-

France's Kante joins Fenerbahce after Erdogan 'support'

France's Kante joins Fenerbahce after Erdogan 'support'

-

CK Hutchison launches arbitration over Panama Canal port ruling

-

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

Stocks mostly rise as traders ignore AI-fuelled sell-off on Wall St

-

Acclaimed Iraqi film explores Saddam Hussein's absurd birthday rituals

-

On rare earth supply, Trump for once seeks allies

On rare earth supply, Trump for once seeks allies

-

Ukrainian chasing sumo greatness after meteoric rise

-

Draper to make long-awaited return in Davis Cup qualifier

Draper to make long-awaited return in Davis Cup qualifier

-

Can Ilia Malinin fulfil his promise at the Winter Olympics?

-

CK Hutchison begins arbitration against Panama over annulled canal contract

CK Hutchison begins arbitration against Panama over annulled canal contract

-

UNESCO recognition inspires hope in Afghan artist's city

-

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

Ukraine, Russia, US negotiators gather in Abu Dhabi for war talks

-

WTO must 'reform or die': talks facilitator

-

Doctors hope UK archive can solve under-50s bowel cancer mystery

Doctors hope UK archive can solve under-50s bowel cancer mystery

-

Stocks swing following latest AI-fuelled sell-off on Wall St

-

Demanding Dupont set to fire France in Ireland opener

Demanding Dupont set to fire France in Ireland opener

-

Britain's ex-prince Andrew leaves Windsor home: BBC

-

Coach plots first South Africa World Cup win after Test triumph

Coach plots first South Africa World Cup win after Test triumph

-

Spin-heavy Pakistan hit form, but India boycott risks early T20 exit

-

Japan eyes Premier League parity by aligning calendar with Europe

Japan eyes Premier League parity by aligning calendar with Europe

-

Whack-a-mole: US academic fights to purge his AI deepfakes

-

Love in a time of war for journalist and activist in new documentary

Love in a time of war for journalist and activist in new documentary

-

'Unprecedented mass killing': NGOs battle to quantify Iran crackdown scale

-

Seahawks kid Cooper Kupp seeks new Super Bowl memories

Seahawks kid Cooper Kupp seeks new Super Bowl memories

-

Thousands of Venezuelans march to demand Maduro's release

-

AI, manipulated images falsely link some US politicians with Epstein

AI, manipulated images falsely link some US politicians with Epstein

-

Move on, says Trump as Epstein files trigger probe into British politician

-

Vanderbilt Report: Coeptis Therapeutics Shareholders Approve Transformational Merger: From Biopharma to Dual-Sector Platform

Vanderbilt Report: Coeptis Therapeutics Shareholders Approve Transformational Merger: From Biopharma to Dual-Sector Platform

-

Vanderbilt Report: NextTrip's 'Watch It, Book It' Model Gains Momentum as Revenue Surges and Company Acquires 200M-Viewer Travel Platform

-

Vanderbilt Report: Global Clean Energy's AI Division Targets $54 Billion Market Opportunity

Vanderbilt Report: Global Clean Energy's AI Division Targets $54 Billion Market Opportunity

-

Transglobal Management Group Achieves Profitability Through Golf Industry Consolidation

-

Vanderbilt Report: RenX Enterprises Builds Technology-Driven Waste-to-Value Platform Through Strategic Asset Monetization and Premium Market Expansion

Vanderbilt Report: RenX Enterprises Builds Technology-Driven Waste-to-Value Platform Through Strategic Asset Monetization and Premium Market Expansion

-

Vanderbilt Report Issues Coverage on Full Alliance Group Inc.

-

The Vanderbilt Report: Argo Graphene Solutions Advances from Concrete Validation to Cold-Climate Asphalt Testing

The Vanderbilt Report: Argo Graphene Solutions Advances from Concrete Validation to Cold-Climate Asphalt Testing

-

Vanderbilt Report: VisionWave's Strategic Acquisitions Position Company for Defense Market Expansion

-

Pantheon Resources PLC Announces Notice of AGM

Pantheon Resources PLC Announces Notice of AGM

-

Arteta backs Arsenal to build on 'magical' place in League Cup final

-

Evil Empire to underdogs: Patriots eye 7th Super Bowl

Evil Empire to underdogs: Patriots eye 7th Super Bowl

-

UBS grilled on Capitol Hill over Nazi-era probe

-

Guardiola 'hurt' by suffering caused in global conflicts

Guardiola 'hurt' by suffering caused in global conflicts

-

Marseille do their work early to beat Rennes in French Cup

-

Colombia's Petro, Trump hail talks after bitter rift

Colombia's Petro, Trump hail talks after bitter rift

-

Trump signs spending bill ending US government shutdown

-

Arsenal sink Chelsea to reach League Cup final

Arsenal sink Chelsea to reach League Cup final

-

Leverkusen sink St Pauli to book spot in German Cup semis

-

'We just need something positive' - Monks' peace walk across US draws large crowds

'We just need something positive' - Monks' peace walk across US draws large crowds

-

Milan close gap on Inter with 3-0 win over Bologna

-

No US immigration agents at Super Bowl: security chief

No US immigration agents at Super Bowl: security chief

-

NASA Moon mission launch delayed to March after test

-

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

'You are great': Trump makes up with Colombia's Petro in fireworks-free meeting

-

Spain to seek social media ban for under-16s

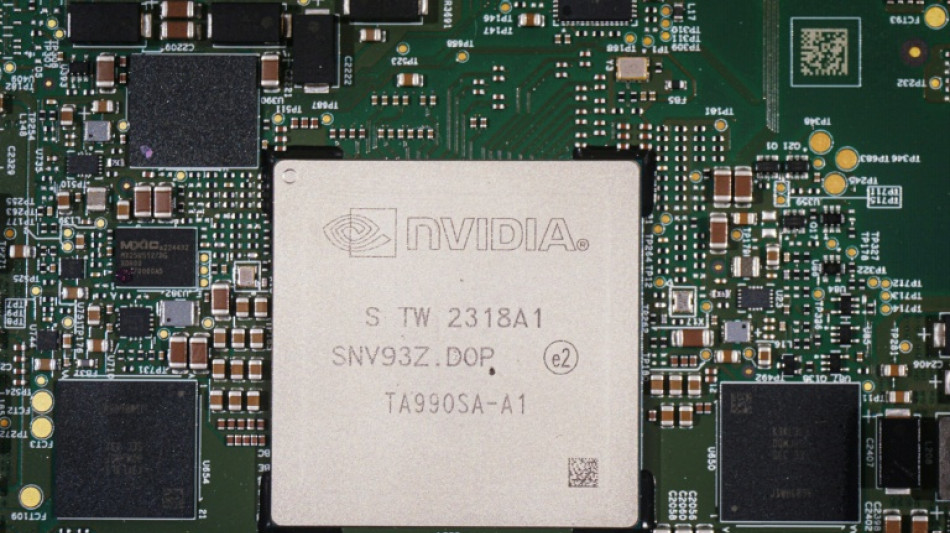

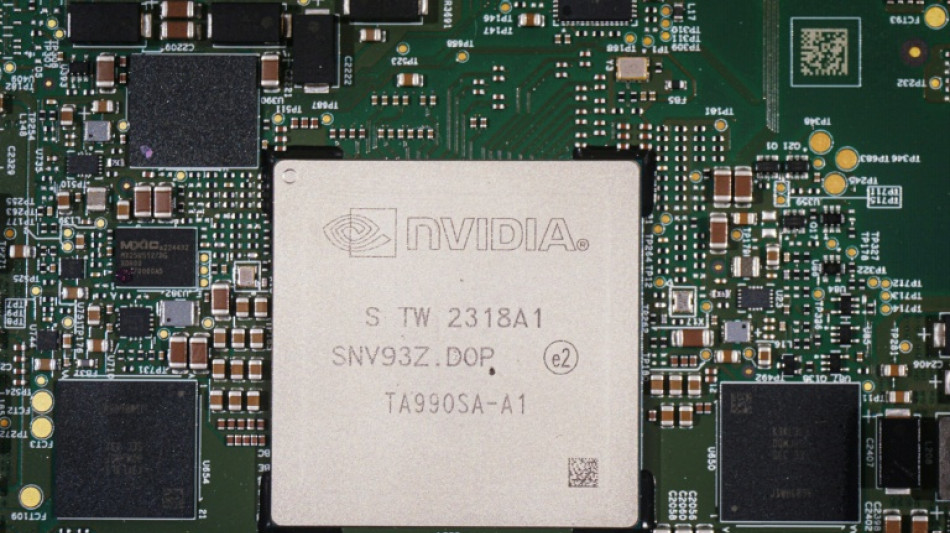

US stocks end mostly higher despite drop in Nvidia

Wall Street stocks mostly rose Tuesday as optimism over a likely end to the US government shutdown offset weakness in some leading technology equities.

After Monday's rally, US stocks opened mostly lower on lingering unease about the stratospheric valuation growth of major players in artificial intelligence.

Those worries ebbed a bit as the session progressed, with some large tech equities finishing in positive territory. But the tech-heavy Nasdaq Composite was down 0.3 percent, the only one of the three main US indices to retreat.

"There's definitely concern over valuations but that valuations don't mean the market's going to sell off," said Tim Urbanowicz of Innovator Capital Management, adding "it just leaves a lot less room for bad news."

Japan's SoftBank announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month. SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

Shares in Nvidia, whose processors are prized by companies training and operating AI models, fell 3.0 percent.

"For the wider investment community, when big investors cash out of their AI positions, they will take notice, and this is why the stock is declining today," said Kathleen Brooks, research director at XTB trading group.

More broadly, Brooks said tech stocks were no longer providing market momentum.

"Without momentum helping US indices move higher, volatility could take hold, so we are not expecting stocks to move in a straight line for now, and the market correction may not be over," she said in a note to clients.

Some market watchers viewed Tuesday's strong rise in the Dow as evidence of a rotation to industrial names from tech.

Investors have been cheered by the progress on legislation on Capitol Hill to reopen the government.

On Monday night several Democratic senators broke ranks to join Republicans in a 60-40 vote passing legislation to reopen the government, which would trigger a release of US economic reports on labor, consumer prices and other key benchmarks in the coming weeks.

Tuesday's session was held on Veteran's Day, a US holiday, resulting in lower volumes than normal.

Europe's main stock markets climbed Tuesday.

London's top-tier FTSE 100 index reached a fresh record high as a weakening pound boosted multi-nationals earning in dollars, while Paris won solid gains in a day that is also a public holiday in France.

- Key figures at 2110 GMT -

New York - Dow: UP 1.2 percent at 47,927.96 (close)

New York - S&P 500: UP 0.2 percent at 6,846.61 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 23,468.30 (close)

London - FTSE 100: UP 1.2 percent at 9,899.60 (close)

Paris - CAC 40: UP 1.3 percent at 8,156.23 (close)

Frankfurt - DAX: UP 0.5 percent at 24,088.06 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,842.93 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,696.41 (close)

Shanghai - Composite: DOWN 0.4 percent at 4,002.76 (close)

Euro/dollar: UP at $1.1588 from $1.1557 on Monday

Pound/dollar: DOWN at $1.3168 from $1.3175

Dollar/yen: DOWN at 154.10 yen from 154.15 yen

Euro/pound: UP at 87.99 pence from 87.72 pence

Brent North Sea Crude: UP 1.7 percent at $65.16 per barrel

West Texas Intermediate: UP 1.5 percent at $61.04 per barrel

burs-jmb/jgc

T.Perez--AT