-

Son of Norway crown princess stands trial for multiple rapes

Son of Norway crown princess stands trial for multiple rapes

-

Side hustle: Part-time refs take charge of Super Bowl

-

Paying for a selfie: Rome starts charging for Trevi Fountain

Paying for a selfie: Rome starts charging for Trevi Fountain

-

Faced with Trump, Pope Leo opts for indirect diplomacy

-

NFL chief expects Bad Bunny to unite Super Bowl audience

NFL chief expects Bad Bunny to unite Super Bowl audience

-

Australia's Hazlewood to miss start of T20 World Cup

-

Bill, Hillary Clinton to testify in US House Epstein probe

Bill, Hillary Clinton to testify in US House Epstein probe

-

Cuba confirms 'communications' with US, but says no negotiations yet

-

Iran orders talks with US as Trump warns of 'bad things' if no deal reached

Iran orders talks with US as Trump warns of 'bad things' if no deal reached

-

From 'watch his ass' to White House talks for Trump and Petro

-

Liverpool seal Jacquet deal, Palace sign Strand Larsen on deadline day

Liverpool seal Jacquet deal, Palace sign Strand Larsen on deadline day

-

Trump says not 'ripping' down Kennedy Center -- much

-

Sunderland rout 'childish' Burnley

Sunderland rout 'childish' Burnley

-

Musk merges xAI into SpaceX in bid to build space data centers

-

Former France striker Benzema switches Saudi clubs

Former France striker Benzema switches Saudi clubs

-

Sunderland rout hapless Burnley

-

Costa Rican president-elect looks to Bukele for help against crime

Costa Rican president-elect looks to Bukele for help against crime

-

Hosts Australia to open Rugby World Cup against Hong Kong

-

New York records 13 cold-related deaths since late January

New York records 13 cold-related deaths since late January

-

In post-Maduro Venezuela, pro- and anti-government workers march for better pay

-

Romero slams 'disgraceful' Spurs squad depth

Romero slams 'disgraceful' Spurs squad depth

-

Trump urges 'no changes' to bill to end shutdown

-

Trump says India, US strike trade deal

Trump says India, US strike trade deal

-

Cuban tourism in crisis; visitors repelled by fuel, power shortages

-

Liverpool set for Jacquet deal, Palace sign Strand Larsen on deadline day

Liverpool set for Jacquet deal, Palace sign Strand Larsen on deadline day

-

FIFA president Infantino defends giving peace prize to Trump

-

Trump cuts India tariffs, says Modi will stop buying Russian oil

Trump cuts India tariffs, says Modi will stop buying Russian oil

-

Borthwick backs Itoje to get 'big roar' off the bench against Wales

-

Twenty-one friends from Belgian village win €123mn jackpot

Twenty-one friends from Belgian village win €123mn jackpot

-

Mateta move to Milan scuppered by medical concerns: source

-

Late-January US snowstorm wasn't historically exceptional: NOAA

Late-January US snowstorm wasn't historically exceptional: NOAA

-

Punctuality at Germany's crisis-hit railway slumps

-

Gazans begin crossing to Egypt for treatment after partial Rafah reopening

Gazans begin crossing to Egypt for treatment after partial Rafah reopening

-

Halt to MSF work will be 'catastrophic' for people of Gaza: MSF chief

-

Italian biathlete Passler suspended after pre-Olympics doping test

Italian biathlete Passler suspended after pre-Olympics doping test

-

Europe observatory hails plan to abandon light-polluting Chile project

-

Iran president orders talks with US as Trump hopeful of deal

Iran president orders talks with US as Trump hopeful of deal

-

Uncertainty grows over when US budget showdown will end

-

Oil slides, gold loses lustre as Iran threat recedes

Oil slides, gold loses lustre as Iran threat recedes

-

Russian captain found guilty in fatal North Sea crash

-

Disney earnings boosted by theme parks, as CEO handover nears

Disney earnings boosted by theme parks, as CEO handover nears

-

Sri Lanka drop Test captain De Silva from T20 World Cup squad

-

France demands 1.7 bn euros in payroll taxes from Uber: media report

France demands 1.7 bn euros in payroll taxes from Uber: media report

-

EU will struggle to secure key raw materials supply, warns report

-

France poised to adopt 2026 budget after months of tense talks

France poised to adopt 2026 budget after months of tense talks

-

Latest Epstein file dump rocks UK royals, politics

-

Arteta seeks Arsenal reinforcement for injured Merino

Arteta seeks Arsenal reinforcement for injured Merino

-

Russia uses sport to 'whitewash' its aggression, says Ukraine minister

-

Chile officially backs Bachelet candidacy for UN top job

Chile officially backs Bachelet candidacy for UN top job

-

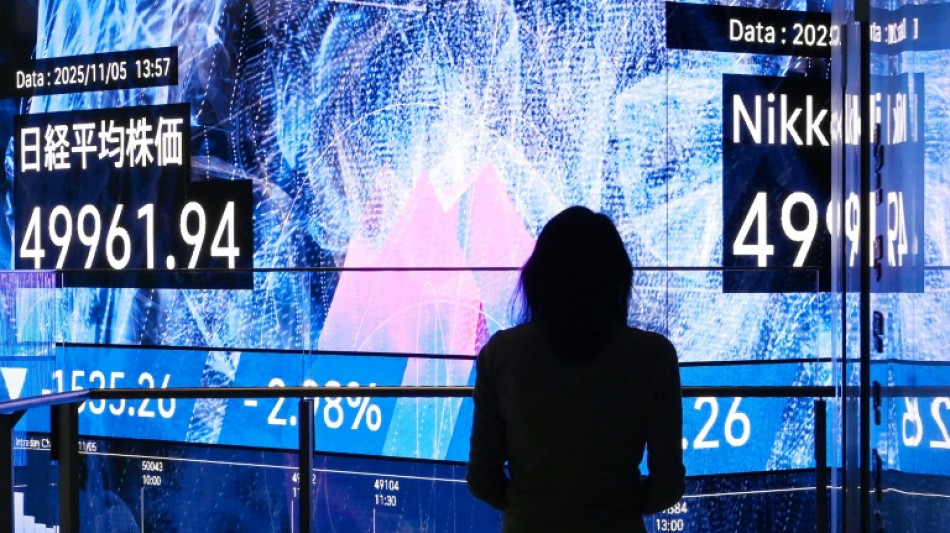

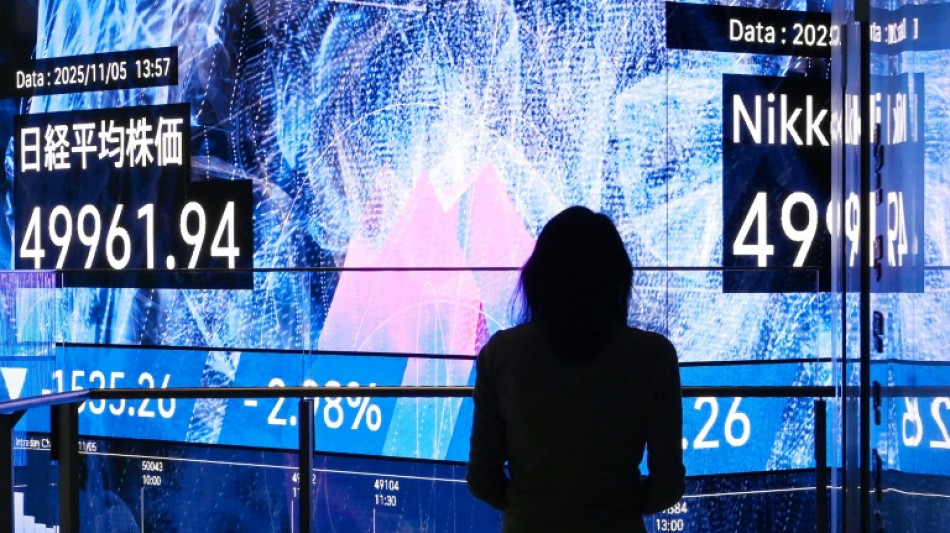

European stocks rise as oil tumbles, while tech worries weigh on New York

Stocks rise eyeing series of US rate cuts

European and Asian stock markets mostly rose Thursday after the latest batch of US data reinforced expectations that the Federal Reserve will cut US interest rates next week and into 2026.

Wall Street rose for a second straight session Wednesday despite lingering concerns regarding high valuations in the tech sector.

Bets on a December reduction for US interest rates had already surged after several Fed officials said supporting jobs was more important than keeping a lid on elevated inflation.

The need for more action was further stoked by Wednesday's data from payrolls firm ADP showing 32,000 posts were lost in November, compared with an expected rise of 10,000.

The drop was the most since early 2023 and is the latest example of a stuttering American labour market.

"Right now, the data argues for additional Fed funds rate cuts," noted Elias Haddad, markets analyst at Brown Brothers Harriman & Co.

"US labor demand is weak, consumer spending is showing early signs of cracking, and upside risks to inflation are fading."

After New York's advance, Tokyo rallied more than two percent Thursday, with Hong Kong, Sydney, Taipei and Bangkok also finishing higher.

London, Paris and Frankfurt all rose heading into afternoon sessions.

A healthy 30-year Japanese government bond sale provided some support for Tokyo's market, as it eased tensions about a possible rate hike from the Bank of Japan this month.

The news compounded a strong response to a 10-year auction earlier in the week that settled some nerves.

While market players remain confident that the Fed will continue to cut interest rates into the new year, economists at Bank of America still had a note of caution.

"The most immediate source of volatility remains the US Federal Reserve," they wrote.

"While inflation has moderated and the trajectory of policy easing is intact, uncertainty around timing persists. Any delay in rate cuts could remain a source of volatility."

On currency markets, the dollar traded mixed and the Indian rupee wallowed at record lows of more than 90 against the greenback as investors grow increasingly worried about a lack of progress in India-US trade talks.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.1 percent at 9,703.48 points

Paris - CAC 40: UP 0.3 percent at 8,109.91

Frankfurt - DAX: UP 0.6 percent at 23,846.64

Tokyo - Nikkei 225: UP 2.3 percent at 51,028.42 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,935.90 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,875.79 (close)

New York - Dow: UP 0.9 percent at 47,882.90 (close)

Euro/dollar: UP at $1.1668 from $1.1667 on Wednesday

Pound/dollar: DOWN at $1.3343 from $1.3352

Dollar/yen: DOWN at 154.76 yen from 155.23 yen

Euro/pound: UP at 87.44 pence from 87.39 pence

Brent North Sea Crude: UP 0.5 percent at $62.97 per barrel

West Texas Intermediate: UP 0.6 percent at $59.30 per barrel

R.Lee--AT