-

US denies visas to EU ex-commissioner, four others over tech rules

US denies visas to EU ex-commissioner, four others over tech rules

-

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

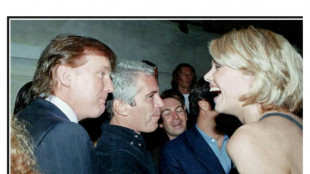

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Asian markets, oil prices extend losses on recession worries

Asian markets fell again Monday and oil prices extended losses on growing fears that central bank moves to rein in soaring inflation will induce a recession.

The losses come after a sell-off last week fuelled by the Federal Reserve's sharp interest rate hike last week -- the biggest in nearly 30 years -- and a warning of more to come, while increases in Britain and Switzerland added to the gloom.

And while the S&P 500 and Nasdaq saw gains on Friday, there is a sense that indexes still have some way down to go before they find a bottom, with economic data suggesting economies are beginning to feel the pinch.

Cleveland Fed chief Loretta Mester added to the worry, saying that the risk of a recession in the United States was increasing and it would take several years to bring inflation down from four decade highs to the bank's two percent target.

She told CBS's "Face The Nation" on Sunday that while she was not predicting a contraction, the Fed's decision not to act sooner to fight rising prices was hurting the economy.

In early trade, Asian traders were struggling, with Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Seoul, Taipei, Jakarta and Wellington all in the red.

Analysts warned there was likely to be more pain ahead for traders as the Ukraine war drags on and uncertainty continues to reign.

"Central banks' hawkish rhetoric and concerns over a global economic slowdown/recession (are) not helping sentiment and at this stage it is hard to see a turn in fortunes until we see evidence of a material ease in inflationary pressures," said National Australia Bank's Rodrigo Catril.

And Stephen Innes of SPI Asset Management added: "Most of these major central banks are praying for some relief from inflation and hoping the data falls in line, but unless there is a detent in the Ukraine -Russia war, escalation will continue to drive energy price fears so it could be a tough road ahead."

Still, oil prices fell further Monday after suffering a hefty drop Friday caused by demand worries caused by a possible recession.

However, US Energy Secretary Jennifer Granholm said prices could continue to surge if the European Union cuts off imports of the commodity from Russia in response to the Ukraine war.

She said Joe Biden had called on global suppliers to ramp up output to help temper the price rises, with the president to discuss the issue at an upcoming visit to Saudi Arabia next month.

- Key figures at around 0245 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 25,534.68 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 21,001.43

Shanghai - Composite: DOWN 0.3 percent at 3,308.08

Dollar/yen: DOWN at 134.85 yen from 134.99 yen late Friday

Pound/dollar: DOWN at $1.2219 from $1.2221

Euro/dollar: UP at $1.0509 from $1.0493

Euro/pound: UP at 86.00 pence from 85.83 pence

West Texas Intermediate: DOWN 0.5 percent at $108.98

Brent North Sea crude: DOWN 0.5 percent at $112.56 a barrel

New York - Dow: DOWN 0.1 percent at 29,888.78 (close)

London - FTSE 100: DOWN 0.4 percent at 7,016.25 (close)

-- Bloomberg News contributed to this story --

W.Stewart--AT