts economic activity.

Feroli of JP Morgan observed that most Fed governors appear to favor lowering rates, while most reserve bank presidents seem inclined to keeping them unchanged.

But New York Fed President John Williams's remarks that there was room for another cut in the near-term tilts the balance.

"We believe he was speaking for the rest of the leadership," Feroli said, referring to Powell and Vice Chair Philip Jefferson. "This should weigh the votes firmly toward a cut."

Meanwhile Fed Governor Stephen Miran, who is on leave from his role heading the White House Council of Economic Advisers, is expected to push for a larger cut.

- Political pressure -

This week's gathering is the last before 2026, a year of key changes for the Fed -- including the accession of a new chief and tests of the central bank's independence as political pressure mounts.

In a Politico interview published Tuesday, Trump signaled he would judge Powell's successor on whether they immediately cut rates.

Interviews for his choice are entering the final stages, and Powell's term as Fed chair ends in May.

Trump earlier hinted he wants to nominate his chief economic adviser Kevin Hassett.

Other top contenders include former Fed official Kevin Warsh, Fed governors Christopher Waller and Michelle Bowman, and Rick Rieder of BlackRock.

Hassett chairs the White House National Economic Council and appears to be in lockstep with the president on key economic issues.

Miran's term as governor also ends in January, creating an opening among top Fed officials. And Trump has sought to free up another seat in attempting to fire Fed Governor Lisa Cook this year.

Cook challenged her ousting, and the Supreme Court awaits oral arguments in the case in January.

O.Gutierrez--AT