-

Japan restarts world's biggest nuclear plant again

Japan restarts world's biggest nuclear plant again

-

Bangladesh poll rivals rally on final day of campaign

-

Third impeachment case filed against Philippine VP Duterte

Third impeachment case filed against Philippine VP Duterte

-

Wallaby winger Nawaqanitawase heads to Japan

-

Thailand's Anutin rides wave of nationalism to election victory

Thailand's Anutin rides wave of nationalism to election victory

-

Venezuela's Machado says ally kidnapped by armed men after his release

-

Maye longs for do-over as record Super Bowl bid ends in misery

Maye longs for do-over as record Super Bowl bid ends in misery

-

Seahawks' Walker rushes to Super Bowl MVP honors

-

Darnold basks in 'special journey' to Super Bowl glory

Darnold basks in 'special journey' to Super Bowl glory

-

Japan's Takaichi may struggle to soothe voters and markets

-

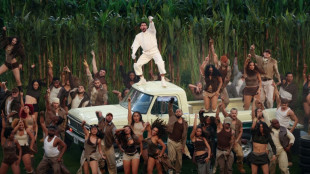

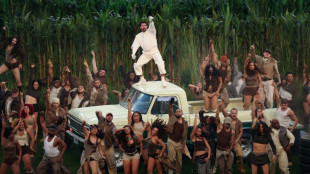

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

Bad Bunny celebrates Puerto Rico at Super Bowl, angering Trump

-

Seahawks soar to Super Bowl win over Patriots

-

'Want to go home': Indonesian crew abandoned off Africa demand wages

'Want to go home': Indonesian crew abandoned off Africa demand wages

-

Asian stocks track Wall St rally as Tokyo hits record on Takaichi win

-

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

Hong Kong sentences pro-democracy mogul Jimmy Lai to 20 years in jail

-

Bad Bunny celebrates Puerto Rico in joyous Super Bowl halftime show

-

Three prominent opposition figures released in Venezuela

Three prominent opposition figures released in Venezuela

-

Japan PM Takaichi basks in historic election triumph

-

Israeli president says 'we shall overcome this evil' at Bondi Beach

Israeli president says 'we shall overcome this evil' at Bondi Beach

-

'Flood' of disinformation ahead of Bangladesh election

-

Arguments to begin in key US social media addiction trial

Arguments to begin in key US social media addiction trial

-

UK-Based Vesalic Limited Emerges from Stealth with Landmark Discovery of Potential Non-CNS Driver of Motor Neuron Diseases, including ALS, and Breakthrough Therapeutic and Diagnostic Opportunities

-

Gotterup tops Matsuyama in playoff to win Phoenix Open

Gotterup tops Matsuyama in playoff to win Phoenix Open

-

New Zealand's Christchurch mosque killer appeals conviction

-

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

Leonard's 41 leads Clippers over T-Wolves, Knicks cruise

-

Patriots-Seahawks Super Bowl approaches as politics swirl

-

Trump says China's Xi to visit US 'toward the end of the year'

Trump says China's Xi to visit US 'toward the end of the year'

-

Real Madrid edge Valencia to stay on Barca's tail, Atletico slump

-

Malinin keeps USA golden in Olympic figure skating team event

Malinin keeps USA golden in Olympic figure skating team event

-

Lebanon building collapse toll rises to 9: civil defence

-

Real Madrid keep pressure on Barca with tight win at Valencia

Real Madrid keep pressure on Barca with tight win at Valencia

-

Dimarco helps Inter to eight-point lead in Serie A, Juve stumble

-

PSG trounce Marseille to move back top of Ligue 1

PSG trounce Marseille to move back top of Ligue 1

-

Two prominent opposition figures released in Venezuela

-

Hong Kong to sentence media mogul Jimmy Lai in national security trial

Hong Kong to sentence media mogul Jimmy Lai in national security trial

-

Lillard will try to match record with third NBA 3-Point title

-

Vonn breaks leg as crashes out in brutal end to Olympic dream

Vonn breaks leg as crashes out in brutal end to Olympic dream

-

Malinin enters the fray as Japan lead USA in Olympics team skating

-

Thailand's Anutin readies for coalition talks after election win

Thailand's Anutin readies for coalition talks after election win

-

Fans arrive for Patriots-Seahawks Super Bowl as politics swirl

-

'Send Help' repeats as N.America box office champ

'Send Help' repeats as N.America box office champ

-

Japan close gap on USA in Winter Olympics team skating event

-

Liverpool improvement not reflected in results, says Slot

Liverpool improvement not reflected in results, says Slot

-

Japan PM Takaichi basks in election triumph

-

Machado's close ally released in Venezuela

Machado's close ally released in Venezuela

-

Dimarco helps Inter to eight-point lead in Serie A

-

Man City 'needed' to beat Liverpool to keep title race alive: Silva

Man City 'needed' to beat Liverpool to keep title race alive: Silva

-

Czech snowboarder Maderova lands shock Olympic parallel giant slalom win

-

Man City fight back to end Anfield hoodoo and reel in Arsenal

Man City fight back to end Anfield hoodoo and reel in Arsenal

-

Diaz treble helps Bayern crush Hoffenheim and go six clear

Stocks slide as investors await key Fed speech

Stock markets mostly fell during cautious trading sessions Thursday, a day before a key speech expected to offer signals about future interest rate cuts in the United States.

US Federal Reserve Chairman Jerome Powell, who has resisted President Donald Trump's public demands to slash rates, is scheduled to deliver remarks Friday at the annual central bankers conference in Wyoming.

Major European indices were lower in midday trading, tracking a lacklustre session in Asia, and Wall Street indices opened lower after weakness seen on Wednesday.

Investors largely brushed off purchasing managers' index (PMI) data showing eurozone business activity reached a 15-month high in August, while UK activity grew at its fastest pace in a year.

"Eyes are turning to... Powell's final speech at the Jackson Hole Symposium as Federal Reserve Chair (before his term ends in May 2026)," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"Although the effect of Trump's tariffs on monetary policy will be the undercurrent theme, investors will be looking specifically for clues as to the Fed's inclination to cut interest rates," she said.

Data last week provided a mixed picture of US inflation, leaving it uncertain whether the Fed will lower rates as many investors expect in September -- a move that could bolster growth in the world's largest economy.

A recent sell-off in major tech stocks has added to market uncertainty, as investors grow wary of the sustained rally across the sector since April.

The tech-heavy Nasdaq fell again on Thursday, though shares in AI chip designer Nvidia were trading flat after heavy selling in previous sessions ahead of its earnings report next week.

Despite the building unease, shares in Seoul closed higher Thursday, bolstered by an uptick in Samsung's share price.

Shanghai, Sydney and Taipei also saw moderate gains.

Tokyo's Nikkei index closed lower, along with Hong Kong.

Global markets have also fluctuated recently on the prospects of a peace deal in Ukraine, following days of high-stakes diplomacy in the aftermath of Trump's Friday meeting with Russian counterpart Vladimir Putin.

The diplomatic whirlwind has sparked volatility in oil markets as traders speculate over the possible lifting of sanctions on Russia, a major producer.

Oil prices rose again Thursday, following a report the previous day showing a sharp decline in US crude stockpiles.

- Key figures at around 1340 GMT -

New York - Dow: DOWN 0.6 percent at 44,675.02 points

New York - S&P 500: DOWN 0.3 percent at 6,374.53

New York - Nasdaq: DOWN 0.3 percent at 21,116.06

London - FTSE 100: DOWN 0.3 percent at 9,259.45 points

Paris - CAC 40: DOWN 0.6 percent at 7,293.03

Frankfurt - DAX: DOWN 0.2 percent at 24,227.68

Tokyo - Nikkei 225: DOWN 0.7 percent at 42,610.17 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 25,104.61 (close)

Shanghai - Composite: UP 0.1 percent at 3,770.78 (close)

Euro/dollar: DOWN at $1.1639 from $1.1648 on Wednesday

Pound/dollar: DOWN at $1.3441 from $1.3452

Dollar/yen: UP at 147.64 yen from 147.44 yen

Euro/pound: DOWN at 86.56 pence from 86.59 pence

West Texas Intermediate: UP 0.1 percent at $63.28 per barrel

Brent North Sea Crude: UP 0.1 percent at $66.93 per barrel

J.Gomez--AT