-

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

West Indies 43-0, need 419 more to win after Conway joins elite

-

'It sucks': Stokes vows England will bounce back after losing Ashes

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

Australia beat England by 82 runs to win third Test and retain Ashes

-

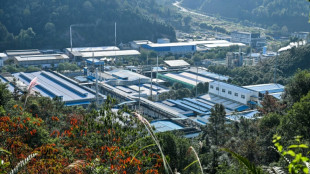

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

D. Boral Capital acted as Exclusive Placement Agent to Decent Holding Inc. (Nasdaq:DXST) in Connection with its ~$8,000,000 Registered Follow-On Offering

NEW YORK CITY, NEW YORK / ACCESS Newswire / December 1, 2025 / On November 11, 2025, Decent Holding Inc. (NASDAQ:DXST) ("Decent" or the "Company"), an established wastewater treatment services provider in China, announced the pricing of its ~$8,000,000 registered follow-on offering (the "Registered Offering") consisting of 13,333,333 Class A ordinary shares, par value US$0.0001 per share ( the "Class A Ordinary Shares") at a purchase price of US$0.60 per share (the "Public Offering Price"), and warrants to purchase 26,666,666 Class A ordinary Shares. The warrants have an exercise price equal to 110% of the Public Offering Price and a 120-day term. Gross proceeds to the Company are expected to be approximately $8,000,000, before deducting commissions and offering expenses. The Registered Offering Closed on November 12, 2025, subject to the satisfaction of customary closing conditions.

The Company expects to use the net proceeds from this Registered Offering for 1) business expansion and additional offices; 2) product research and development; 3) promoting river water quality management and expanding river water treatment; 4) development and upgrade of wastewater treatment technologies; and 5) recruiting further talent in research, development and management.

The Registered Offering is being conducted on a reasonable best effort basis. D. Boral Capital LLC acted as the exclusive placement agent for the Registered Offering. Ortoli Rosenstadt LLP acted as U.S. counsel to the Company, and Crone Law Group, P.C. acted as U.S. counsel to the placement agent.

The Registered Offering is being conducted pursuant to an effective registration statement on Form F-1 (File No. 333-289797), as amended, previously filed with the U.S. Securities and Exchange Commission ("SEC") and which subsequently became effective automatically on November 6, 2025 pursuant to Section 8(a) of the Securities Act of 1933. The Registered Offering is being made only by means of a prospectus that forms a part of the effective registration statement. Copies of the prospectus relating to the Registered Offering can be obtained at the SEC's website at www.sec.gov or from D. Boral Capital LLC by standard mail to D. Boral Capital LLC, 590 Madison Ave 39th Floor, New York, NY 10022, or by email at [email protected], or by telephone at +1 (212) 970-5150. In addition, copies of the final prospectus relating to the Registered Offering, when available, may be obtained via the SEC's website at www.sec.gov.

This press release has been prepared for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About Decent Holding Inc.

Decent Holding Inc. specializes in the provision of wastewater treatment by cleansing the industrial wastewater, ecological river restoration and river ecosystem management by enhancing the water quality, as well as microbial products primarily used for pollutant removal and water quality enhancement, through the Company's operating subsidiary, Shandong Dingxin Ecology Environmental Co., Ltd. For more information, please visit: https://ir.dxshengtai.com.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the Middle East, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated approximately $35 billion in capital since its inception in 2020, executing ~350 transactions across a broad range of investment banking products.

Forward Looking Statement

This press release contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts, such as the timing and completion of the Registered Offering, the satisfaction of closing conditions, the amount of proceeds to be received, the Company's intended use of proceeds, and the closing of the Registered Offering. When the Company uses words such as "may," "will," "intend," "should," "believe," "expect," "anticipate," "project," "estimate" or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company's expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions, the completion of the Registered Offering on the anticipated terms or at all, and all other factors discussed in the "Risk Factors" section of the Company's latest Annual Report on Form 20-F and the "Risk Factors" section of the registration statement filed with the SEC, available for review at www.sec.gov. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

D. Boral Capital LLC

Email: [email protected]

Telephone: +1 (212) 970-5150

SOURCE: D. Boral Capital

View the original press release on ACCESS Newswire

A.Anderson--AT