-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Penalty king Jimenez strikes for Fulham to sink Forest

-

Kansas City Chiefs confirm stadium move

-

Liverpool rocked by Isak blow after surgery on broken leg

Liverpool rocked by Isak blow after surgery on broken leg

-

Liverpool rocked by Isak blow after surgery on ankle injury

-

US stocks push higher while gold, silver notch fresh records

US stocks push higher while gold, silver notch fresh records

-

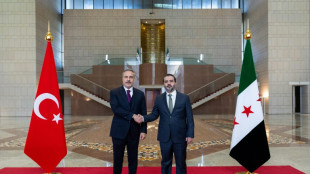

Deadly clashes in Aleppo as Turkey urges Kurds not to be obstacle to Syria's stability

-

Is the United States after Venezuela's oil?

Is the United States after Venezuela's oil?

-

Trump admin halts US offshore wind projects citing 'national security'

-

Right wing urges boycott of iconic Brazilian flip-flops

Right wing urges boycott of iconic Brazilian flip-flops

-

From misfits to MAGA: Nicki Minaj's political whiplash

-

Foster grabs South Africa winner against Angola in AFCON

Foster grabs South Africa winner against Angola in AFCON

-

Russia pledges 'full support' for Venezuela against US 'hostilities'

-

Spotify says piracy activists hacked its music catalogue

Spotify says piracy activists hacked its music catalogue

-

Winter Olympics organisers resolve snow problem at ski site

-

Fuming Denmark summons US ambassador over Greenland envoy

Fuming Denmark summons US ambassador over Greenland envoy

-

UK's street artist Banksy unveils latest mural in London

Asian stocks extend global rally as recession fears ease for now

Asian markets rose Friday on easing recession fears, while there were growing hopes that Joe Biden will remove some Trump-era tariffs from Chinese goods.

Buying was also boosted by reports that Beijing was considering a huge stimulus shot to the struggling economy by allowing local governments to raise billions of dollars through bond issuance for infrastructure projects.

However, surging inflation, rising interest rates and a fresh flare-up of Covid infections in Shanghai continued to keep investor sentiment grounded.

Traders were handed a strong lead from Wall Street, where all three main indexes climbed for a fourth straight day, helped by two top Federal Reserve officials who said the economy could withstand sharper rate hikes and maintain growth.

There has been growing talk that the fast pace of monetary tightening by the bank will tip the world's top economy into recession.

But Christopher Waller, a member of the board of governors, said worries were overblown and that a strong jobs market would provide a buffer, adding that rates needed to go up sharply and quickly.

St Louis Fed president James Bullard also said there was "a good chance of a soft landing".

And Brian Belski, at BMO Capital Markets, agreed that fears of a recession had gone too far.

"I'm calling this period right now a recession obsession," he told Bloomberg Television. "Institutional investors are not positioned for any kind of upside move. That’s why you are seeing these sharp moves on a day like (Thursday). We remain positive and think people are way too negative."

With the mood more upbeat, Asian equities advanced with Hong Kong, Shanghai, Tokyo, Sydney, Seoul, Singapore, Wellington, Taipei, Manila and Jakarta all in the green.

- Jobs market weakness -

The Fed's policy plans will be in focus later Friday when US employment data is released, with a strong reading providing the central bank with evidence to stick to its hawkish line.

But Matt Simpson at StoneX Financial said there were indications the jobs market could be showing signs of weakness.

The report "is unlikely to deter the Fed from a 75 basis points hike this month. But when the precious non-farm payroll numbers begin to crumble, so does the Fed’s argument that the US economy is robust", he said.

"And we’re seeing early signs of that across multiple employment metrics."

"When we do see unemployment begin to rise and headline employment growth lose momentum it will be hard for the Fed to ignore," he added.

"And that could provide a reason for the Fed to at least pause their hiking cycle, because a crumbling jobs market is great for deflation. So I’d expect market fireworks if and when (non-farm payroll numbers) begins to disappoint."

Biden is also reported to be holding a meeting later Friday with top advisers to discuss whether or not to lift some of the Trump-era tariffs imposed on around $300 billion of Chinese imports.

While he is also said to be considering another probe into other facets of Beijing's trade policy, analysts said the removal of the levies could boost China's export growth to the United States by about 20 percent.

The move could also help ease upward pressure on US inflation, which is running at a four-decade high.

Sterling extended Thursday's rally that came after Boris Johnson resigned as leader of the ruling Conservatives, paving the way for a new prime minister and bringing an end to weeks of political uncertainty in the United Kingdom.

The euro remained stuck at a 20-year low against the greenback after minutes from the European Central Bank's most recent meeting indicated that, unlike the Fed, it was happy to hike rates at a slower pace despite surging inflation.

- Key figures at around 0245 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 26,869.82 (break)

Hong Kong - Hang Seng Index: UP 0.9 percent at 21,841.61

Shanghai - Composite: UP 0.5 percent at 3,381.11

Pound/dollar: UP at $1.2041 from $1.2024 Thursday

Euro/dollar: UP at $1.0173 from $1.0162

Euro/pound: DOWN at 84.46 pence from 84.49 pence

Dollar/yen: DOWN at 135.72 yen from 136.01 yen

West Texas Intermediate: DOWN 0.3 percent at $102.43 per barrel

Brent North Sea crude: DOWN 0.2 percent at $104.49 per barrel

New York - Dow: UP 1.1 percent at 31,384.55 (close)

London - FTSE 100: UP 1.1 percent at 7,189.08 (close)

M.O.Allen--AT